- Norway

- /

- Interactive Media and Services

- /

- OB:VEND

Vend Marketplaces (OB:VEND) Valuation in Focus After Share Class Unification and Insider Participation in New Issue

Reviewed by Simply Wall St

Vend Marketplaces (OB:VEND) recently unified its share classes and has launched a new share issue, granting subscription rights to former A shareholders. Several key insiders opted to participate, which reflects confidence in the company’s next phase.

See our latest analysis for Vend Marketplaces.

After a turbulent stretch that included multiple index moves and some mixed earnings news, Vend Marketplaces’ share price has managed a 4.4% gain year-to-date, even as its 1-year total shareholder return sits at just over 1%. The recent changes in capital structure and insider participation suggest renewed momentum, while the three-year total return of nearly 199% shows how quickly fortunes can shift for active market players like Vend.

If you’re curious about where market leaders might emerge next, now is a good time to broaden your search and discover fast growing stocks with high insider ownership

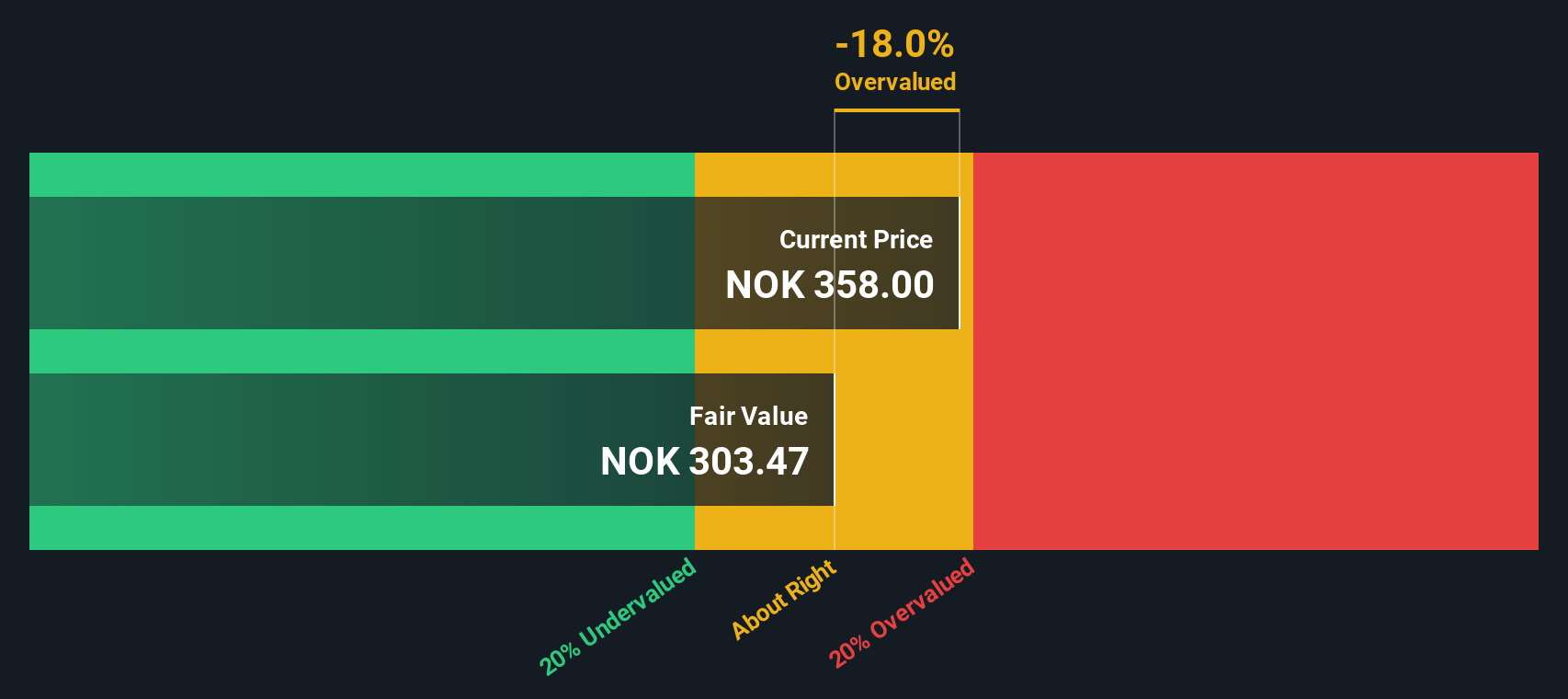

With the share class unification and new insider buying underway, the key question now is whether Vend Marketplaces’ current valuation offers investors a compelling entry point, or if the market has already anticipated its next phase of growth.

Price-to-Earnings of 49.5x: Is it justified?

Vend Marketplaces is currently trading at a price-to-earnings (P/E) ratio of 49.5x, noticeably above industry standards based on the last closing price.

The P/E ratio gauges how much investors are willing to pay for each unit of current earnings, making it a key benchmark for assessing value in interactive media and services. For a company like Vend, a high P/E typically suggests the market expects strong future earnings growth or premium profitability, but can also signal over-exuberance if those expectations are not grounded.

In Vend's case, the current P/E of 49.5x far surpasses the global industry average of 22.6x, as well as its peer group at 26.8x. Notably, the fair P/E, or what the ratio should be based on fundamentals, is estimated at 36.4x. This indicates the market is pricing in even more optimism than the fundamentals support. This raises the possibility that Vend's shares could face downward pressure if future results do not justify such a premium.

Explore the SWS fair ratio for Vend Marketplaces

Result: Price-to-Earnings of 49.5x (OVERVALUED)

However, sluggish revenue and profit growth or a sharp shift in market sentiment could quickly challenge Vend Marketplaces’ currently optimistic share valuation.

Find out about the key risks to this Vend Marketplaces narrative.

Another View: What Does the DCF Model Suggest?

While the current price-to-earnings ratio points to an overvalued stock, our DCF model tells a similar story. Based on projected cash flows, Vend Marketplaces' shares trade above our estimate of fair value (NOK314.92 compared to the current NOK349). So, is the market pricing in too much optimism, or does it see something the model cannot?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vend Marketplaces for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vend Marketplaces Narrative

If you see things differently or want to dig deeper, you can quickly build your own perspective from the data in just a few minutes. Do it your way.

A great starting point for your Vend Marketplaces research is our analysis highlighting 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your edge in today's market by acting on unique stock opportunities beyond Vend Marketplaces. Don't wait on the sidelines while others move ahead.

- Tap into breakthrough tech by scanning for innovation leaders among these 27 AI penny stocks who are transforming everything from automation to business intelligence.

- Maximize steady returns by targeting these 22 dividend stocks with yields > 3% that offer attractive yields and a track record of consistent payments.

- Seize undervalued gems before the crowd by analyzing these 840 undervalued stocks based on cash flows based on future cash flow potential and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:VEND

Vend Marketplaces

Develops and operates various marketplaces in Sweden, Norway, Denmark, Finland, and Poland.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives