Arctic Fish Holding (OB:AFISH): Five-Year Loss Acceleration Tests Bullish Profitability Narrative

Reviewed by Simply Wall St

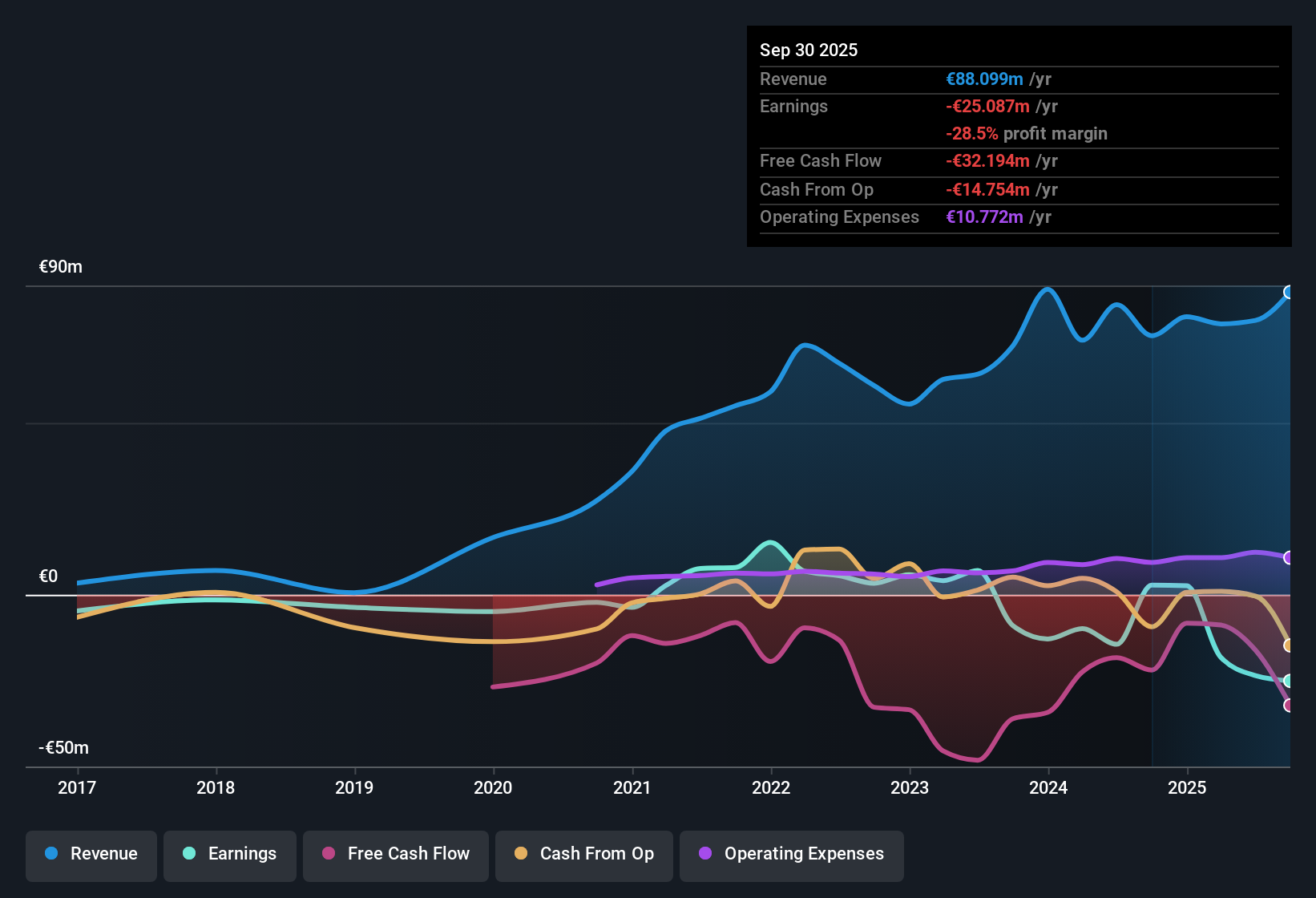

Arctic Fish Holding (OB:AFISH) remains unprofitable, with losses having grown at an average rate of 53.5% per year over the past five years. Despite the lack of positive net profit margins, revenue is forecast to surge by 25.9% annually, which is well ahead of the broader Norwegian market’s 2.4% forecast. Earnings are expected to rise 101.94% per year and there is potential for profitability within the next three years. This outlook has put a spotlight on the stock’s NOK30.2 share price, especially given its current trading level above one estimate of fair value and ongoing debate about the right balance between risk and reward.

See our full analysis for Arctic Fish Holding.With the latest earnings out, the next section compares AFISH’s headline results with the main storylines driving market expectations. This highlights where the numbers reinforce sentiment and where surprises could upend the consensus.

Curious how numbers become stories that shape markets? Explore Community Narratives

Losses Mount as 53.5% Annual Increase Erodes Margins

- Over the last five years, Arctic Fish Holding’s losses have increased at a steep 53.5% annual rate, with no period of reported net profit according to the filing summary.

- What stands out in the prevailing market view is that despite mounting losses, investors remain focused on projections for a rapid turnaround, hinging optimism on forecasts rather than historic performance.

- The lack of any positive net margin so far leaves little earnings safety net, but proponents point to aggressive earnings forecasts (101.94% annual growth) as justification for patience.

- Still, the current record shows costs outpacing revenues, making the company’s path to profitability dependent on the accuracy of these forward-looking numbers.

Price-to-Sales Ratio Flags Discount Yet Sentiment Remains Divided

- AFISH is trading at a Price-To-Sales ratio of 1.3x, below the Norwegian food industry’s 1.8x and peer average of 3.1x, offering a valuation discount against the sector.

- The prevailing market view highlights that this lower ratio could signal shares are priced attractively relative to sales, but with the stock at NOK30.2, well above the DCF fair value of NOK16.03, some argue the discount may not reflect actual upside if high growth expectations fall short.

- Supporters of the potential upside say the sales multiple leaves room for share appreciation if forecast growth materializes.

- Cautious voices, however, stress that premium pricing above fair value carries risk unless the company delivers a major operational turnaround.

Profitability Target in Three Years Pivots on Ambitious Forecasts

- Management and analysts are positioning AFISH to hit profitability within the next three years, based on a projected earnings growth rate of 101.94% annually, far above the broader Norwegian market forecast of 2.4%.

- The prevailing market view underscores that while these targets, if realized, could substantially shift the company’s financial narrative, investors must weigh the track record of escalating losses with the challenge of reversing negative margins in a short timeframe.

- Some investors interpret the ambitious outlook as evidence of an inflection point on the horizon, especially with revenue growth also forecast above sector norms.

- Yet, the company’s historical loss profile means that risks remain elevated, making future results pivotal for sentiment shifts rather than past performance.

For a deeper dive into how numbers could reshape the investment story if targets are met or missed, check out the balanced narrative on future prospects—📊 Read the full Arctic Fish Holding Consensus Narrative.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Arctic Fish Holding's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Arctic Fish Holding’s steep and persistent losses, combined with uncertain profitability targets, highlight its challenges with stable financial performance and valuation concerns.

If you want companies trading at fairer valuations with more dependable upside, check out these 836 undervalued stocks based on cash flows as a smarter place to start your search.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AFISH

Arctic Fish Holding

Engages in the salmon farming activities in the Westfjords, Iceland.

High growth potential and fair value.

Market Insights

Community Narratives