- Norway

- /

- Energy Services

- /

- OB:SUBC

Is Subsea 7 (OB:SUBC) Still Undervalued? A Fresh Look at Its Current Valuation

Reviewed by Simply Wall St

See our latest analysis for Subsea 7.

Subsea 7’s steady momentum is hard to ignore, with a 1-year total shareholder return of 11% and a robust 162% return over five years. Recent price action has been a bit mixed; however, the longer-term performance underlines investor confidence in the company’s value story.

If you’re looking to broaden your search beyond oil services, now might be the perfect time to discover fast growing stocks with high insider ownership.

But with Subsea 7 shares trading above NOK 190 and more than 20% below consensus analyst targets, the question remains: is the current price an opportunity for buyers, or is the market already factoring in the company’s future prospects?

Most Popular Narrative: 16% Undervalued

Subsea 7's popular narrative sets its fair value far above the most recent close, hinting that shares may have room to run if the market embraces current analyst expectations. This narrative brings together future operational gains with recent strategic initiatives and sector tailwinds to justify a higher valuation.

Accelerating investment in offshore wind, as indicated by a 9% year-on-year increase in renewables revenue and substantial engagement in major upcoming UK and European projects, positions Subsea 7 to benefit from global decarbonization initiatives and increasing renewable energy adoption, likely further diversifying and growing top-line revenues.

Curious how a combination of industry megatrends and aggressive internal shifts fuel this valuation? This narrative relies on bold growth bets in renewables and profit expansion efforts. Find out what specific turns could push shares beyond what the typical energy stock delivers.

Result: Fair Value of $228.56 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, key risks remain, including the uncertainty surrounding the Saipem merger and the possibility of lower-than-expected growth in the global offshore wind sector.

Find out about the key risks to this Subsea 7 narrative.

Another View: How Do Market Ratios Stack Up?

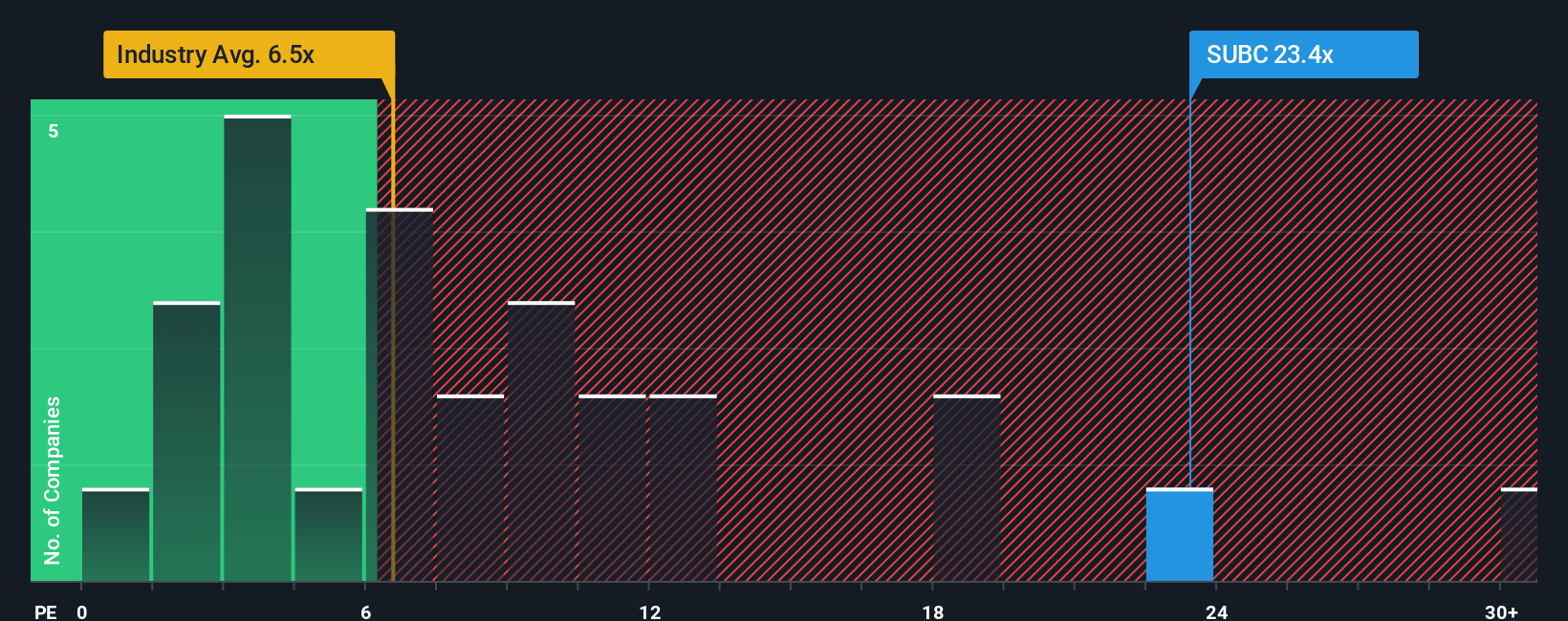

Looking through a market ratio lens, Subsea 7 appears expensive. Its price-to-earnings ratio sits at 19.2x, which is well above both the peer average of 12.3x and the Norwegian Energy Services industry’s 6.6x. Even when compared to the fair ratio of 11.1x, Subsea 7 looks pricey. Does this gap signal overenthusiasm, or is there something in the numbers the market might be missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Subsea 7 Narrative

If you want a different perspective or enjoy digging into the details yourself, you can shape your own view of Subsea 7 in just minutes. Do it your way.

A great starting point for your Subsea 7 research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your portfolio when standout opportunities are always emerging? Level up your investing strategy by tapping into a fresh range of carefully selected stocks you might otherwise miss.

- Boost your passive income stream by targeting top-yield picks through these 16 dividend stocks with yields > 3%. See how steady returns can compound your wealth.

- Capture the excitement of next-generation healthcare breakthroughs with access to these 30 healthcare AI stocks, focused on innovation and smarter medical solutions.

- Capitalize on untapped potential by hunting for great value among these 926 undervalued stocks based on cash flows, primed for growth and trading at attractive prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SUBC

Subsea 7

Subsea 7 S.A. delivers offshore projects and services for the energy industry worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives