Is SalMar Poised for Growth After New Aquaculture Licenses and a 12% Share Price Rise?

Reviewed by Bailey Pemberton

- Wondering if SalMar could be undervalued or if you might be missing out on a hidden opportunity? You are not alone, especially with the stock’s unique position in Norway’s seafood industry.

- SalMar’s share price has climbed 11.6% in the last year and is up 4.0% year-to-date, which hints at investor optimism even after a brief dip of 3.0% in the last week.

- Behind these moves are recent headlines about regulatory changes and evolving sustainability requirements for Norwegian fish farming. Both factors keep SalMar in the market spotlight. News of new aquaculture licenses also caught investors' eyes and could fuel future growth, but some see these changes as a mixed bag for risk.

- Right now, SalMar scores 2 out of 6 on our value checks. This suggests there is more to unpack. Let’s break down the main ways investors judge fair value and, later, explore an approach that goes beyond the usual metrics.

SalMar scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

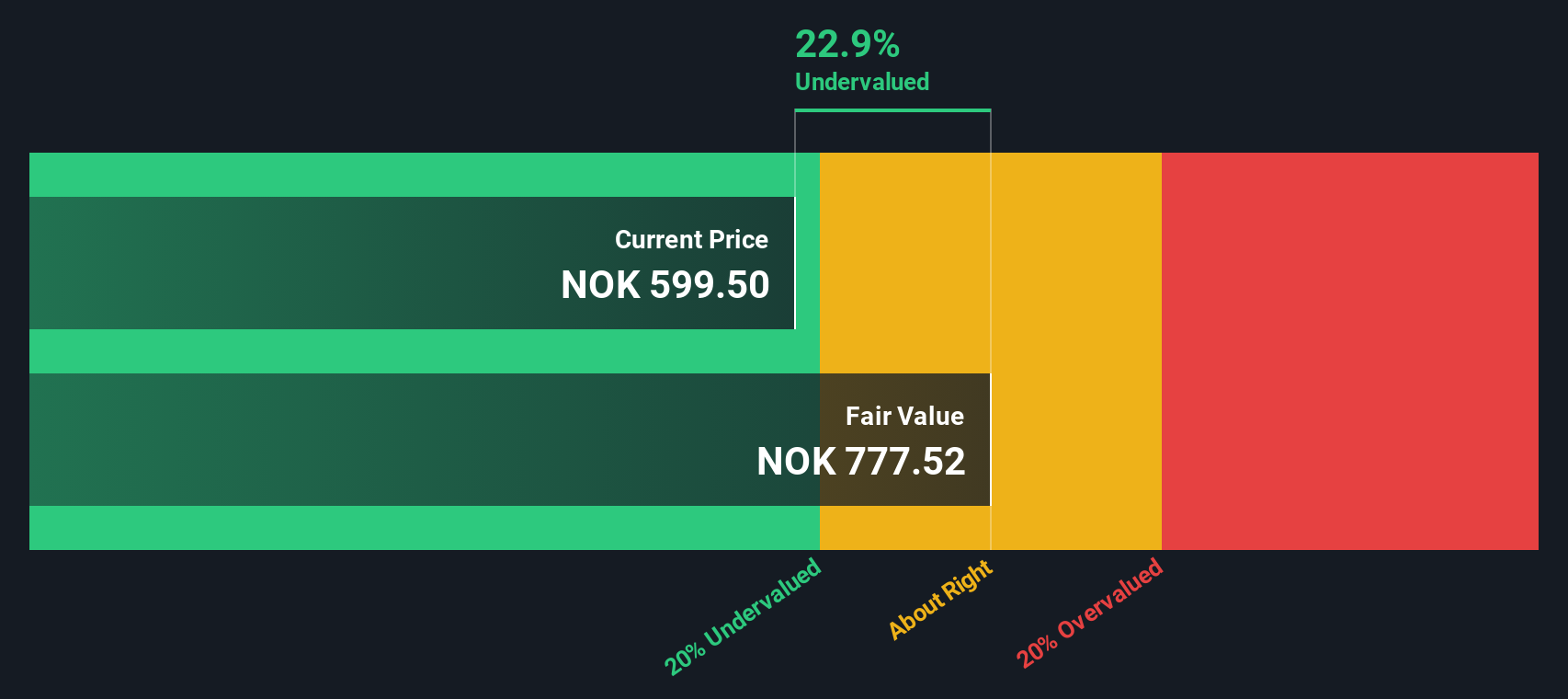

Approach 1: SalMar Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model forecasts a company’s future cash flows and then discounts them back to today’s value. This model aims to capture the intrinsic worth of the business based on projected earnings and growth potential.

For SalMar, the starting point is its latest reported Free Cash Flow (FCF), which is currently negative at -780 Million NOK. Analysts estimate that FCF will recover, reaching 7.8 Billion NOK in 2029, with five-year projections averaging over 5 Billion NOK annually. After that, further growth estimates are extrapolated to suggest FCF could approach 10 Billion NOK by 2035, according to Simply Wall St's two-stage model in NOK.

When all these cash flows are discounted back, the result is an intrinsic value for SalMar of 1,666 NOK per share. This figure is 65.6% above the current market price, suggesting the stock is significantly undervalued based on the company’s future earning potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SalMar is undervalued by 65.6%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

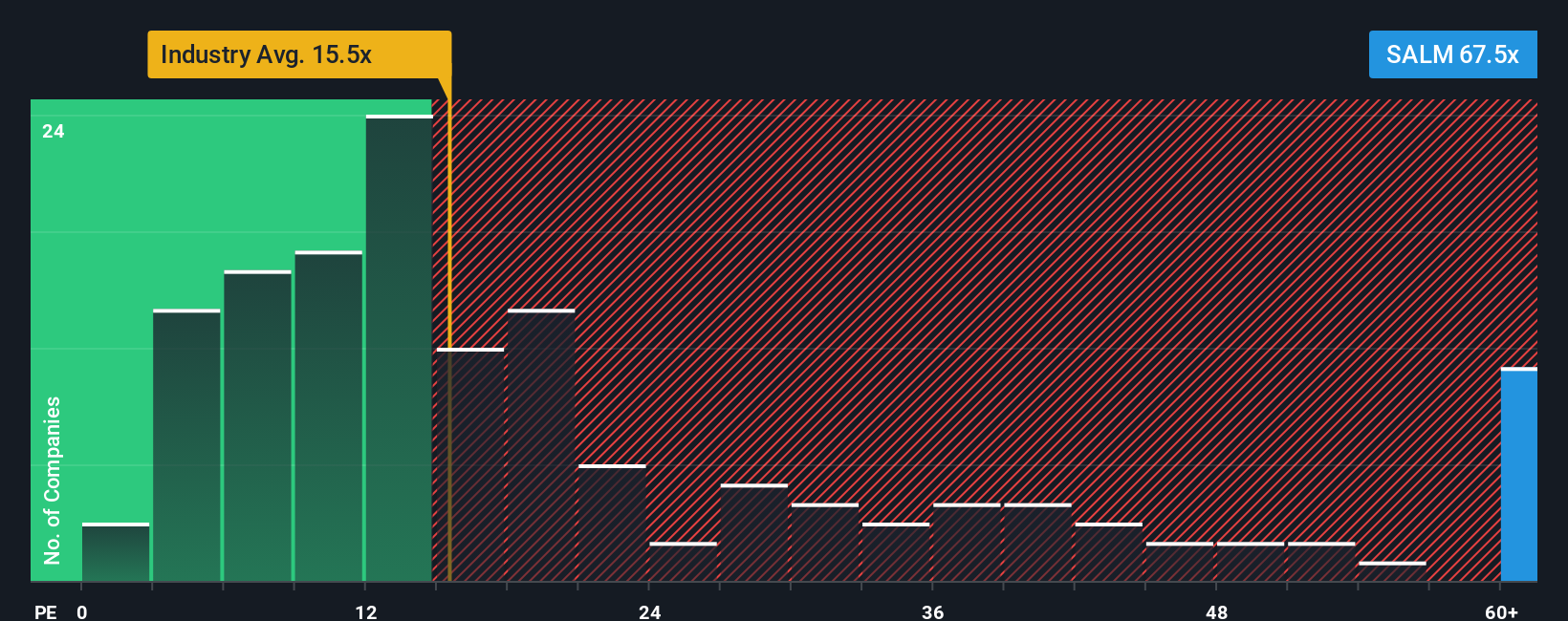

Approach 2: SalMar Price vs Earnings (PE Ratio)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like SalMar because it directly relates a company’s share price to its earnings per share. By showing how much investors are willing to pay for each unit of profits, the PE ratio provides a snapshot of market sentiment about a company's future prospects.

A "normal" or "fair" PE ratio is influenced by expectations of future earnings growth and the risks surrounding those projections. Companies with higher growth potential and more stable earnings typically command higher PE ratios. In contrast, riskier businesses or those growing more slowly tend to trade at lower multiples.

Currently, SalMar’s PE ratio stands at 68.5x, which is significantly higher than both the food industry average of 16.2x and its immediate peers' average of 28.5x. At first glance, this premium might suggest the stock is expensive.

To provide more context, Simply Wall St’s "Fair Ratio" uses a proprietary methodology that goes beyond simple peer or sector comparisons. It considers SalMar’s projected earnings growth, industry trends, profit margins, market cap, and overall risk profile. This offers a more personalized view of what PE ratio is justified. For SalMar, the "Fair Ratio" is calculated at 52.3x.

Since SalMar’s current PE multiple (68.5x) is well above its Fair Ratio (52.3x), the stock appears overvalued based on this metric. Investors are currently paying a significant premium for expected future growth.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

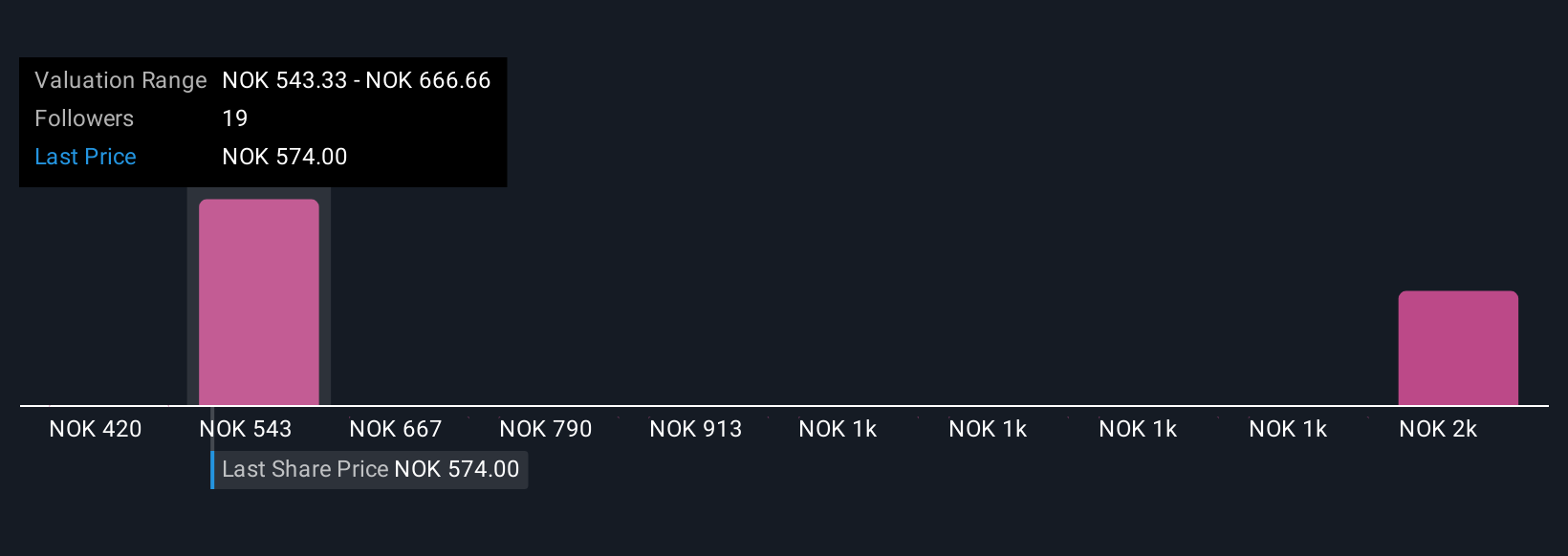

Upgrade Your Decision Making: Choose your SalMar Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal story or perspective about a company, summarizing not only your own expected fair value but also the reasons, forecasts, and assumptions behind your viewpoint on SalMar's future revenue, profit margins, and risks.

Narratives link the company's business story directly to a financial forecast, and then to a calculated fair value. This helps you bridge the gap between what you believe and the numbers you see. On Simply Wall St’s Community page, Narratives are easy to use and accessible to everyone, empowering millions of investors to clearly lay out their investment thesis, review others' perspectives, and keep their thinking up to date.

This approach helps you decide when to buy or sell by showing how your personal fair value compares to the current market price. Because Narratives are dynamically updated as news, earnings, or sector changes come in, your investment rationale stays relevant.

For example, some investors might take a bullish view and set SalMar’s fair value as high as NOK 650 if they are confident in sustained revenue growth and margin improvements, while others could see significant ongoing risks and assign a much lower fair value near NOK 420. Narratives bring these diverse viewpoints together and make your investment decisions more informed, transparent, and adaptable.

Do you think there's more to the story for SalMar? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SALM

SalMar

An aquaculture company, produces and sells farmed salmon in Norway, Asia, Europe, North America, and internationally.

High growth potential with low risk.

Similar Companies

Market Insights

Community Narratives