Stock Analysis

- Norway

- /

- Energy Services

- /

- OB:SHLF

Shelf Drilling (OB:SHLF) delivers shareholders incredible 67% CAGR over 3 years, surging 11% in the last week alone

For us, stock picking is in large part the hunt for the truly magnificent stocks. But when you hold the right stock for the right time period, the rewards can be truly huge. Take, for example, the Shelf Drilling, Ltd. (OB:SHLF) share price, which skyrocketed 364% over three years. On top of that, the share price is up 19% in about a quarter.

The past week has proven to be lucrative for Shelf Drilling investors, so let's see if fundamentals drove the company's three-year performance.

Check out our latest analysis for Shelf Drilling

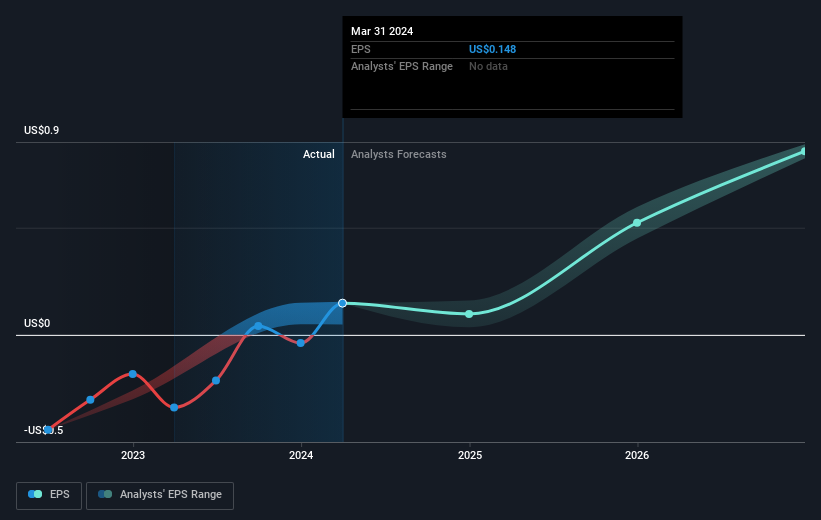

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Shelf Drilling became profitable within the last three years. Given the importance of this milestone, it's not overly surprising that the share price has increased strongly.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Shelf Drilling has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at Shelf Drilling's financial health with this free report on its balance sheet.

A Different Perspective

Shelf Drilling provided a TSR of 11% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5% endured over half a decade. It could well be that the business is stabilizing. It's always interesting to track share price performance over the longer term. But to understand Shelf Drilling better, we need to consider many other factors. Take risks, for example - Shelf Drilling has 4 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Norwegian exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Shelf Drilling is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Shelf Drilling is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SHLF

Shelf Drilling

Operates as a shallow water offshore drilling contractor in the Middle East, North Africa, the Mediterranean, Southeast Asia, India, West Africa, and North Sea.

High growth potential and fair value.