- Norway

- /

- Real Estate

- /

- OB:PUBLI

Public Property Invest (OB:PUBLI): One-Off Gain Clouds Profit Quality Despite Strong Revenue Outlook

Reviewed by Simply Wall St

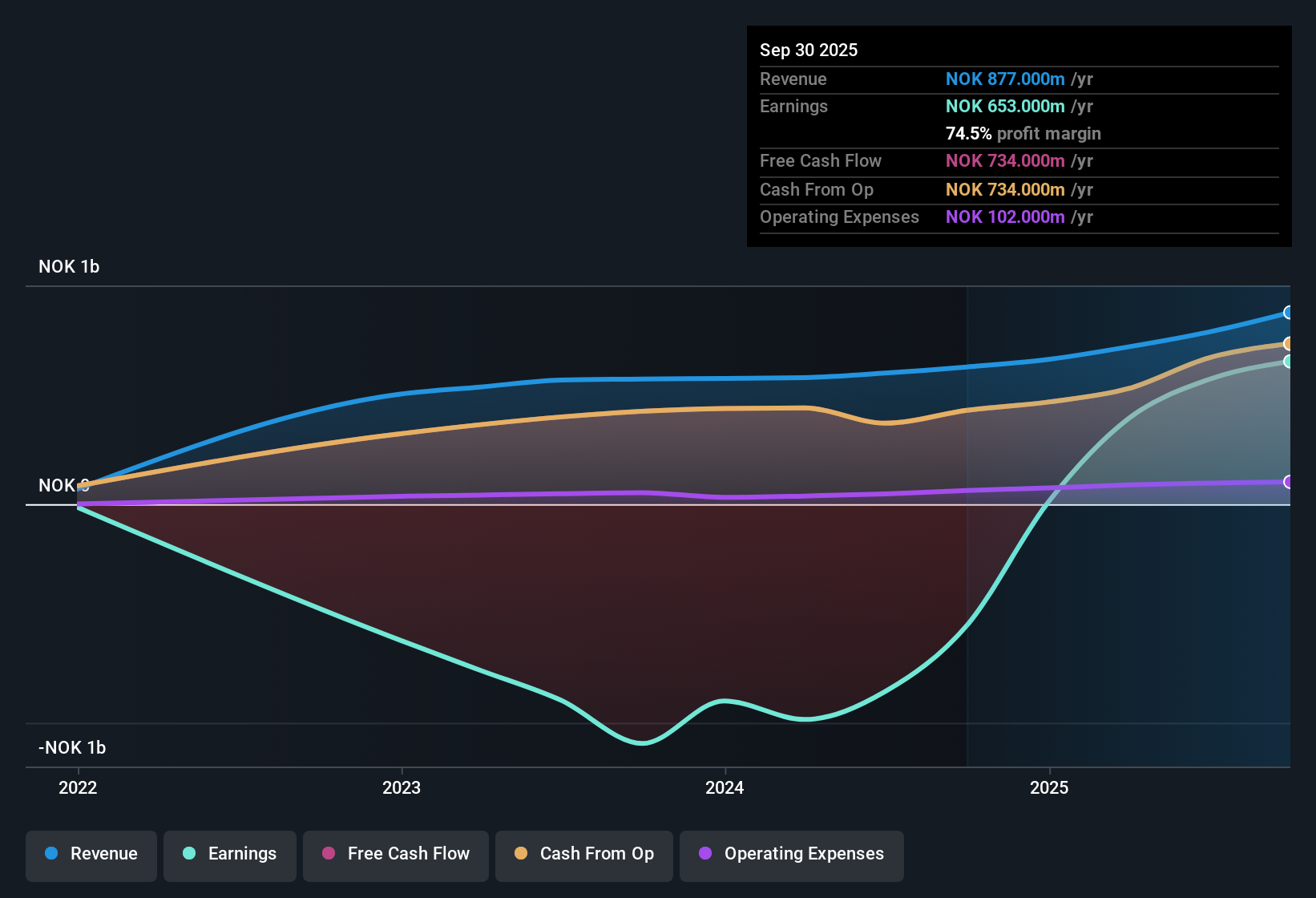

Public Property Invest (OB:PUBLI) reported annual revenue growth forecasts of 17.7%, outpacing the Norwegian market’s 2.8% benchmark. The company became profitable for the first time this year, backed by a five-year annualized profit increase of 47.8%. However, this year’s NOK503 million one-off gain significantly boosted results, making it tough to judge the underlying strength of earnings. With profitability now forecast to drop 3.9% per year over the next three years, investors face a complex outlook.

See our full analysis for Public Property Invest.The real test is how these headline figures stack up against the current narratives. Some views may stand up, while others will come under fresh scrutiny.

See what the community is saying about Public Property Invest

Margins Slide After One-Off Boost

- Profit margins are forecast to shrink sharply from 72.4% today to 38.2% within three years, a rare reversal for newly profitable real estate businesses.

- The analysts' consensus view expects this margin compression, but believes long-term revenue stability is protected by:

- Predominantly government-backed tenant income, currently accounting for 84-85% of total rent. This is viewed as a factor that will shield net margins even as underlying profitability trends lower.

- A portfolio of investments directly linked to demographic demand and redevelopment projects (for example, conversions to nursing homes), which consensus suggests will support resilient occupancy rates despite margin declines.

What surprised analysts this year is how rapidly margins were inflated by a NOK503 million one-off gain. Now, the sharp fall in future margin guidance tests whether portfolio fundamentals or one-off events are really driving the company’s profitability. 📊 Read the full Public Property Invest Consensus Narrative.

Revenue Growth Far Outpaces Industry

- Analysts are forecasting annual revenue growth of 21.2% for Public Property Invest over the next three years, dwarfing the Norwegian real estate market’s 2.8% annual pace.

- The consensus narrative argues that this gap is possible thanks to:

- Recent rapid expansion, with 48 properties acquired since IPO and targeted growth in urban and life-science hubs to capitalize on strong tenant demand and build long-term rental streams.

- Over 270,000 square meters of pipeline redevelopment and exposure to social infrastructure supporting medium- to long-term top-line stability, in contrast to the industry’s lower velocity.

Valuation Debate: Discount Versus DCF Fair Value

- Shares now trade at NOK22.10, which is well above the NOK15.27 DCF fair value but below the analyst price target of NOK26.67. This highlights active debate on the company’s outlook.

- According to the analysts' consensus view, the tension in valuation comes from:

- PUBLI’s Price-to-Earnings Ratio of 11.6x is below both peer (17.3x) and European sector averages (15x), supporting the argument for relative value, even if headline multiples are pressured by future margin declines.

- Realizing analyst forecasts—including whether the company reaches NOK1.4 billion in 2028 revenues and NOK535 million in earnings—is essential for justifying the price target, making future execution the focal point for bulls and skeptics alike.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Public Property Invest on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on the figures? Shape your perspective and share your narrative in just a few minutes. Do it your way

A great starting point for your Public Property Invest research is our analysis highlighting 5 key rewards and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Public Property Invest faces a forecasted decline in profit margins and sustained pressure on long-term earnings, even with impressive top-line growth.

If you’re looking for steadier performers, use our stable growth stocks screener (2119 results) to pinpoint companies consistently expanding revenue and earnings, regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PUBLI

Public Property Invest

A real estate company, owns, develops, operates, and rents real estate properties in Norway.

Good value with slight risk.

Market Insights

Community Narratives