- Norway

- /

- Energy Services

- /

- OB:SOFF

Solstad Offshore (OB:SOFF) One-Off Gain Boosts Margin, Challenges Profit Quality Narrative

Reviewed by Simply Wall St

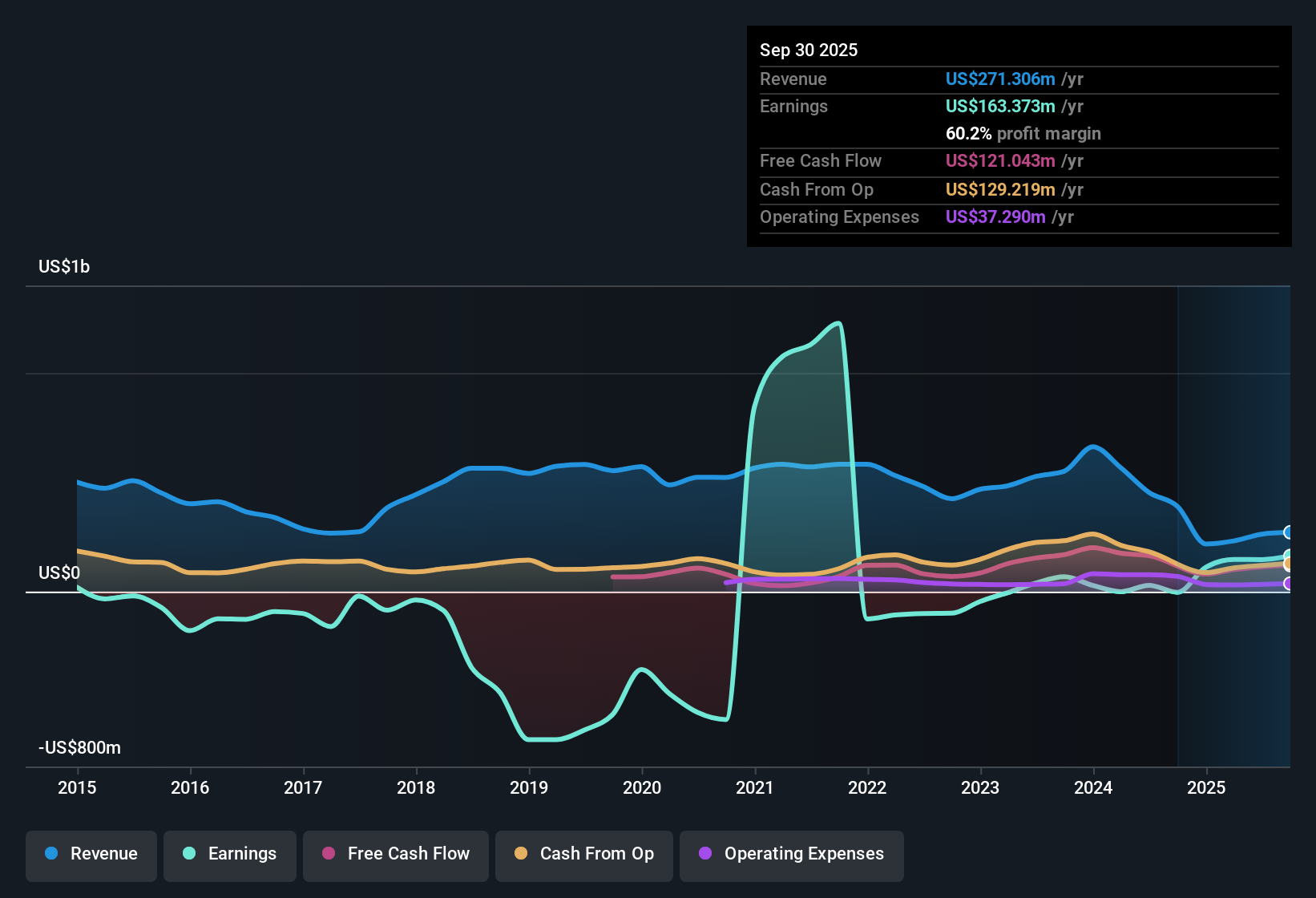

Solstad Offshore (OB:SOFF) posted current net profit margins of 55.7% for the twelve months to 30 September 2025, a sharp jump from last year’s 6.4%, largely due to a one-off gain of $60.3 million. Earnings have turned positive over the past five years, although they declined at an average of -37.5% annually across that stretch. Looking ahead, forecasts call for earnings to climb 11.3% per year, with revenue growth of 9.9% per year expected to outpace the Norwegian market average of 2.3%. All told, the outsized non-recurring gain and rapid earnings acceleration over the last year are likely to shape investor sentiment, making the quality of profits a focal point as the company trades at a Price-to-Earnings ratio of 2.4x, which is well below sector averages, despite its share price of NOK43.5 sitting well above the estimated fair value of NOK11.47.

See our full analysis for Solstad Offshore.Next up, we’ll compare these headline results to the prevailing narratives that investors follow most closely, looking at which stories hold up, and where the latest numbers start to challenge the consensus view.

Curious how numbers become stories that shape markets? Explore Community Narratives

One-Off Gain Drives 55.7% Net Margin

- Net profit margin surged to 55.7% for the twelve months to September 2025, mainly due to a sizeable one-off gain of $60.3 million rather than underlying business improvement.

- Investors hoping for a sustained turnaround must recognize that while the margin headline looks impressive, recurring earnings averaged a -37.5% annual decline over the last five years, so the recent spike does not erase long-term pressure.

- The prominent gain will likely draw bulls’ attention to profit expansion, yet this isolated boost does not signal a structural change in core profitability.

- What is surprising is that even with this jump, forward-looking growth rates (11.3% for earnings, 9.9% for revenue) are solid but not spectacular relative to sector leaders. This suggests bulls should focus on repeatability, not just this year’s number.

Forecasted Growth: Solid but Not Sector-Leading

- Earnings are forecast to grow at 11.3% per year and revenue at 9.9% per year, stronger than Norway’s 2.3% average, but notably lower than 20%+ high-growth benchmarks.

- Optimistic views about a sustained sector re-rating could be challenged by the fact that even after a 404.9% earnings acceleration, consensus expects Solstad’s earnings growth to lag behind Norway’s broader market and not rise above industry pace.

- The current growth outlook gives Solstad an edge, but consensus narrative notes that competition and high capital requirements in offshore services may limit how fast growth can accelerate from here.

- Peers could pull ahead if new contracts or sector-level tailwinds disproportionately favor others, reminding investors that market share battles are not all won on momentum alone.

Valuation: Deep Discount Hides Risk Premium

- At a Price-to-Earnings ratio of 2.4x, Solstad trades well below both the energy services peer average of 5.7x and the industry at 6.2x, which would catch a value investor’s eye, yet its share price of NOK43.5 is nearly four times above its DCF fair value of NOK11.47.

- The data-heavy prevailing view is that while this valuation discount makes the company look attractive on paper, it exists to offset ongoing concerns about the non-recurring nature of recent profits and inconsistent long-term earnings power.

- Critics highlight that the large gap between share price and DCF fair value signals investors are paying up for optionality or are betting on continued exceptionalism, not simply business-as-usual progress.

- If future results fail to match the optimism embedded in the price, this value could quickly become a trap, especially with the one-off gain disappearing from next year’s comps.

See how new perspectives and narrative debate could impact Solstad's share price down the road. See what the community is saying about Solstad Offshore

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Solstad Offshore's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Solstad’s headline profits rely heavily on one-off gains. Recurring earnings remain inconsistent, and future growth is uncertain compared to sector leaders.

If you want more reliable growth and less reliance on unpredictable events, use stable growth stocks screener (2103 results) to focus on companies delivering steady results year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SOFF

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives