- Norway

- /

- Interactive Media and Services

- /

- OB:VEND

Why Vend Marketplaces (OB:VEND) Is Up 5.4% After Q3 EBITDA Surge and Marketplace Shift

Reviewed by Sasha Jovanovic

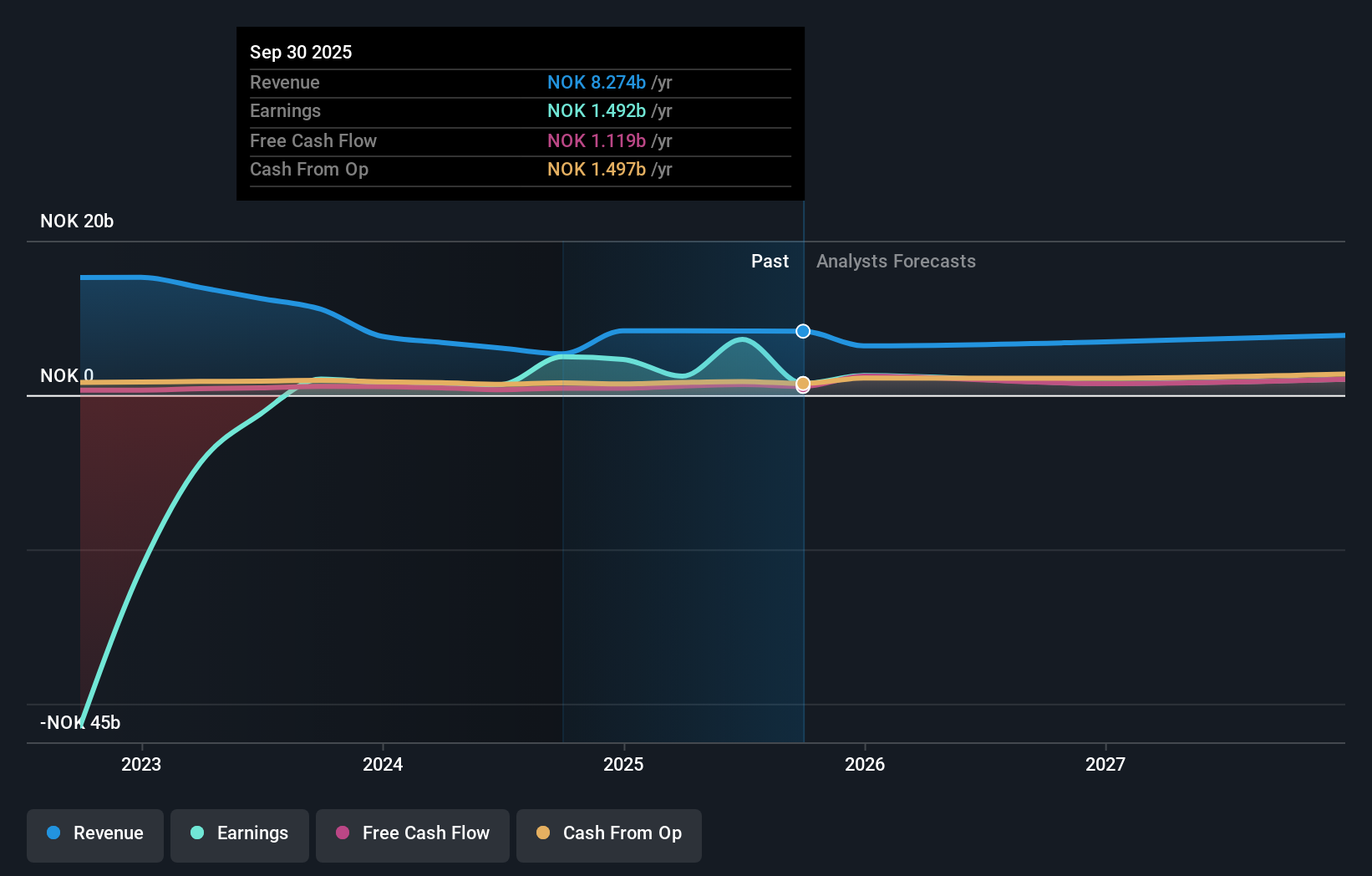

- Vend Marketplaces ASA recently reported its third quarter 2025 results, highlighting a 24% increase in EBITDA to NOK 642 million, despite a 1% year-on-year decrease in revenue and significant swings in net income and earnings per share compared to the previous year.

- The company has accelerated its transition to a pure-play marketplace model, including cost management actions, a dual-class share structure collapse, and the launch of a NOK 2 billion share buyback program.

- We'll explore how the company's outperformance on EBITDA and operational streamlining impacts its investment narrative and future growth opportunities.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Vend Marketplaces' Investment Narrative?

To stay invested in Vend Marketplaces ASA, you need to believe in the company's path toward a streamlined, marketplace-focused future, despite recent turbulence in its fundamentals. The removal from several global indices could limit institutional demand temporarily, but being added back to the Oslo OBX Total Return Index may help offset short-term outflows. The collapse of the dual-class share structure, operational simplification, and a NOK 2 billion share buyback stand out as potential catalysts to rebuild momentum and restore investor confidence. While strong EBITDA improvements indicate successful cost controls, weaker sales, ongoing margin pressures, and lower earnings growth forecasts highlight execution risk. Management turnover and an inexperienced board may compound volatility if strategic shifts stumble. Any near-term upside hinges on sustained margin gains outweighing sluggish revenue trends and past one-off items. Overall, the latest news seems unlikely to materially change the biggest risks, but it could keep the spotlight on execution and capital allocation. On the flip side, execution risk remains critical if cost controls do not translate into sustained growth.

Vend Marketplaces' shares are on the way up, but they could be overextended by 11%. Uncover the fair value now.Exploring Other Perspectives

Explore another fair value estimate on Vend Marketplaces - why the stock might be worth just NOK364.19!

Build Your Own Vend Marketplaces Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vend Marketplaces research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free Vend Marketplaces research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vend Marketplaces' overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VEND

Vend Marketplaces

Develops and operates various marketplaces in Sweden, Norway, Denmark, Finland, and Poland.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives