Institutional investors may adopt severe steps after P/F Bakkafrost's (OB:BAKKA) latest 3.7% drop adds to a year losses

Key Insights

- Given the large stake in the stock by institutions, P/F Bakkafrost's stock price might be vulnerable to their trading decisions

- A total of 17 investors have a majority stake in the company with 51% ownership

- Insider ownership in P/F Bakkafrost is 13%

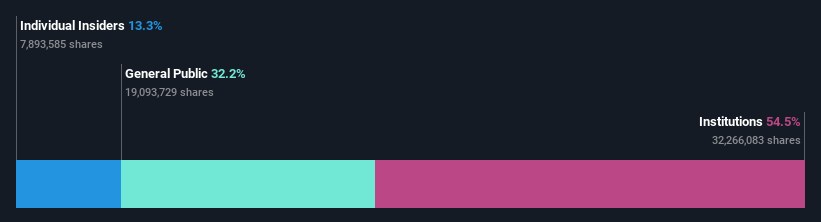

Every investor in P/F Bakkafrost (OB:BAKKA) should be aware of the most powerful shareholder groups. With 54% stake, institutions possess the maximum shares in the company. That is, the group stands to benefit the most if the stock rises (or lose the most if there is a downturn).

And institutional investors saw their holdings value drop by 3.7% last week. Needless to say, the recent loss which further adds to the one-year loss to shareholders of 19% might not go down well especially with this category of shareholders. Often called “market movers", institutions wield significant power in influencing the price dynamics of any stock. Hence, if weakness in P/F Bakkafrost's share price continues, institutional investors may feel compelled to sell the stock, which might not be ideal for individual investors.

In the chart below, we zoom in on the different ownership groups of P/F Bakkafrost.

See our latest analysis for P/F Bakkafrost

What Does The Institutional Ownership Tell Us About P/F Bakkafrost?

Institutions typically measure themselves against a benchmark when reporting to their own investors, so they often become more enthusiastic about a stock once it's included in a major index. We would expect most companies to have some institutions on the register, especially if they are growing.

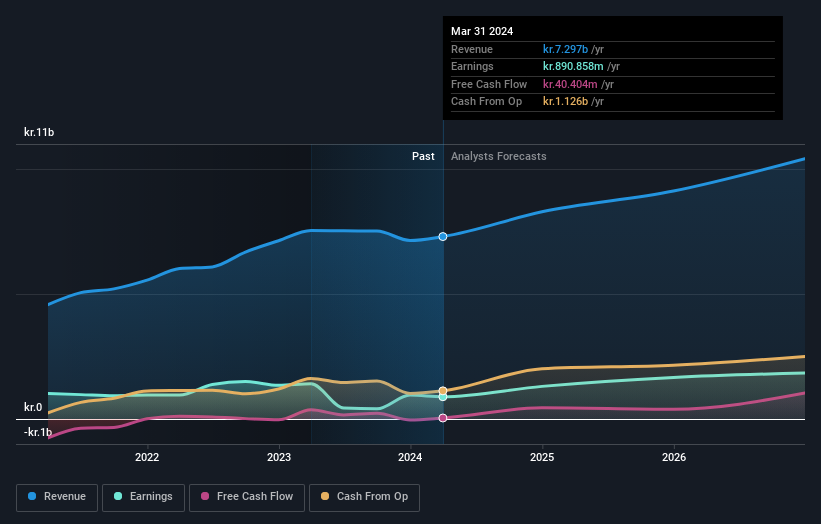

As you can see, institutional investors have a fair amount of stake in P/F Bakkafrost. This can indicate that the company has a certain degree of credibility in the investment community. However, it is best to be wary of relying on the supposed validation that comes with institutional investors. They too, get it wrong sometimes. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at P/F Bakkafrost's earnings history below. Of course, the future is what really matters.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. Hedge funds don't have many shares in P/F Bakkafrost. The company's CEO Johan Jacobsen is the largest shareholder with 7.8% of shares outstanding. The second and third largest shareholders are Sprucegrove Investment Management Ltd and Oddvor Jacobsen, with an equal amount of shares to their name at 5.0%.

After doing some more digging, we found that the top 17 have the combined ownership of 51% in the company, suggesting that no single shareholder has significant control over the company.

While it makes sense to study institutional ownership data for a company, it also makes sense to study analyst sentiments to know which way the wind is blowing. Quite a few analysts cover the stock, so you could look into forecast growth quite easily.

Insider Ownership Of P/F Bakkafrost

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. The company management answer to the board and the latter should represent the interests of shareholders. Notably, sometimes top-level managers are on the board themselves.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

It seems insiders own a significant proportion of P/F Bakkafrost. Insiders own kr4.4b worth of shares in the kr33b company. That's quite meaningful. Most would be pleased to see the board is investing alongside them. You may wish to access this free chart showing recent trading by insiders.

General Public Ownership

With a 32% ownership, the general public, mostly comprising of individual investors, have some degree of sway over P/F Bakkafrost. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important. Case in point: We've spotted 1 warning sign for P/F Bakkafrost you should be aware of.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:BAKKA

P/F Bakkafrost

Produces and sells salmon products in North America, Western Europe, Eastern Europe, Asia, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success