The European stock market has shown resilience, with major indices like Germany's DAX and France's CAC 40 experiencing modest gains despite ongoing evaluations of interest rate policies and trade concerns. As investors navigate these conditions, identifying stocks that are estimated to be trading below their intrinsic values can present opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| XTPL (WSE:XTP) | PLN68.70 | PLN135.56 | 49.3% |

| Truecaller (OM:TRUE B) | SEK41.48 | SEK82.27 | 49.6% |

| Noratis (XTRA:NUVA) | €0.805 | €1.56 | 48.3% |

| LION E-Mobility (XTRA:LMIA) | €1.09 | €2.14 | 49% |

| Lingotes Especiales (BME:LGT) | €5.80 | €11.26 | 48.5% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.378 | €0.73 | 48.5% |

| Endomines Finland Oyj (HLSE:PAMPALO) | €26.05 | €50.53 | 48.5% |

| E-Globe (BIT:EGB) | €0.675 | €1.31 | 48.5% |

| Demant (CPSE:DEMANT) | DKK220.20 | DKK429.31 | 48.7% |

| Atea (OB:ATEA) | NOK143.80 | NOK282.14 | 49% |

Underneath we present a selection of stocks filtered out by our screen.

Aker BioMarine (OB:AKBM)

Overview: Aker BioMarine ASA is a biotech innovator that develops and supplies krill-derived products for consumer health and wellness worldwide, with a market cap of NOK8.14 billion.

Operations: The company's revenue segments include Consumer Health Products at $112.40 million, Human Health Ingredients at $105.30 million, and Emerging Businesses at $8.60 million.

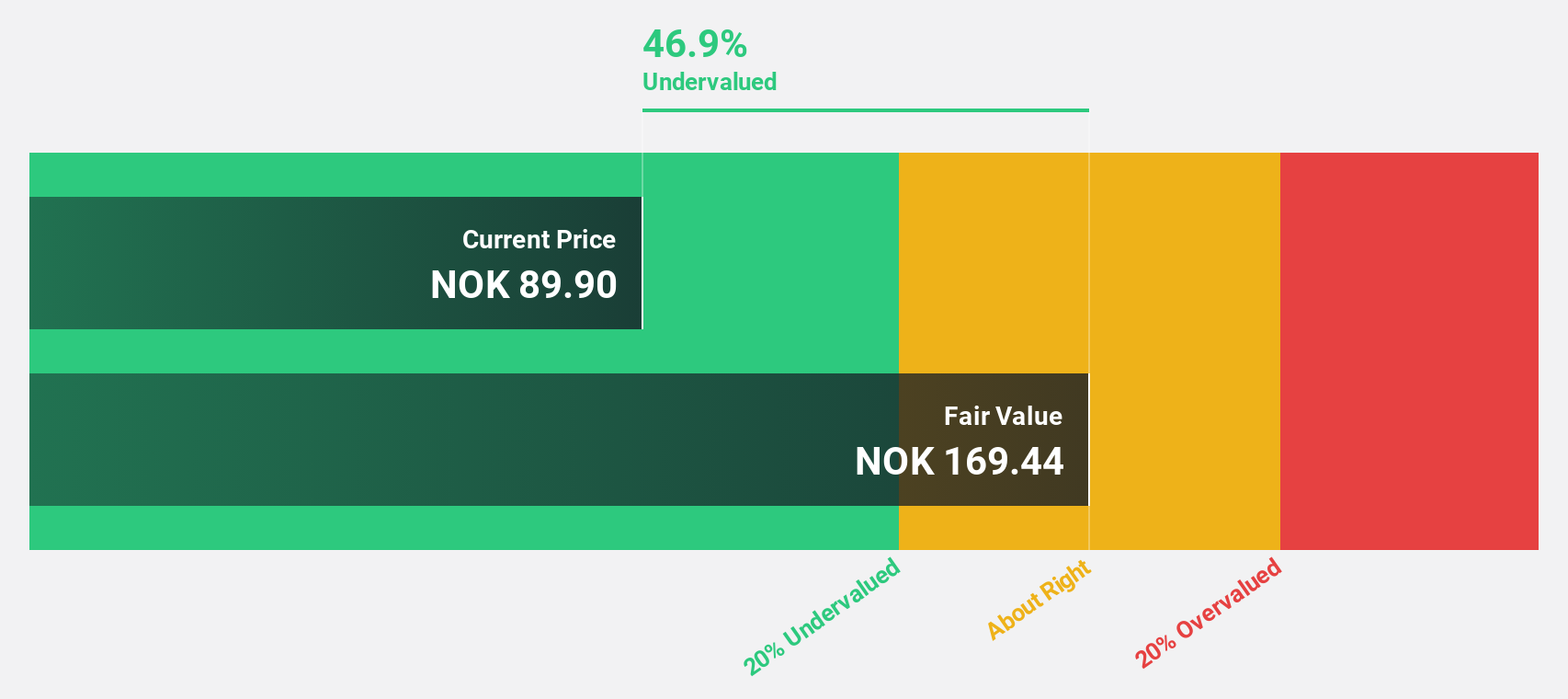

Estimated Discount To Fair Value: 44.9%

Aker BioMarine is trading at NOK92.8, significantly below its estimated fair value of NOK168.28, suggesting it may be undervalued based on cash flows. Despite being dropped from the S&P Global BMI Index, the company secured a major new client for Superba Krill Oil, potentially boosting future revenues. Forecasted revenue growth of 13% per year outpaces the Norwegian market average, although its return on equity is projected to remain modest at 12.6%.

- According our earnings growth report, there's an indication that Aker BioMarine might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Aker BioMarine.

Hensoldt (XTRA:HAG)

Overview: Hensoldt AG, with a market cap of €12.74 billion, provides sensor solutions for defense and security applications globally through its subsidiaries.

Operations: The company's revenue is primarily derived from its Sensors segment, which generated €1.98 billion, followed by the Optronics segment with €374 million.

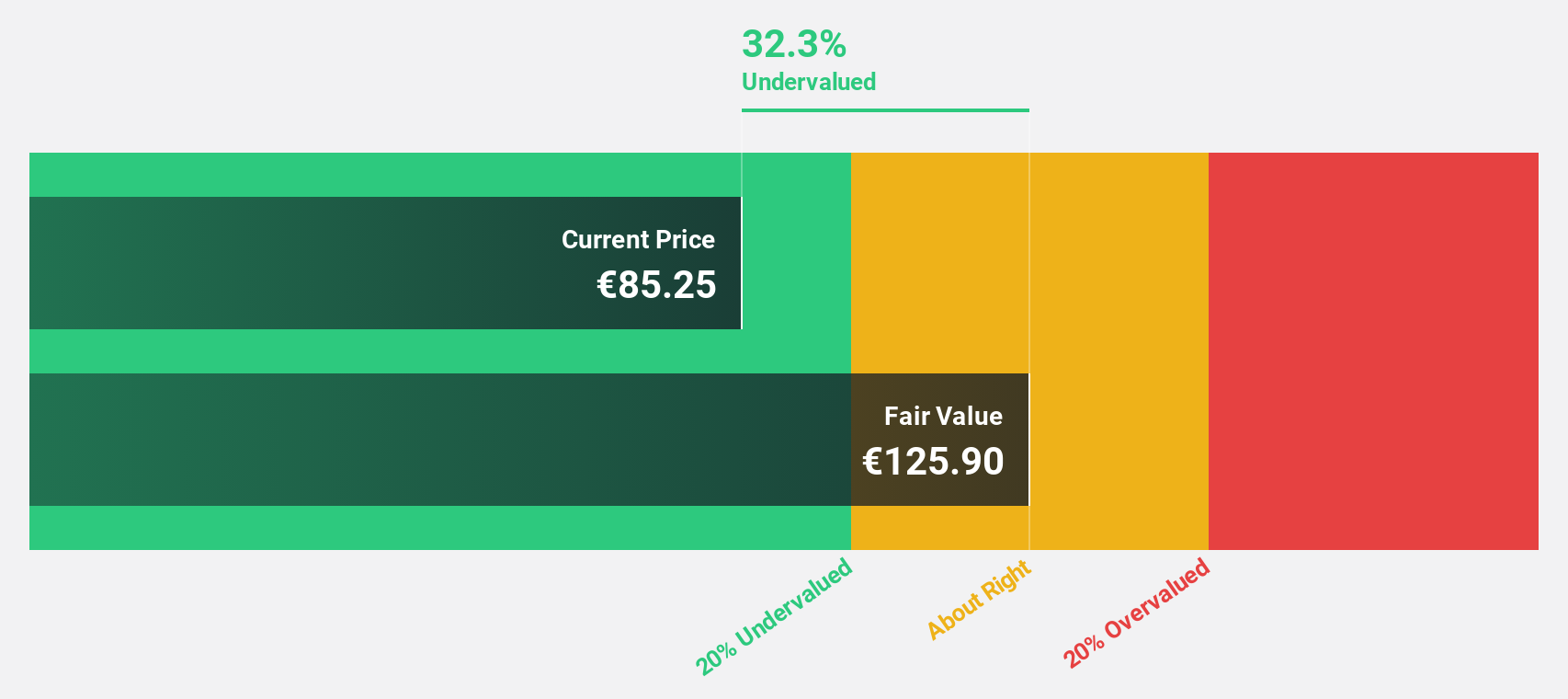

Estimated Discount To Fair Value: 14.2%

Hensoldt AG is trading at €110.3, which is 14.2% below its estimated fair value of €128.59, indicating potential undervaluation based on cash flows. Despite a net loss of €42 million for the first half of 2025, the company forecasts significant earnings growth at 31.7% annually, outpacing the German market's average. Recently added to the FTSE All-World Index, Hensoldt expects annual revenues between €2.5 billion and €2.6 billion for 2025.

- The analysis detailed in our Hensoldt growth report hints at robust future financial performance.

- Navigate through the intricacies of Hensoldt with our comprehensive financial health report here.

Ströer SE KGaA (XTRA:SAX)

Overview: Ströer SE & Co. KGaA offers out-of-home and digital out-of-home advertising services in Germany and internationally, with a market cap of €2.12 billion.

Operations: The company's revenue is primarily derived from three segments: Out-Of-Home Media (€983.80 million), Digital & Dialog Media (€875.42 million), and Daas & E-Commerce (€355.75 million).

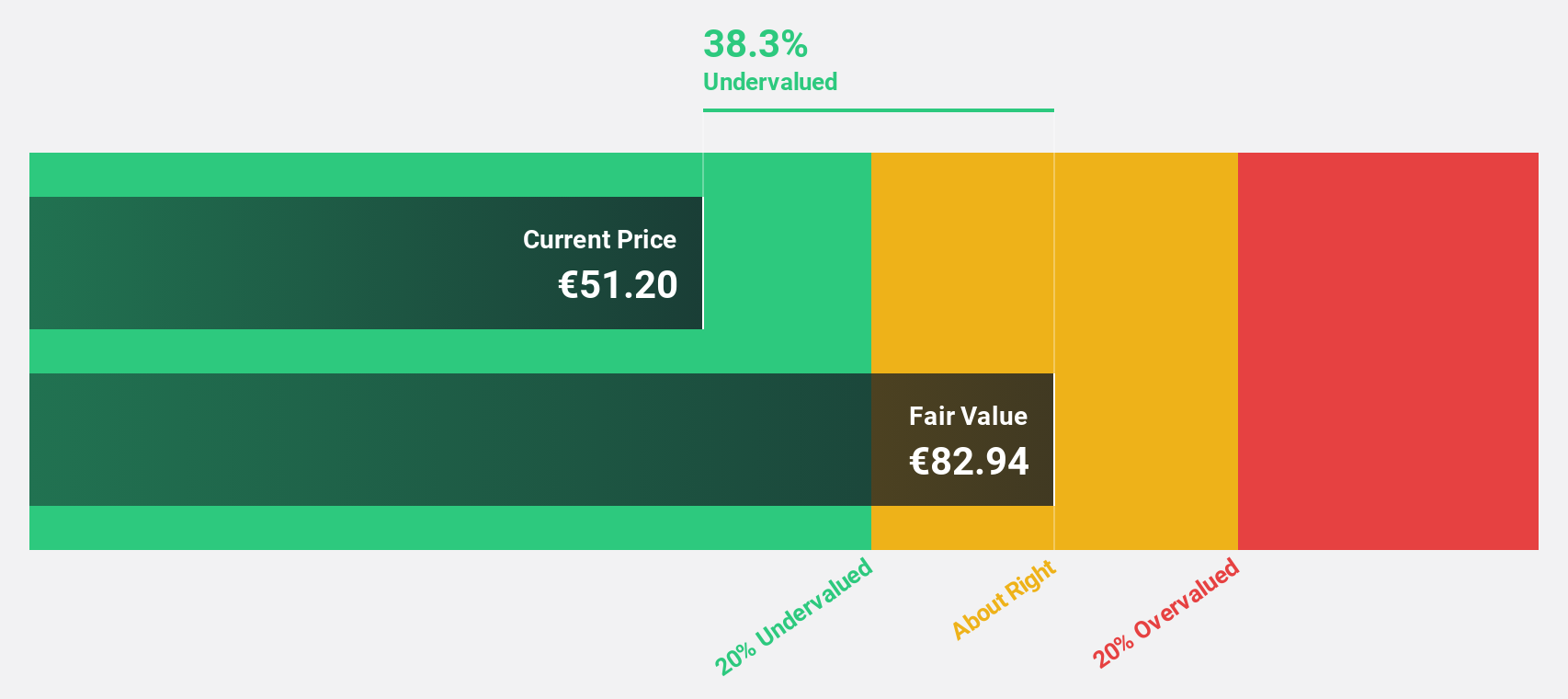

Estimated Discount To Fair Value: 47%

Ströer SE & Co. KGaA, trading at €37.9, is priced 47% below its estimated fair value of €71.45, suggesting potential undervaluation based on cash flows. Despite a decline in quarterly sales to €504.73 million from the previous year, earnings are projected to grow significantly at 21.5% annually, surpassing the German market average of 16.8%. However, high debt levels and a dividend yield of 6.07% not fully covered by earnings present concerns for investors.

- Insights from our recent growth report point to a promising forecast for Ströer SE KGaA's business outlook.

- Take a closer look at Ströer SE KGaA's balance sheet health here in our report.

Where To Now?

- Explore the 212 names from our Undervalued European Stocks Based On Cash Flows screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKBM

Aker BioMarine

A biotech innovator, develops and supplies krill-derived products for consumer health and wellness worldwide.

Reasonable growth potential with mediocre balance sheet.

Market Insights

Community Narratives