- Norway

- /

- Energy Services

- /

- OB:SHLF

Shelf Drilling, Ltd. (OB:SHLF) Looks Inexpensive After Falling 27% But Perhaps Not Attractive Enough

Shelf Drilling, Ltd. (OB:SHLF) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

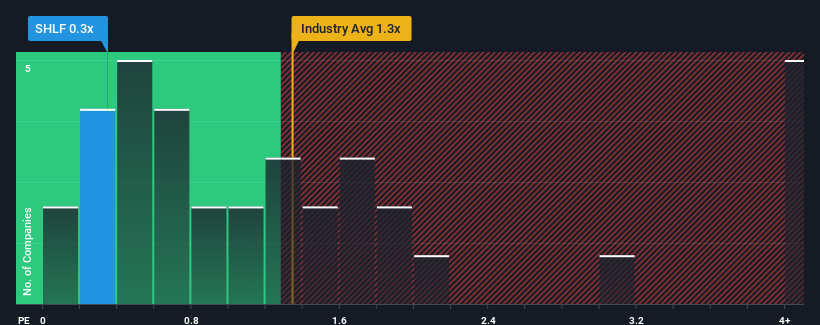

Even after such a large drop in price, given about half the companies operating in Norway's Energy Services industry have price-to-sales ratios (or "P/S") above 1.3x, you may still consider Shelf Drilling as an attractive investment with its 0.3x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Shelf Drilling

How Has Shelf Drilling Performed Recently?

Recent times haven't been great for Shelf Drilling as its revenue has been rising slower than most other companies. The P/S ratio is probably low because investors think this lacklustre revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Shelf Drilling's future stacks up against the industry? In that case, our free report is a great place to start.How Is Shelf Drilling's Revenue Growth Trending?

Shelf Drilling's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. Pleasingly, revenue has also lifted 94% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 5.7% over the next year. Meanwhile, the broader industry is forecast to expand by 29%, which paints a poor picture.

In light of this, it's understandable that Shelf Drilling's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

What Does Shelf Drilling's P/S Mean For Investors?

Shelf Drilling's recently weak share price has pulled its P/S back below other Energy Services companies. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Shelf Drilling's P/S is on the lower end of the spectrum. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Shelf Drilling (at least 1 which shouldn't be ignored), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Shelf Drilling, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SHLF

Shelf Drilling

Operates as a shallow water offshore drilling contractor in the Middle East, North Africa, the Mediterranean, Southeast Asia, India, West Africa, and the North Sea.

Proven track record with slight risk.

Similar Companies

Market Insights

Community Narratives