- Norway

- /

- Energy Services

- /

- OB:SEA1

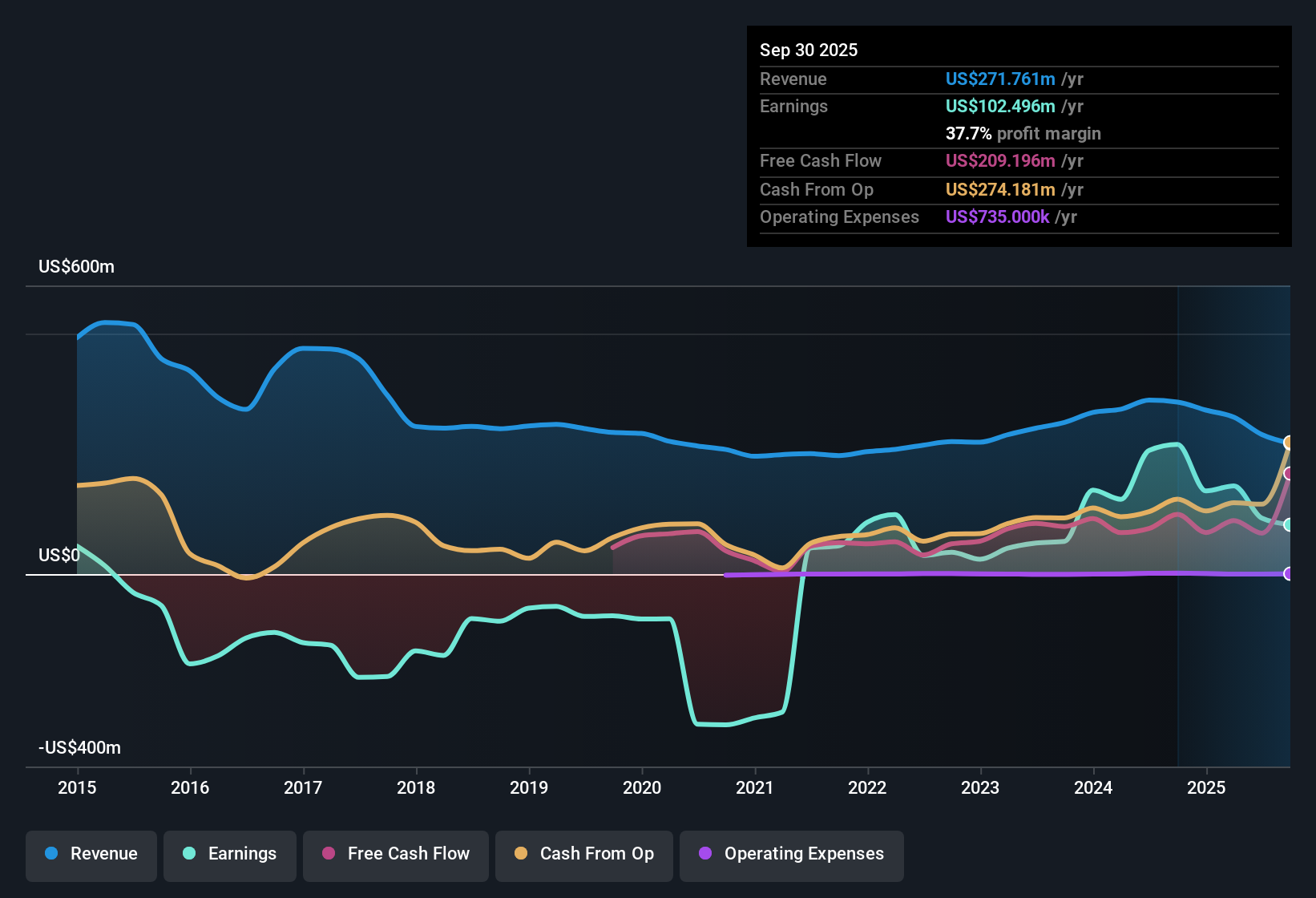

Sea1 Offshore (OB:SEA1) Margin Halves to 37.7%, Raising Questions on Profit Sustainability

Reviewed by Simply Wall St

Sea1 Offshore (OB:SEA1) posted a net profit margin of 37.7%, a notable step down from last year’s 75.4% mark. Over the last five years, the company has achieved annual cumulative earnings growth of 55.4%. However, revenue is only expected to grow 0.4% per year going forward, which lags behind the broader Norwegian market’s 2.4% forecast. Despite a price-to-earnings ratio of just 3x and a share price well below fair value at NOK20.05, the outlook is clouded by expectations that earnings will decline annually by 26.4% over the next three years.

See our full analysis for Sea1 Offshore.The next section examines how these earnings numbers compare to popular narratives about Sea1 Offshore. It highlights where expectations match reality and where there is a disconnect.

See what the community is saying about Sea1 Offshore

Analyst Price Target Sits 50% Above Market

- The analyst consensus price target is NOK30.08, which is about 50% above Sea1 Offshore’s current share price of NOK20.05.

- Analysts' consensus view leans positive despite falling profits, citing:

- Resilient contract backlog of $756 million and high fleet utilization provide continued revenue visibility, even as earnings trend lower.

- Expected 24.1% upside from today’s share price to target also strengthens the consensus and keeps Sea1 Offshore in focus as a value play against broader Norwegian energy peers.

Margins Under Pressure as Fleet Shrinks

- Forecasts indicate profit margins will drop from 40.0% to just 16.2% over the next three years, while the fleet continues to reduce in size.

- Analysts' consensus view flags long-term risks:

- Shrinking asset base due to vessel disposals and scrapping could limit revenue generation and squeeze margins more than contract visibility alone would suggest.

- Exposure to volatile spot markets, especially in the North Sea, adds to this risk as overcapacity could cut into both rates and utilization despite near-term backlog strength.

DCF Fair Value Triples the Current Price

- The DCF fair value estimate for Sea1 Offshore is NOK62.38, over three times the current share price of NOK20.05, and a substantial discount to both peer and industry price-to-earnings ratios.

- Analysts' consensus view highlights this valuation mismatch:

- Sea1 Offshore’s PE of 3x is less than half the industry average of 6.1x, despite a robust five-year profit growth history.

- This steep discount only makes sense if you are convinced that future profit declines will substantially exceed even the current forecasts, or that industry conditions will erode long-term margins beyond what is currently expected.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sea1 Offshore on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these figures? Share your fresh perspective and shape the story in just a few minutes. Do it your way.

A great starting point for your Sea1 Offshore research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Sea1 Offshore faces shrinking margins and uncertain profit growth as its fleet reduces in size. This raises questions about the sustainability of future earnings.

If you are looking for companies delivering more consistent growth and reliable expansion, check out our stable growth stocks screener (2088 results) to discover businesses with steady, dependable performance through market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SEA1

Sea1 Offshore

Owns and operates offshore support vessels for the offshore energy service industry.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives