- Norway

- /

- Semiconductors

- /

- OB:NOD

Nordic Semiconductor (OB:NOD): Valuation Insights Following Q3 Earnings and Strategic Updates

Reviewed by Simply Wall St

Nordic Semiconductor (OB:NOD) shares took a dip after the company released its third-quarter earnings. The report showed revenue growth, but EBITDA fell short of expectations, in part due to higher payroll and acquisition costs.

See our latest analysis for Nordic Semiconductor.

After a strong run in recent months, Nordic Semiconductor’s share price dropped sharply following the earnings miss, declining 10.15% over the past week and finishing at NOK 147.0. Even with this pullback, the stock still boasts a year-to-date share price return of 42.79% and a total shareholder return of 35.8% over the past year, underscoring momentum that, while recently tested by softer profitability, remains positive in the broader context.

If today's volatility has you thinking about other opportunities, now's a great time to broaden your search and discover fast growing stocks with high insider ownership

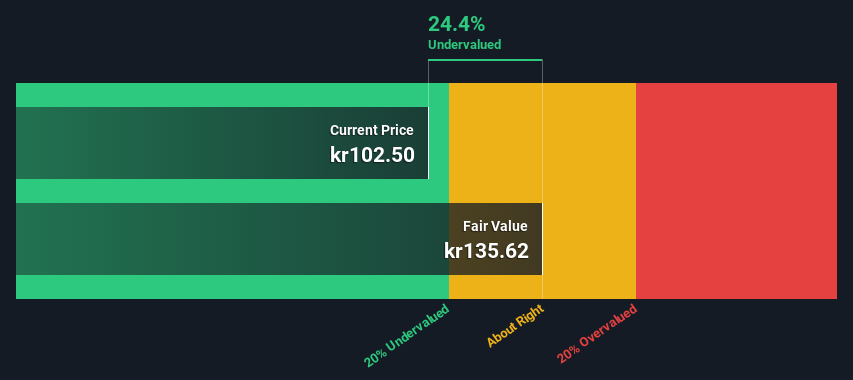

With the stock’s impressive gains this year now facing a setback after the earnings miss, the question for investors is clear: is Nordic Semiconductor undervalued at current levels, or is the market already pricing in future growth?

Most Popular Narrative: 1.4% Undervalued

The current narrative places Nordic Semiconductor's fair value just above its latest close, suggesting modest upside potential. The market and the consensus appear closely aligned, but differing assumptions about future growth could sway that balance.

The move toward a solution-oriented, chip-to-cloud provider and recent M&A (Newton AI, Memfault) are seen as strong long-term growth catalysts. However, integration risks and consistently high R&D and OpEx requirements, especially for high-salary software talent, could weigh on profitability and net margins in the near term.

Which high-stakes bets are shaping this fair value? Analysts are banking on aggressive growth, earnings increasing significantly, margins expanding, and a future profit multiple typically reserved for industry heavyweights. Intrigued by what’s fueling these bold projections? You’ll want to see the detailed numbers and hidden levers behind this valuation.

Result: Fair Value of $149.14 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if regulatory costs surge or customer demand weakens due to global volatility, these factors could quickly challenge the company's optimistic growth outlook.

Find out about the key risks to this Nordic Semiconductor narrative.

Another View: SWS DCF Model Weighs In

While the current fair value is based on analyst forecasts and market sentiment, our DCF model tells a different story. According to the SWS DCF approach, Nordic Semiconductor is actually trading well above its estimated fair value. This suggests the shares may be overvalued if only future cash flows are considered. Does this caution from the DCF method challenge the optimism seen in analyst targets?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Nordic Semiconductor Narrative

If you see the story differently or want to dig into the details yourself, you can craft your own view in just a few minutes, so why not Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Nordic Semiconductor.

Ready for More Fresh Investment Ideas?

Every smart investor keeps their toolbox full. Don’t wait for market headlines to tell you where to look next. Take charge and tap into new opportunities right now with these hand-picked ideas:

- Spot fast-moving front runners and jump into the action by checking out these 26 AI penny stocks setting the pace in artificial intelligence innovation.

- Boost your portfolio’s stability by uncovering these 22 dividend stocks with yields > 3% that consistently pay out yields above 3% even in uncertain markets.

- Capitalize on market mispricing and seize potential bargains with these 831 undervalued stocks based on cash flows based on real cash flow strength, not hype.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nordic Semiconductor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NOD

Nordic Semiconductor

A fabless semiconductor company, develops and sells integrated circuits for use in short- and long- range wireless applications in Europe, the Americas, and the Asia Pacific.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives