As an investor its worth striving to ensure your overall portfolio beats the market average. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Subsea 7 S.A. (OB:SUBC) shareholders have had that experience, with the share price dropping 52% in three years, versus a market decline of about 5.0%. And the ride hasn't got any smoother in recent times over the last year, with the price 33% lower in that time. Unfortunately the share price momentum is still quite negative, with prices down 11% in thirty days.

See our latest analysis for Subsea 7

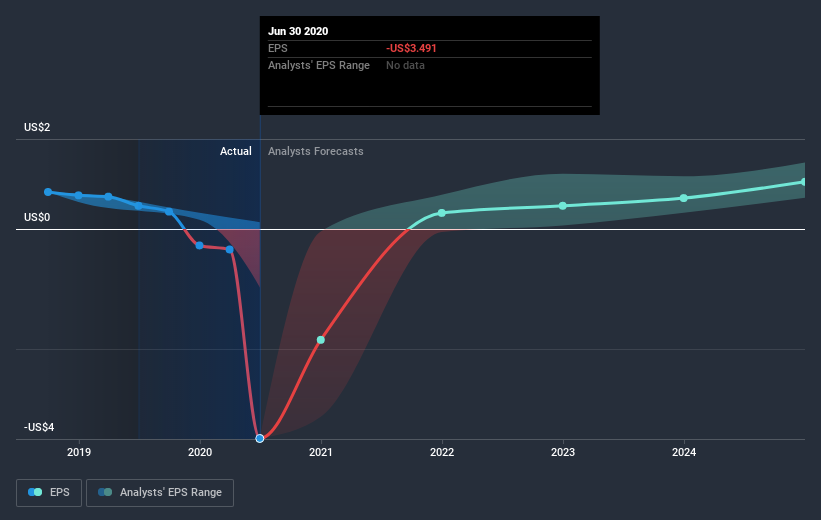

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Subsea 7 saw its share price decline over the three years in which its EPS also dropped, falling to a loss. Extraordinary items contributed to this situation. Due to the loss, it's not easy to use EPS as a reliable guide to the business. However, we can say we'd expect to see a falling share price in this scenario.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What about the Total Shareholder Return (TSR)?

We've already covered Subsea 7's share price action, but we should also mention its total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that Subsea 7's TSR, which was a 49% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

While the broader market lost about 11% in the twelve months, Subsea 7 shareholders did even worse, losing 33%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 0.1% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before spending more time on Subsea 7 it might be wise to click here to see if insiders have been buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on NO exchanges.

When trading Subsea 7 or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OB:SUBC

Subsea 7

Subsea 7 S.A. delivers offshore projects and services for the energy industry worldwide.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives