It's Unlikely That Elliptic Laboratories ASA's (OB:ELABS) CEO Will See A Huge Pay Rise This Year

Key Insights

- Elliptic Laboratories' Annual General Meeting to take place on 21st of May

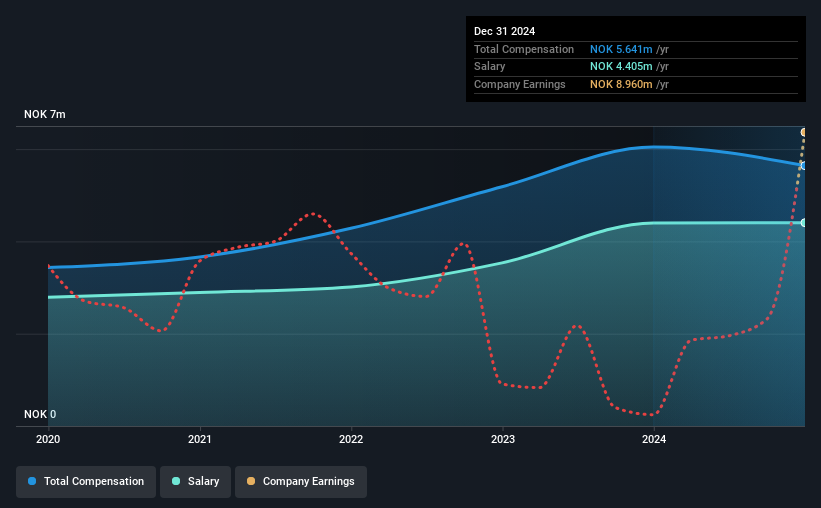

- Total pay for CEO Laila Danielsen includes kr4.41m salary

- The overall pay is 82% above the industry average

- Over the past three years, Elliptic Laboratories' EPS grew by 1.6% and over the past three years, the total loss to shareholders 35%

The underwhelming share price performance of Elliptic Laboratories ASA (OB:ELABS) in the past three years would have disappointed many shareholders. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. The AGM coming up on the 21st of May could be an opportunity for shareholders to bring these concerns to the board's attention. They could also influence management through voting on resolutions such as executive remuneration. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

View our latest analysis for Elliptic Laboratories

How Does Total Compensation For Laila Danielsen Compare With Other Companies In The Industry?

Our data indicates that Elliptic Laboratories ASA has a market capitalization of kr1.2b, and total annual CEO compensation was reported as kr5.6m for the year to December 2024. That's slightly lower by 6.7% over the previous year. We note that the salary portion, which stands at kr4.41m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the Norwegian Software industry with market capitalizations under kr2.1b, the reported median total CEO compensation was kr3.1m. Accordingly, our analysis reveals that Elliptic Laboratories ASA pays Laila Danielsen north of the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | kr4.4m | kr4.4m | 78% |

| Other | kr1.2m | kr1.6m | 22% |

| Total Compensation | kr5.6m | kr6.0m | 100% |

On an industry level, around 73% of total compensation represents salary and 27% is other remuneration. Our data reveals that Elliptic Laboratories allocates salary more or less in line with the wider market. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Elliptic Laboratories ASA's Growth Numbers

Over the past three years, Elliptic Laboratories ASA has seen its earnings per share (EPS) grow by 1.6% per year. Its revenue is up 93% over the last year.

It's great to see that revenue growth is strong. Combined with modest EPS growth, we get a good impression of the company. We wouldn't say this is necessarily top notch growth, but it is certainly promising. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Elliptic Laboratories ASA Been A Good Investment?

The return of -35% over three years would not have pleased Elliptic Laboratories ASA shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Despite the growth in its earnings, the share price decline in the past three years is certainly concerning. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. If there are some unknown variables that are influencing the stock's price, surely shareholders would have some concerns. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We've identified 1 warning sign for Elliptic Laboratories that investors should be aware of in a dynamic business environment.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

Valuation is complex, but we're here to simplify it.

Discover if Elliptic Laboratories might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ELABS

Elliptic Laboratories

An artificial intelligence (AI) software company, engages in the provision of AI virtual smart sensors for the smartphone, laptop, Internet of Things, and automotive markets in Norway, the United States, China, South Korea, Taiwan, and Japan.

Exceptional growth potential with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026