Mowi (OB:MOWI): Evaluating Valuation After Recent 13% Share Price Gain

Reviewed by Simply Wall St

Mowi (OB:MOWI) has delivered a 13% share price gain over the past 3 months, drawing fresh attention from market watchers. Investors are now considering what is driving the momentum and whether current levels reflect the company’s true potential.

See our latest analysis for Mowi.

After some choppiness earlier this year, Mowi’s 13% share price gain in the last three months stands out, especially as total shareholder return over the past year reached an impressive 17.6%. The momentum suggests that investors are starting to recognize both the solid 5.9% share price return in the past month and the company’s compelling long-term performance.

If strong near-term gains are catching your attention, this could be the moment to broaden your horizons and discover fast growing stocks with high insider ownership

With Mowi’s shares on the rise, the key question looms: Is the recent momentum a sign that the market is still undervaluing the company, or are expectations of future growth already factored into the price?

Most Popular Narrative: 4.5% Undervalued

Mowi’s most closely watched narrative values the stock just above its last close, highlighting a slim margin between market price and projected fair value. The calculation intrigues investors, as it weighs future earnings power against present expectations.

Persistent cost improvements, including an 8% reduction in feed costs year over year, productivity enhancements through automation, and further expected annual cost savings (between €300 and €400 million over the next five years), are set to structurally improve operating margins and net earnings.

How will relentless cost-cutting and next-generation automation impact the company’s future valuation? The real surprise lies in profit margins and earnings forecasts that are anything but ordinary. Want to know what financial levers make this outlook tick? Read the entire narrative to uncover what drives analysts' bullish stance on Mowi’s fair value.

Result: Fair Value of $236.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the risk of rising raw material prices or further supply surges could quickly challenge Mowi's ability to maintain its current profit momentum.

Find out about the key risks to this Mowi narrative.

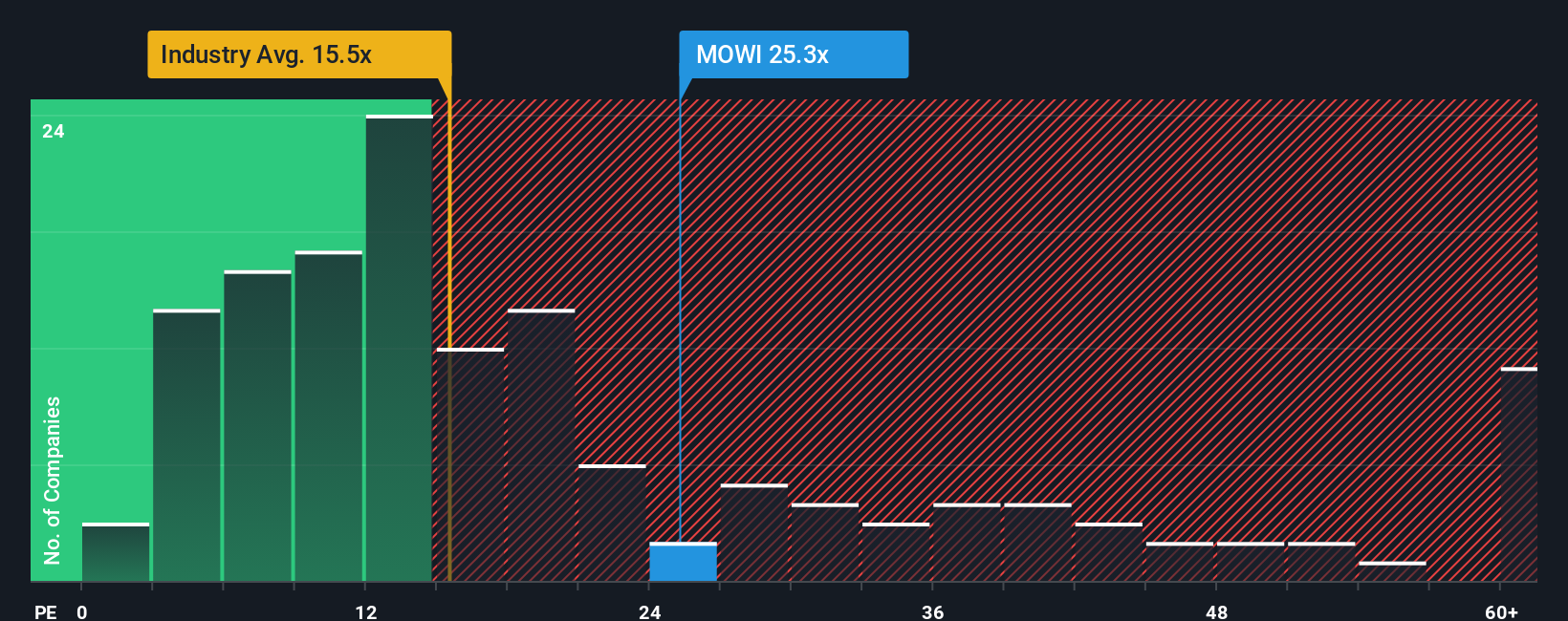

Another View: Market Multiples Tell a Different Story

While the fair value narrative highlights upside, market price-to-earnings ratios suggest a different risk. Mowi trades at 30.3 times earnings, which is higher than both the European food industry’s 15.6x and its fair ratio of 29.8x. This premium suggests investors are paying up for future growth and raises the stakes if expectations change. Could today’s optimism price in too much?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Mowi Narrative

Not convinced by the consensus or eager to dive deeper yourself? In just a few minutes, you can shape your perspective with Do it your way.

A great starting point for your Mowi research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Opportunities?

Smart investing means staying ahead of the curve, and some of the best ideas are just a click away. Don’t let others beat you to the next big opportunity. See what’s catching attention right now!

- Unlock growth by targeting small-cap gems with strong fundamentals using these 3606 penny stocks with strong financials and spot tomorrow’s leaders before the crowd.

- Supercharge your portfolio with innovation and access potential trailblazers in artificial intelligence through these 26 AI penny stocks.

- Boost your income with reliable payouts by browsing these 20 dividend stocks with yields > 3% yielding over 3% while maintaining resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MOWI

Mowi

A seafood company, produces and sells Atlantic salmon products worldwide.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives