- Norway

- /

- Energy Services

- /

- OB:SHLF

There's No Escaping Shelf Drilling, Ltd.'s (OB:SHLF) Muted Revenues Despite A 32% Share Price Rise

Those holding Shelf Drilling, Ltd. (OB:SHLF) shares would be relieved that the share price has rebounded 32% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Looking further back, the 14% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

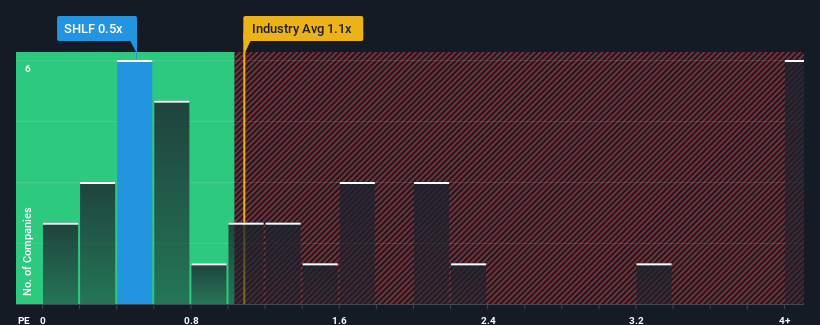

Although its price has surged higher, considering around half the companies operating in Norway's Energy Services industry have price-to-sales ratios (or "P/S") above 1.1x, you may still consider Shelf Drilling as an solid investment opportunity with its 0.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Shelf Drilling

What Does Shelf Drilling's P/S Mean For Shareholders?

Recent times have been advantageous for Shelf Drilling as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Shelf Drilling.Is There Any Revenue Growth Forecasted For Shelf Drilling?

In order to justify its P/S ratio, Shelf Drilling would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 80% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue growth is heading into negative territory, declining 5.8% over the next year. With the industry predicted to deliver 17% growth, that's a disappointing outcome.

With this in consideration, we find it intriguing that Shelf Drilling's P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Shelf Drilling's stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Shelf Drilling's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 4 warning signs for Shelf Drilling (1 is a bit concerning) you should be aware of.

If you're unsure about the strength of Shelf Drilling's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SHLF

Shelf Drilling

Operates as a shallow water offshore drilling contractor in the Middle East, North Africa, the Mediterranean, Southeast Asia, India, West Africa, and the North Sea.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives