Photocure (OB:PHO): Revenue Forecast to Grow 14.5% Annually Ahead of Profitability Turnaround

Reviewed by Simply Wall St

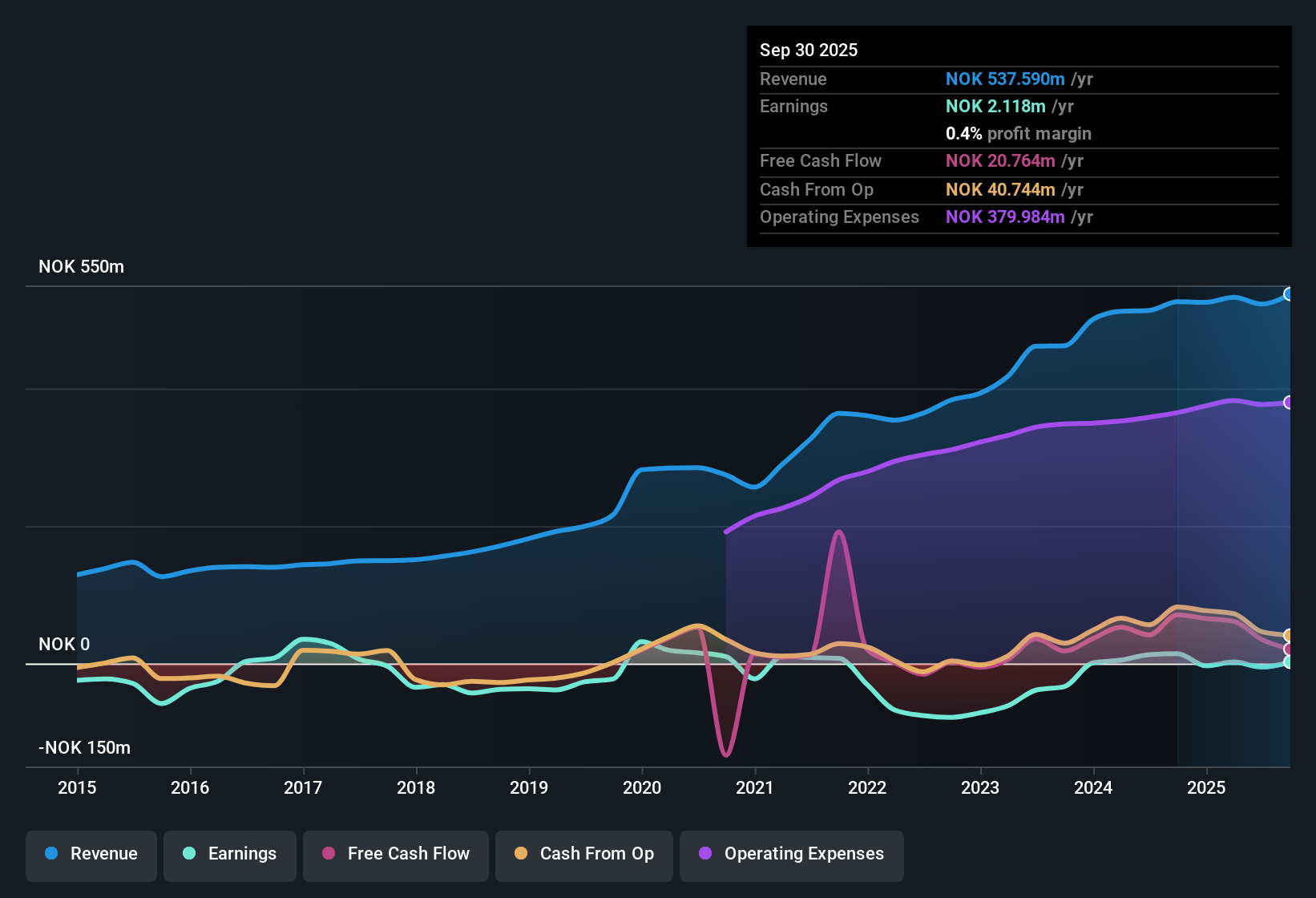

Photocure (OB:PHO) remains unprofitable but has managed to reduce its losses at an annual rate of 12.8% over the last five years. Backed by forecasts calling for 103.28% annual EPS growth and 14.5% annual revenue growth, which compares to the Norwegian market’s 2.8%, investors have reason to watch closely as the company is anticipated to turn profitable within three years. With a price-to-sales ratio of 2.8x, lower than both its peer average of 6.5x and the European Pharmaceuticals industry at 4.1x, Photocure is currently viewed as a value opportunity with a primarily reward-oriented outlook.

See our full analysis for Photocure.The next section pits these headline numbers against the market’s prevailing narratives, highlighting where the consensus is confirmed and where surprises may emerge.

See what the community is saying about Photocure

Profit Margin Set to Climb Toward 9.6%

- Analysts expect profit margins to rise from 0.4% today to 9.6% over the next three years, signaling a transformative shift in earnings potential as the business scales.

- According to analysts' consensus view, robust margin expansion is anchored in several major catalysts:

- Strategic launch of new technologies, like Olympus's Viscera III Elite in the Nordics, and partnerships such as ForTec’s mobile strategy in the U.S., are anticipated to bolster market access and add high-margin revenue streams.

- While these positive moves support the outlook, consensus notes ongoing market expansion efforts and success with FDA reclassification are both necessary to fully realize margin improvement. This leaves execution risk on the table.

Share Count Projected to Decline

- Analysts forecast that Photocure’s total shares outstanding will shrink by 1.69% per year over the next three years, reinforcing future earnings growth on a per-share basis.

- Building on the consensus narrative, falling share count adds clout to earnings targets:

- Higher earnings per share (EPS) projections, as analysts see EPS climbing from NOK 2.1 million to NOK 63.8 million by July 2028, gain extra support as each share owns a slightly larger slice of profits over time.

- This trend, together with revenue drivers and margin expansion, makes profitability forecasts more attainable and less reliant on pure top-line growth.

Valuation Gap: Share Price vs DCF and Peers

- Photocure’s share price of 55.30 NOK trades well below the DCF fair value of 259.47 and the analyst target of 82.50 NOK. Its price-to-sales ratio of 2.8x is a notable discount to both peers, at 6.5x, and the European Pharmaceuticals industry, at 4.1x.

- Consensus narrative spotlights this discount as a potential advantage, but with caveats:

- Valuation multiples suggest investors are cautious, possibly factoring in execution risks such as reliance on FDA reclassification or expansion hurdles in target markets.

- Consensus warns that closing the value gap may depend on sustained margin expansion and revenue growth, not just headline earnings optimism.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Photocure on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think these figures tell a different story? Take a moment to build your own perspective and share your narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Photocure.

See What Else Is Out There

While Photocure’s turnaround depends on widening margins and consistent revenue progress, investors still face uncertainty around execution risks and the company’s ability to sustain stable growth.

If steady, proven performance is what you value most, use our stable growth stocks screener (2112 results) to quickly discover companies that have delivered reliable earnings and revenue expansion regardless of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PHO

Photocure

Engages in the research, development, production, distribution, marketing, and sale of pharmaceutical products.

Flawless balance sheet and good value.

Market Insights

Community Narratives