Stock Analysis

- China

- /

- Electrical

- /

- SHSE:688408

Three Growth Companies With High Insider Ownership And 34% Revenue Growth

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets and political uncertainties, investors continue to seek stable growth opportunities. High insider ownership in growth companies can signal strong confidence from those who know the business best, aligning well with the current market's cautious optimism driven by recent positive inflation data and interest rate adjustments.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Medley (TSE:4480) | 34% | 28.7% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Arctech Solar Holding (SHSE:688408) | 38.6% | 24.8% |

| Gaming Innovation Group (OB:GIG) | 13.2% | 36.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

| Plenti Group (ASX:PLT) | 12.8% | 106.4% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 101.9% |

| HANA Micron (KOSDAQ:A067310) | 19.9% | 76.8% |

| Vow (OB:VOW) | 31.8% | 97.6% |

Let's uncover some gems from our specialized screener.

P/F Bakkafrost (OB:BAKKA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: P/F Bakkafrost operates in the production and sale of salmon products across North America, Western Europe, Eastern Europe, Asia, and other international markets, with a market capitalization of approximately NOK 34.37 billion.

Operations: P/F Bakkafrost generates revenue through various segments including DKK 9628.38 million from Sales and Other, DKK 1354.33 million from Farming Scotland, DKK 132.99 million from Freshwater Scotland, DKK 3670.97 million from Farming Faroe Islands, DKK 587.75 million from Freshwater Faroe Islands, and DKK 3496.01 million from Fishmeal, Fish Oil and Fish Feed.

Insider Ownership: 13.3%

Revenue Growth Forecast: 12.4% p.a.

P/F Bakkafrost, with high insider ownership, is poised for substantial earnings growth, forecasted at 24.4% annually over the next three years, outpacing the Norwegian market's 11.8%. However, its revenue growth projections are modest at 12.4% annually, slightly above the market average but below high-growth benchmarks. Recent adjustments in company bylaws and a stable Q1 earnings report underline operational adjustments despite a slight year-over-year dip in net income from DKK 467 million to DKK 401 million.

- Click here and access our complete growth analysis report to understand the dynamics of P/F Bakkafrost.

- In light of our recent valuation report, it seems possible that P/F Bakkafrost is trading behind its estimated value.

Arctech Solar Holding (SHSE:688408)

Simply Wall St Growth Rating: ★★★★★★

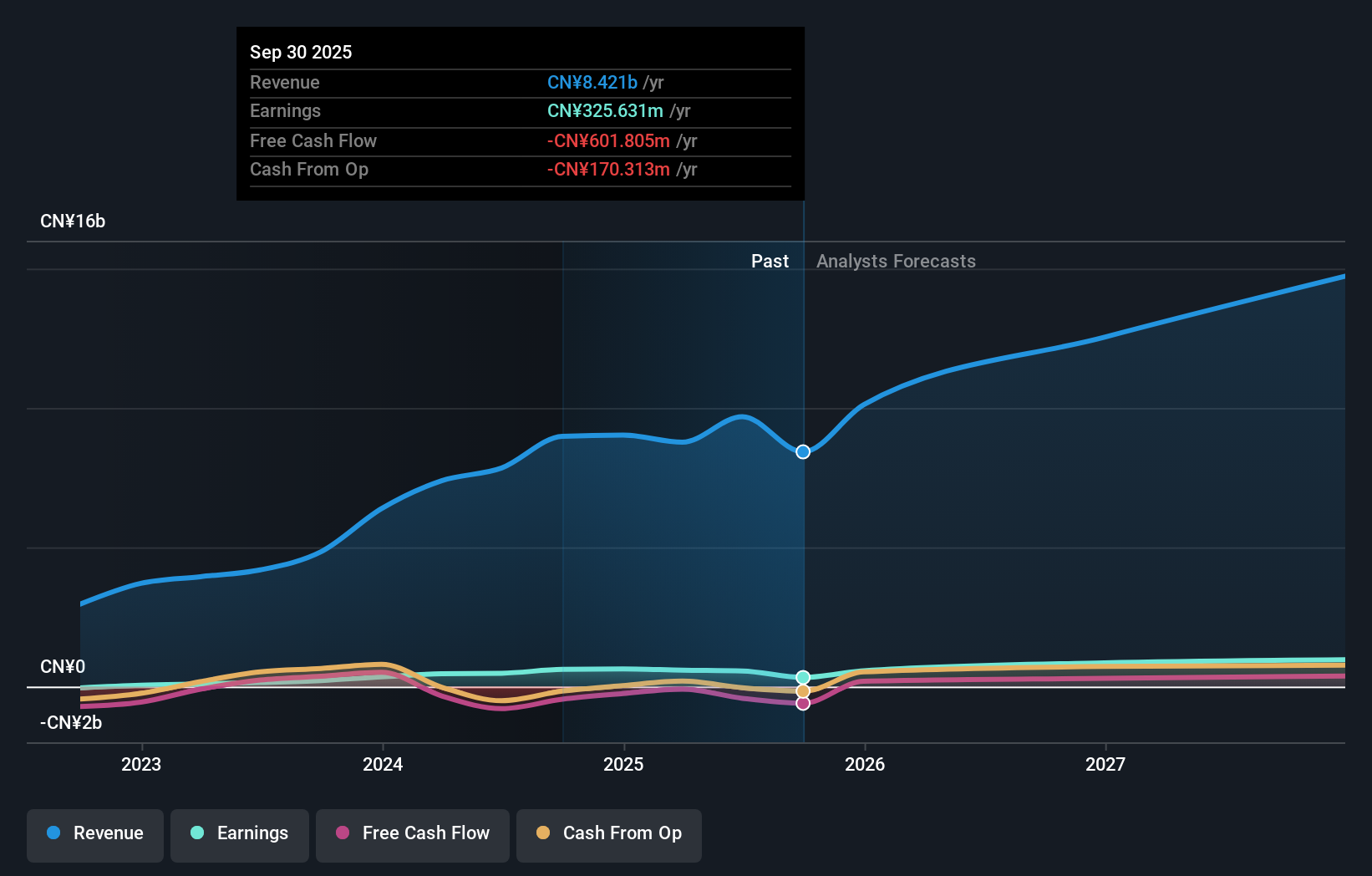

Overview: Arctech Solar Holding Co., Ltd. is a global provider of solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects, with a market capitalization of CN¥13.91 billion.

Operations: The company generates revenue primarily from the sale of solar trackers and fixed-tilt structures.

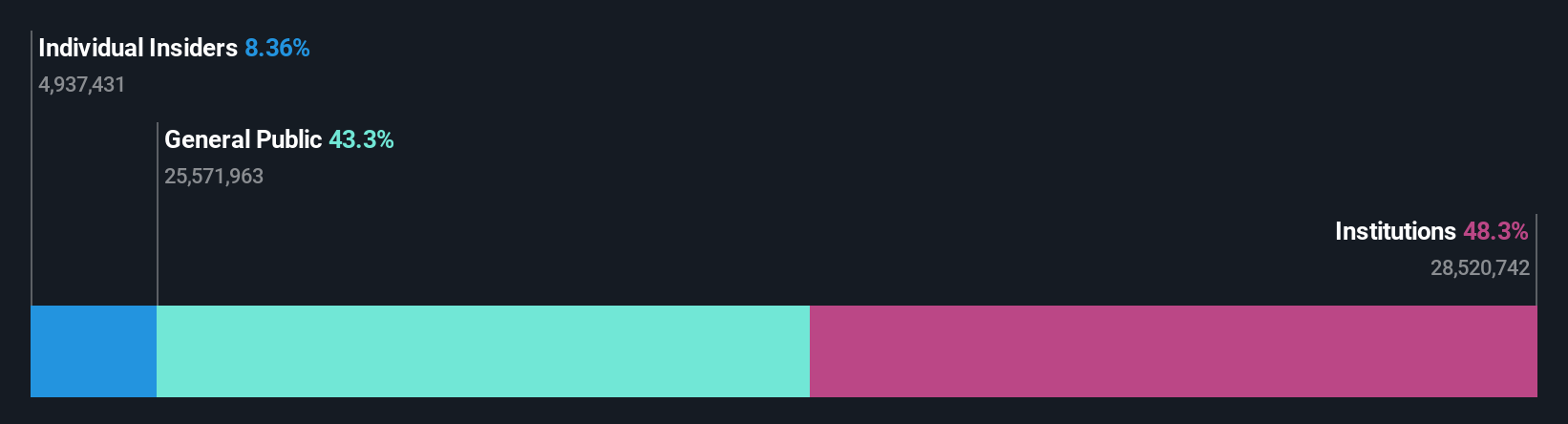

Insider Ownership: 38.6%

Revenue Growth Forecast: 20.6% p.a.

Arctech Solar Holding is experiencing robust growth with a significant increase in earnings, up by 399.6% over the past year, and expected to grow at 24.84% annually over the next three years. Revenue also surged to CNY 1.81 billion from CNY 815.48 million year-over-year in Q1 2024, reflecting strong market demand. Despite these positives, its dividend sustainability is questionable as it's not well covered by cash flows, indicating potential reinvestment of profits into further growth rather than shareholder payouts.

- Get an in-depth perspective on Arctech Solar Holding's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Arctech Solar Holding is trading beyond its estimated value.

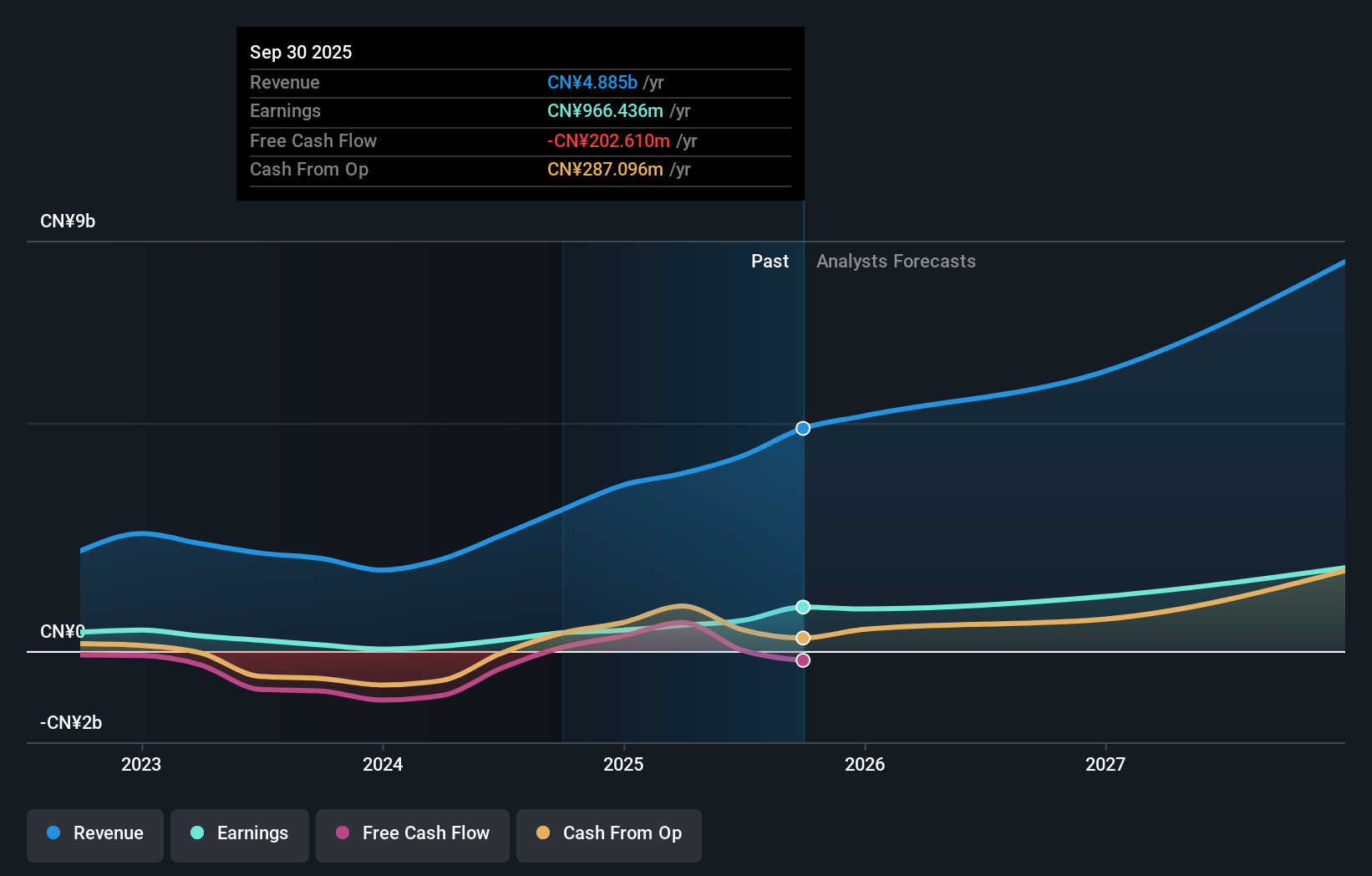

Hangzhou Changchuan TechnologyLtd (SZSE:300604)

Simply Wall St Growth Rating: ★★★★★★

Overview: Hangzhou Changchuan Technology Co., Ltd. specializes in researching, developing, producing, and selling integrated circuit equipment and high-frequency communication materials, with a market capitalization of approximately CN¥20.07 billion.

Operations: The company generates revenue primarily from the sale of integrated circuit equipment and high-frequency communication materials.

Insider Ownership: 28.4%

Revenue Growth Forecast: 35% p.a.

Hangzhou Changchuan Technology Co., Ltd has demonstrated a substantial recovery, with first-quarter sales in 2024 surging to CNY 559.39 million from CNY 320 million the previous year, alongside a shift to a net income of CNY 4.08 million from a significant loss. Despite this progress and strong insider ownership which aligns management with shareholders, the company's profit margins have declined year-over-year, and shareholder equity was diluted over the past year. These factors present mixed signals for its growth trajectory despite robust earnings forecasts.

- Click to explore a detailed breakdown of our findings in Hangzhou Changchuan TechnologyLtd's earnings growth report.

- Our valuation report unveils the possibility Hangzhou Changchuan TechnologyLtd's shares may be trading at a premium.

Where To Now?

- Dive into all 1443 of the Fast Growing Companies With High Insider Ownership we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Arctech Solar Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688408

Arctech Solar Holding

Manufactures and supplies solar trackers, fixed-tilt structures, and building-integrated photovoltaics (BIPV) solutions for utility-scale and commercial solar projects worldwide.

Exceptional growth potential with proven track record.