Photocure (OB:PHO investor three-year losses grow to 53% as the stock sheds kr179m this past week

If you are building a properly diversified stock portfolio, the chances are some of your picks will perform badly. Long term Photocure ASA (OB:PHO) shareholders know that all too well, since the share price is down considerably over three years. So they might be feeling emotional about the 53% share price collapse, in that time. The more recent news is of little comfort, with the share price down 35% in a year. Even worse, it's down 20% in about a month, which isn't fun at all. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

See our latest analysis for Photocure

While Photocure made a small profit, in the last year, we think that the market is probably more focussed on the top line growth at the moment. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. It would be hard to believe in a more profitable future without growing revenues.

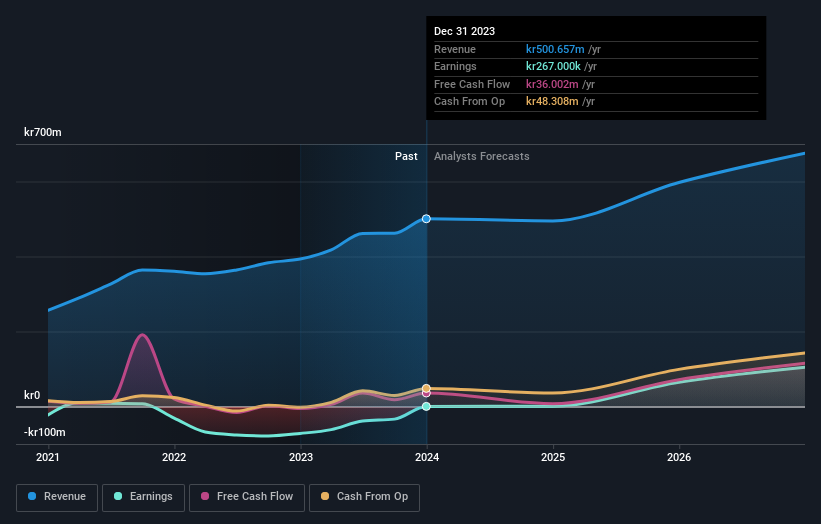

In the last three years, Photocure saw its revenue grow by 18% per year, compound. That's a pretty good rate of top-line growth. So some shareholders would be frustrated with the compound loss of 15% per year. To be frank we're surprised to see revenue growth and share price growth diverge so strongly. It would be well worth taking a closer look at the company, to determine growth trends (and balance sheet strength).

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think Photocure will earn in the future (free profit forecasts).

A Different Perspective

Investors in Photocure had a tough year, with a total loss of 35%, against a market gain of about 1.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 7% per year over half a decade. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Photocure by clicking this link.

Photocure is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:PHO

Photocure

Engages in the research, development, production, distribution, marketing, and sale of pharmaceutical products in Nordic countries, Germany, France, Austria, the United Kingdom, the BeNeLux, Italy, other European Countries, Canada, and the United States.

Flawless balance sheet with reasonable growth potential.