- Poland

- /

- Professional Services

- /

- WSE:GPP

European Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As European markets grapple with the fallout from higher-than-expected U.S. tariffs, leading to significant declines in major stock indexes, investors are increasingly focused on identifying resilient investment opportunities amid the uncertainty. In such volatile conditions, companies exhibiting strong growth potential and high insider ownership can be particularly appealing, as they often indicate a vested interest by those closely involved in the company’s success.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Elicera Therapeutics (OM:ELIC) | 28.3% | 97.2% |

| Bergen Carbon Solutions (OB:BCS) | 12% | 50.8% |

| Lokotech Group (OB:LOKO) | 13.9% | 58.1% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| CD Projekt (WSE:CDR) | 29.7% | 36.8% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Ortoma (OM:ORT B) | 27.7% | 68.6% |

| Circus (XTRA:CA1) | 26% | 51.4% |

Here we highlight a subset of our preferred stocks from the screener.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★★☆

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of €1.62 billion.

Operations: The company's revenue is primarily derived from its Private Cloud segment at €638.33 million, followed by Public Cloud at €189.67 million, and Web Cloud & Other services contributing €188.80 million.

Insider Ownership: 12.6%

OVH Groupe's recent partnership with HYCU, Inc. enhances its cloud offerings, aiming to simplify data management for businesses. Its earnings have shown improvement, with first-quarter sales reaching €263.5 million and a return to profitability. OVH has completed a €500 million fixed-income offering, supporting its financial stability. While the company's growth prospects are strong with forecasted revenue growth of 9.7% annually and high expected returns on equity, its share price remains volatile despite trading below estimated fair value.

- Delve into the full analysis future growth report here for a deeper understanding of OVH Groupe.

- Insights from our recent valuation report point to the potential undervaluation of OVH Groupe shares in the market.

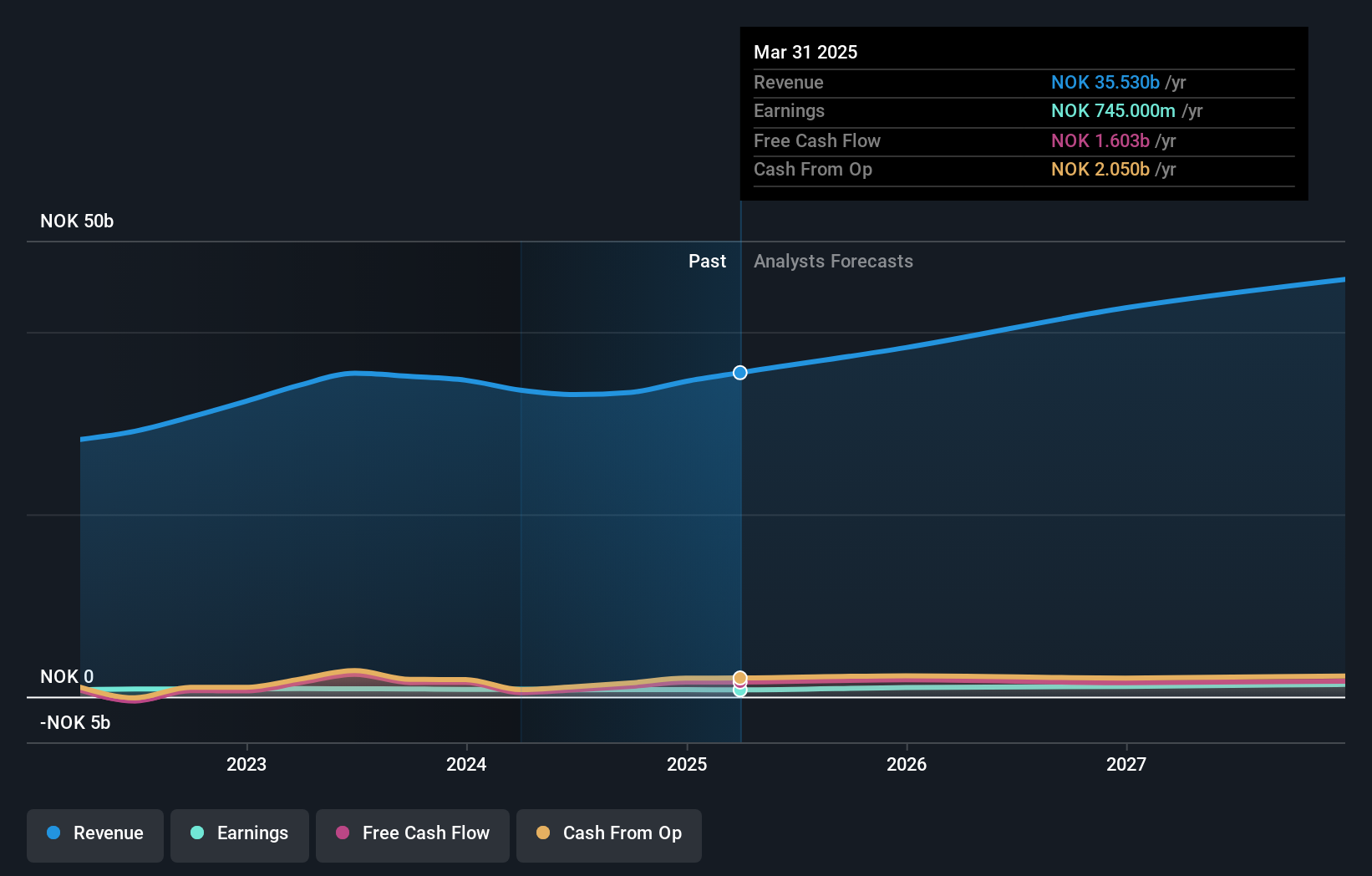

Atea (OB:ATEA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Atea ASA offers IT infrastructure and related solutions to businesses and public sector organizations in the Nordic countries and Baltic regions, with a market cap of NOK14.05 billion.

Operations: The company's revenue segments are comprised of Norway (NOK8.80 billion), Sweden (NOK12.76 billion), Denmark (NOK7.86 billion), Finland (NOK3.58 billion), and The Baltics (NOK1.72 billion).

Insider Ownership: 29.1%

Atea ASA's earnings are forecast to grow significantly at 20.6% annually, outpacing the Norwegian market. Despite a slight decline in 2024 sales and net income, the company trades at 46% below its estimated fair value, suggesting potential upside. While revenue growth is slower than desired at 7.3%, it still surpasses market expectations. However, the dividend yield of 5.56% isn't well covered by earnings, indicating sustainability concerns despite high insider ownership stability recently.

- Click here and access our complete growth analysis report to understand the dynamics of Atea.

- The analysis detailed in our Atea valuation report hints at an deflated share price compared to its estimated value.

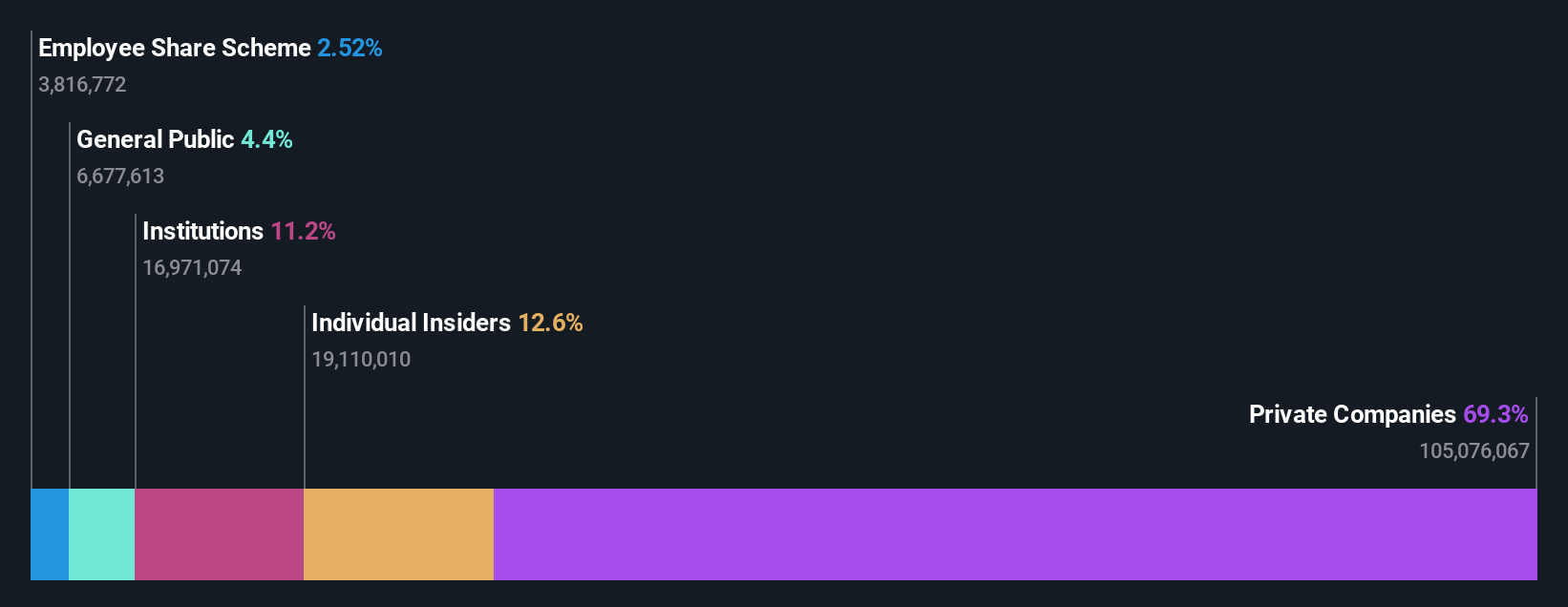

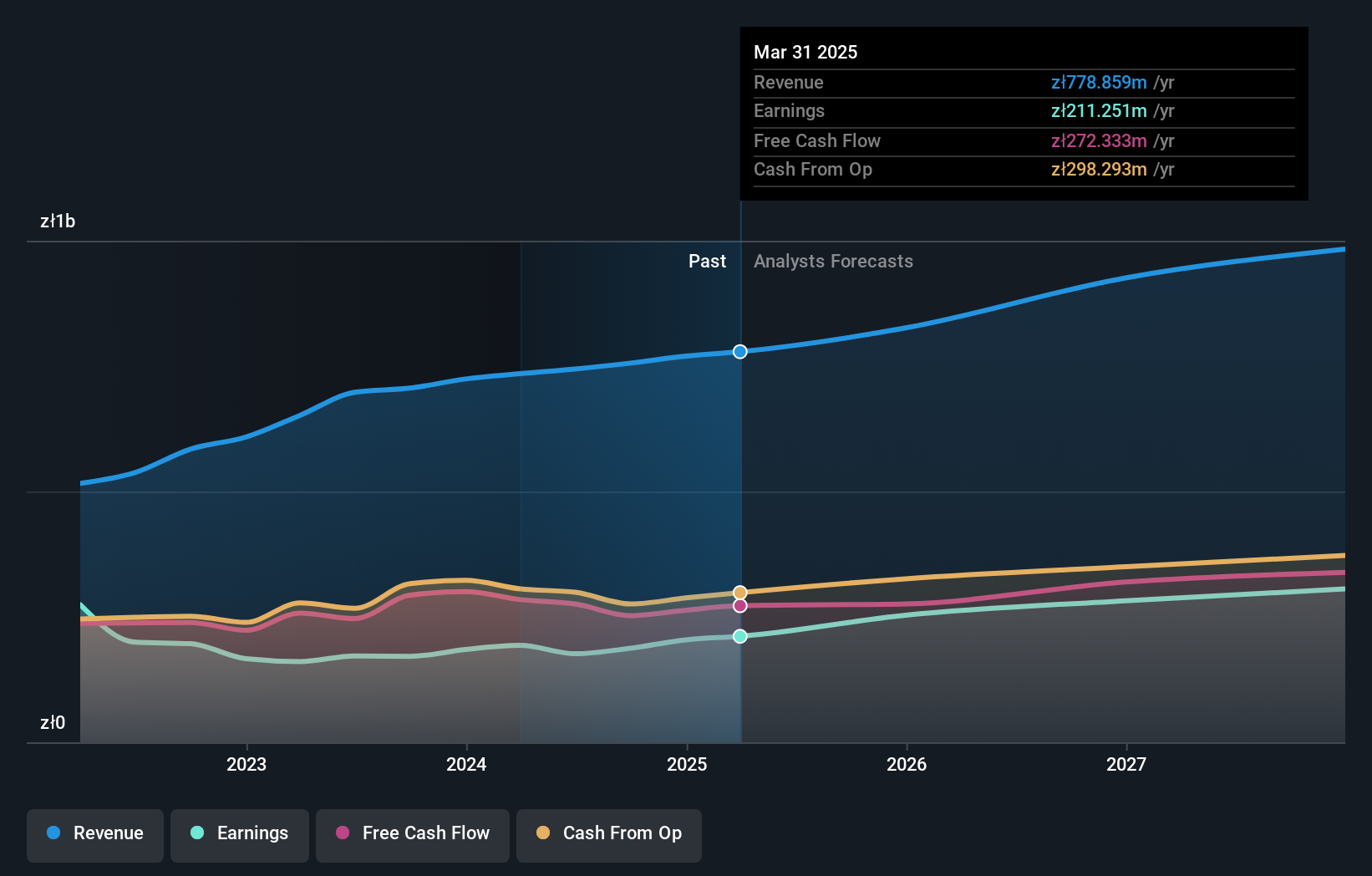

Grupa Pracuj (WSE:GPP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grupa Pracuj S.A. operates in the digital recruitment market across Poland, Ukraine, and Germany with a market cap of PLN3.65 billion.

Operations: The company generates revenue from its Staffing & Outsourcing Services segment, amounting to PLN756.07 million.

Insider Ownership: 11.7%

Grupa Pracuj's earnings are forecast to grow at 14.1% annually, surpassing the Polish market's growth rate. The stock trades at 46% below its estimated fair value, indicating potential for appreciation. Despite an unstable dividend track record, a recent annual dividend of PLN 2.10 per share has been announced. Revenue is expected to grow by 8.6% annually, outpacing the broader market but not reaching high growth levels seen in some peers.

- Click to explore a detailed breakdown of our findings in Grupa Pracuj's earnings growth report.

- Our valuation report unveils the possibility Grupa Pracuj's shares may be trading at a discount.

Key Takeaways

- Embark on your investment journey to our 228 Fast Growing European Companies With High Insider Ownership selection here.

- Ready To Venture Into Other Investment Styles? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:GPP

Grupa Pracuj

Operates HR technology platform in Poland, Ukraine, and Germany.

Outstanding track record and undervalued.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success