- Norway

- /

- Oil and Gas

- /

- OB:SEAPT

Seacrest Petroleo Bermuda Limited (OB:SEAPT) Soars 38% But It's A Story Of Risk Vs Reward

Seacrest Petroleo Bermuda Limited (OB:SEAPT) shareholders are no doubt pleased to see that the share price has bounced 38% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 61% share price drop in the last twelve months.

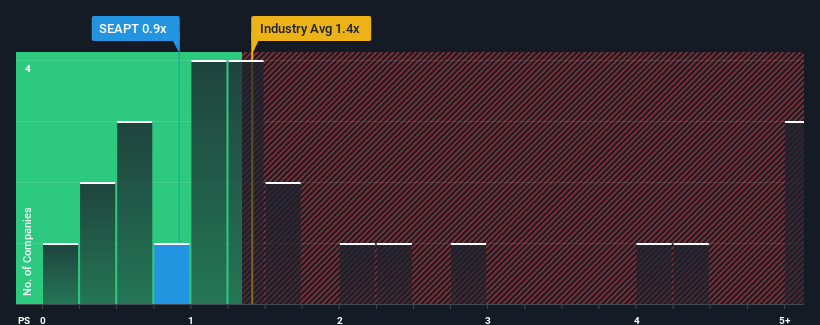

In spite of the firm bounce in price, it's still not a stretch to say that Seacrest Petroleo Bermuda's price-to-sales (or "P/S") ratio of 0.9x right now seems quite "middle-of-the-road" compared to the Oil and Gas industry in Norway, where the median P/S ratio is around 1.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Seacrest Petroleo Bermuda

How Has Seacrest Petroleo Bermuda Performed Recently?

Recent times have been pleasing for Seacrest Petroleo Bermuda as its revenue has risen in spite of the industry's average revenue going into reverse. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Want the full picture on analyst estimates for the company? Then our free report on Seacrest Petroleo Bermuda will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Seacrest Petroleo Bermuda's to be considered reasonable.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. Still, revenue has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that revenue growth has been inconsistent recently for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth will be highly resilient over the next three years growing by 42% per annum. That would be an excellent outcome when the industry is expected to decline by 3.3% per annum.

In light of this, it's peculiar that Seacrest Petroleo Bermuda's P/S sits in-line with the majority of other companies. Apparently some shareholders are skeptical of the contrarian forecasts and have been accepting lower selling prices.

The Bottom Line On Seacrest Petroleo Bermuda's P/S

Seacrest Petroleo Bermuda's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Seacrest Petroleo Bermuda's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. We assume that investors are attributing some risk to the company's future revenues, keeping it from trading at a higher P/S. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Having said that, be aware Seacrest Petroleo Bermuda is showing 3 warning signs in our investment analysis, and 2 of those are potentially serious.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:SEAPT

Seacrest Petroleo Bermuda

An independent oil and gas production company, engages in the redevelopment of midlife onshore producing oil and gas fields in Brazil.

Slight risk and slightly overvalued.

Market Insights

Community Narratives