Amid renewed worries about inflated AI stock valuations, the pan-European STOXX Europe 600 Index ended 2.21% lower, reflecting broader market sentiment that has been cautious due to receding expectations for a U.S. interest rate cut and its impact on global markets. In this environment, identifying high-growth tech stocks in Europe requires careful consideration of their potential to innovate and adapt within the evolving technology landscape while maintaining strong fundamentals and growth prospects.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 21.68% | 41.50% | ★★★★★★ |

| Hacksaw | 32.86% | 37.50% | ★★★★★★ |

| Bonesupport Holding | 27.78% | 49.69% | ★★★★★★ |

| Pexip Holding | 10.67% | 22.75% | ★★★★★☆ |

| KebNi | 25.19% | 61.24% | ★★★★★★ |

| Comet Holding | 11.07% | 36.76% | ★★★★★☆ |

| CD Projekt | 35.69% | 50.71% | ★★★★★★ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Waystream Holding | 15.92% | 44.85% | ★★★★★☆ |

| Gapwaves | 41.49% | 89.60% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Kitron (OB:KIT)

Simply Wall St Growth Rating: ★★★★★☆

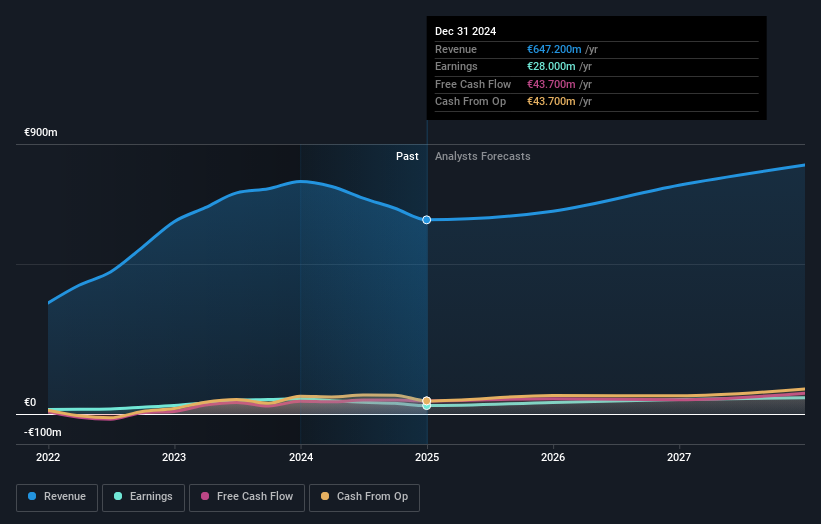

Overview: Kitron ASA is an electronics manufacturing services provider operating in multiple countries including Norway, Sweden, and the United States, with a market cap of NOK12.18 billion.

Operations: Kitron ASA generates revenue primarily from its Electronics Manufacturing Services (EMS) segment, which amounted to €665.20 million. The company operates across various countries including Norway, Sweden, and the United States.

Kitron's recent strategic moves, including the acquisition of DeltaNordic AB and a significant order from the defense/aerospace sector valued at EUR 100 million, underscore its robust positioning in high-growth markets. With a revised upward earnings guidance for 2025 reflecting increased demand, Kitron anticipates revenues between EUR 700 million and EUR 740 million and an operating profit (EBIT) from EUR 59 million to EUR 66 million. These figures demonstrate a tangible response to evolving market dynamics, particularly in sectors where technological innovation is critical. Moreover, Kitron's commitment to shareholder returns is evident from its ongoing share repurchase program authorized up to NOK 1.98 million, enhancing shareholder value while strategically reinvesting in growth areas.

- Dive into the specifics of Kitron here with our thorough health report.

Understand Kitron's track record by examining our Past report.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Pexip Holding ASA is a video technology company that offers an end-to-end video conferencing platform and digital infrastructure across various regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific, with a market capitalization of NOK5.89 billion.

Operations: Pexip generates revenue primarily from the sale of collaboration services, amounting to NOK1.23 billion.

Pexip Holding has demonstrated a robust growth trajectory, with revenue anticipated to expand by 10.7% annually, outpacing the Norwegian market's 2.3% growth rate. This performance is bolstered by earnings projections showing an impressive 22.8% annual increase, significantly higher than the broader market's 16.1%. The company recently reported a substantial uplift in quarterly sales to NOK 265.63 million from NOK 228.48 million year-over-year and more than doubled its net income to NOK 25.64 million, reflecting both operational efficiency and strategic market positioning. These financial metrics underscore Pexip's potential in a competitive tech landscape, with its recent profitability marking a pivotal turn in its market standing and providing a solid foundation for sustained growth amidst dynamic industry demands.

- Navigate through the intricacies of Pexip Holding with our comprehensive health report here.

Examine Pexip Holding's past performance report to understand how it has performed in the past.

Ependion (OM:EPEN)

Simply Wall St Growth Rating: ★★★★☆☆

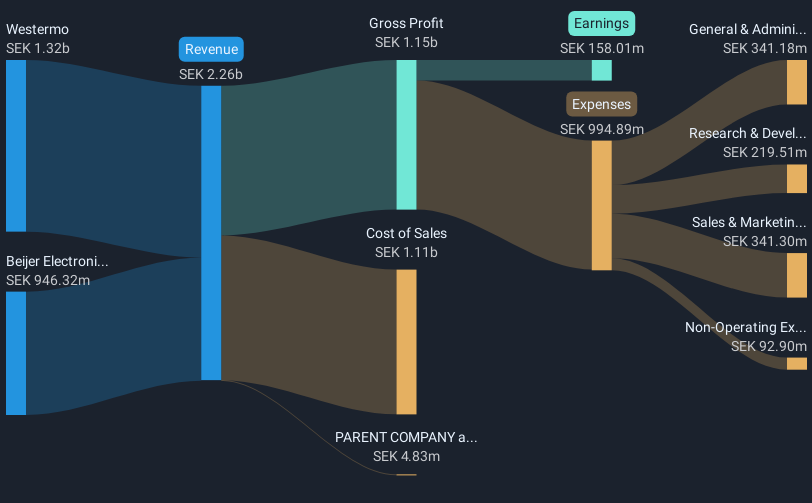

Overview: Ependion AB, with a market cap of SEK3.68 billion, offers digital solutions for secure control, management, visualization, and data communication tailored to industrial applications through its subsidiaries.

Operations: Ependion AB generates revenue primarily through its subsidiaries, with Westermo contributing SEK1.36 billion and Beijer Electronics (including Korenix) adding SEK875.54 million. The company focuses on providing digital solutions for industrial applications, emphasizing secure control and data communication.

Ependion AB's recent financial performance highlights a promising trajectory in the tech sector, with third-quarter sales rising to SEK 543.59 million from SEK 493.03 million year-over-year and net income increasing to SEK 40.44 million from SEK 31.41 million. These results are part of a broader trend where Ependion's revenue is expected to grow by 10.7% annually, outpacing the Swedish market's growth rate of 3.8%. Additionally, the company’s earnings are projected to surge by an impressive 29.1% per year, significantly above Sweden's market average of 13.5%. This robust financial health is supported by Ependion’s strategic focus on innovation and market expansion, positioning it well for sustained future growth despite previous challenges in earnings growth over the past year.

Summing It All Up

- Explore the 51 names from our European High Growth Tech and AI Stocks screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kitron might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KIT

Kitron

Operates as an electronics manufacturing services provider in Norway, Sweden, Denmark, Lithuania, Germany, Poland, the Czech Republic, India, China, Malaysia, and the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success