- Norway

- /

- Communications

- /

- OB:NAPA

Napatech A/S (OB:NAPA) Stocks Shoot Up 26% But Its P/S Still Looks Reasonable

Those holding Napatech A/S (OB:NAPA) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The annual gain comes to 115% following the latest surge, making investors sit up and take notice.

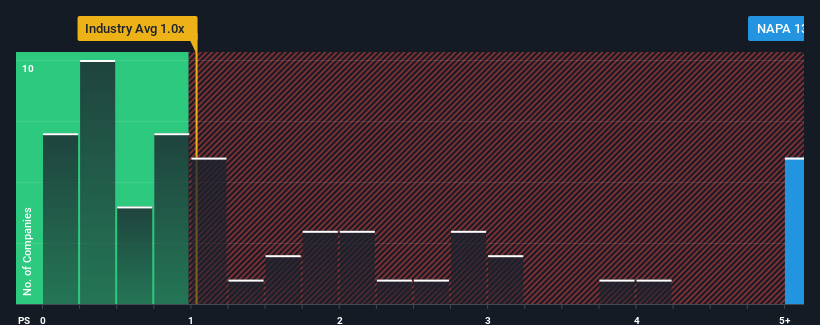

Since its price has surged higher, you could be forgiven for thinking Napatech is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 13x, considering almost half the companies in Norway's Communications industry have P/S ratios below 1x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Napatech

How Has Napatech Performed Recently?

Napatech's negative revenue growth of late has neither been better nor worse than most other companies. Perhaps the market is expecting the company to reverse its fortunes and beat out a struggling industry in the future, elevating the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Napatech's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Napatech's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 14%. The last three years don't look nice either as the company has shrunk revenue by 29% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 104% as estimated by the only analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 2.3%, which is noticeably less attractive.

In light of this, it's understandable that Napatech's P/S sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Napatech's P/S Mean For Investors?

The strong share price surge has lead to Napatech's P/S soaring as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our look into Napatech shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Napatech you should know about.

If these risks are making you reconsider your opinion on Napatech, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Napatech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:NAPA

Napatech

Provides programmable smart network interface cards and infrastructure processing units for cloud, enterprise, and telecom datacenter networks in the Americas and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives