Elopak (OB:ELO): Evaluating Valuation After Mixed Q3 2025 Results and Shifting Profit Trends

Reviewed by Simply Wall St

Elopak (OB:ELO) just published its third quarter 2025 earnings, revealing a small dip in sales year over year, but an improved net income for the quarter compared to last year. Nine-month results painted a more mixed picture.

See our latest analysis for Elopak.

Elopak’s share price has steadily climbed 6.1% year-to-date, with a 1-year total shareholder return of 9.3%. While momentum has cooled off lately, especially after the latest earnings, the company’s impressive 131% total shareholder return over three years suggests longer-term growth potential that has caught investors’ attention.

If you’re looking for more opportunities beyond the headlines, now is a great time to expand your search and discover fast growing stocks with high insider ownership

With Elopak trading about 11% below analyst targets and boasting a solid value score, investors may wonder if the recent share price weakness is creating a potential buying window or if the market has already captured all the expected upside.

Most Popular Narrative: 9.7% Undervalued

Compared to Elopak's last close price of NOK47.70, the most popular narrative places its fair value at NOK52.84. This benchmark sets up a notable upside signal, but the assumptions driving this outlook are critical to grasp.

Ongoing product innovation (for example, Natural White Board, D-PAK cartons with recycled polymers, and advanced Pure-Fill filling machines) directly addresses regulatory and consumer demands for lower CO2 packaging, enabling premium pricing opportunities and improved net margins.

Want to know what’s fueling this bullish target? The reasoning lies in bold projections for revenue growth, stronger margins, and an earnings surge by 2028. This narrative builds its case on future numbers rarely seen in this sector. Click for the surprising details that support Elopak’s fair value.

Result: Fair Value of NOK52.84 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, declining demand in key categories and intense competition in core segments could quickly undercut the bullish outlook for Elopak’s future growth.

Find out about the key risks to this Elopak narrative.

Another View: Digging into Market Ratios

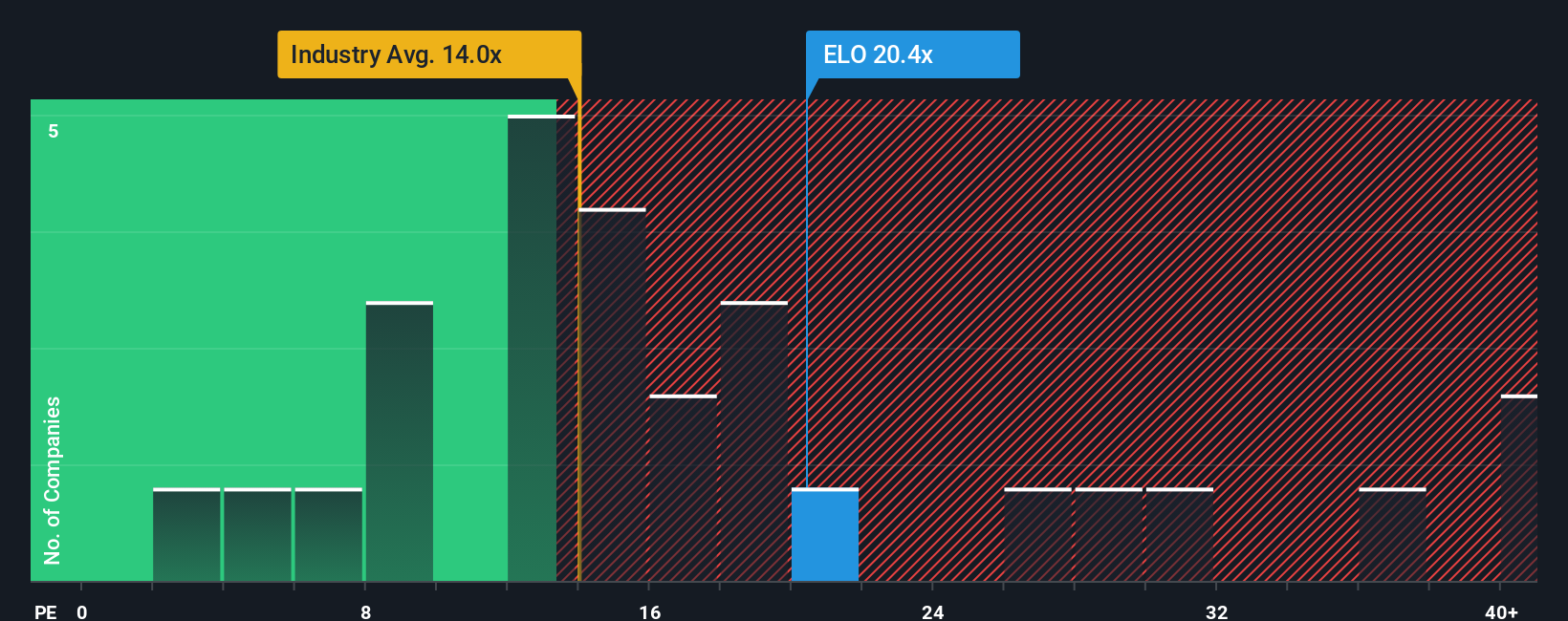

Looking beyond analyst targets, Elopak’s current price-to-earnings ratio sits at 21.1 times. This is notably higher than both the peer average at 19.3 times and the broader European packaging industry at 14.4 times. The fair ratio suggests a level closer to 15.1 times, hinting that the market may be building in a premium for future growth or simply overpricing the stock. Does this mean there is risk of a valuation correction ahead?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Elopak Narrative

If the consensus doesn’t quite match your perspective, you can easily dive into the details and shape your own Elopak story in just minutes. Do it your way

A great starting point for your Elopak research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let your next smart investment slip away. The Simply Wall Street Screener unlocks handpicked stocks across emerging trends, hidden value, and reliable income for you now.

- Capture untapped growth by scanning these 3588 penny stocks with strong financials that combine strong financial health with exciting upside potential.

- Boost your portfolio’s future with these 27 AI penny stocks, which fuel advancements in artificial intelligence across a range of industries.

- Generate steady passive income by targeting these 20 dividend stocks with yields > 3% that offer yields above 3% and robust balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Elopak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ELO

Elopak

Manufactures and supplies paper-based packaging solutions for liquid food in Europe, the Middle East, Africa, Asia, the Americas, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives