European markets have recently seen a positive upswing, with the pan-European STOXX Europe 600 Index climbing 1.68% and major indices in Germany, Italy, France, and the UK also posting gains. In this context of market optimism and economic resilience, penny stocks continue to capture investor interest as they often represent smaller or newer companies with potential for growth. Although the term "penny stocks" may seem outdated, these investments can still offer significant opportunities when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €3.638 | €1.26B | ✅ 5 ⚠️ 2 View Analysis > |

| Lucisano Media Group (BIT:LMG) | €1.09 | €16.19M | ✅ 4 ⚠️ 5 View Analysis > |

| DigiTouch (BIT:DGT) | €1.985 | €27.43M | ✅ 3 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €224.95M | ✅ 2 ⚠️ 2 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.54 | SEK215.37M | ✅ 2 ⚠️ 2 View Analysis > |

| Nurminen Logistics Oyj (HLSE:NLG1V) | €0.944 | €76.18M | ✅ 2 ⚠️ 4 View Analysis > |

| Faes Farma (BME:FAE) | €4.46 | €1.39B | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.03 | €280.59M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.906 | €30.34M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 277 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Cemat (CPSE:CEMAT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Cemat A/S develops, operates, and sells properties in Poland with a market cap of DKK244.64 million.

Operations: The company's revenue is derived from Development, generating DKK0.02 million, and Property Management & Holding, contributing DKK38.77 million.

Market Cap: DKK244.64M

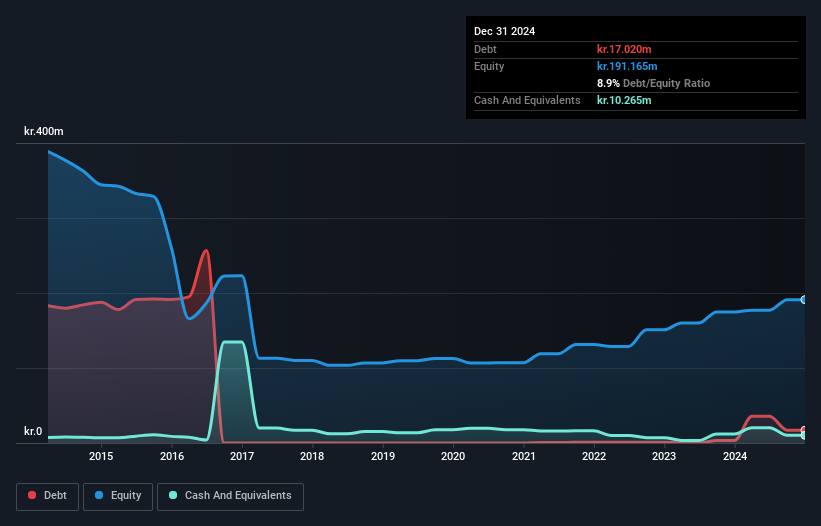

Cemat A/S, with a market cap of DKK244.64 million, operates in the property sector in Poland and has shown strong financial performance recently. Despite being classified as a penny stock, it is trading significantly below its estimated fair value. The company reported substantial earnings growth over the past year at 157.8%, driven by improved net profit margins and effective debt management—having more cash than total debt and well-covered interest payments. However, recent results were influenced by large one-off items, which may affect earnings quality perception. Cemat's upgraded earnings guidance for 2025 further indicates positive momentum in its financial outlook.

- Get an in-depth perspective on Cemat's performance by reading our balance sheet health report here.

- Gain insights into Cemat's past trends and performance with our report on the company's historical track record.

S.D. Standard ETC (OB:SDSD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: S.D. Standard ETC Plc is an investment holding company that focuses on the energy, transport, and commodities segments, with a market cap of NOK959.80 million.

Operations: The company reported a revenue segment of $-5.21 million from its investment holding activities.

Market Cap: NOK959.8M

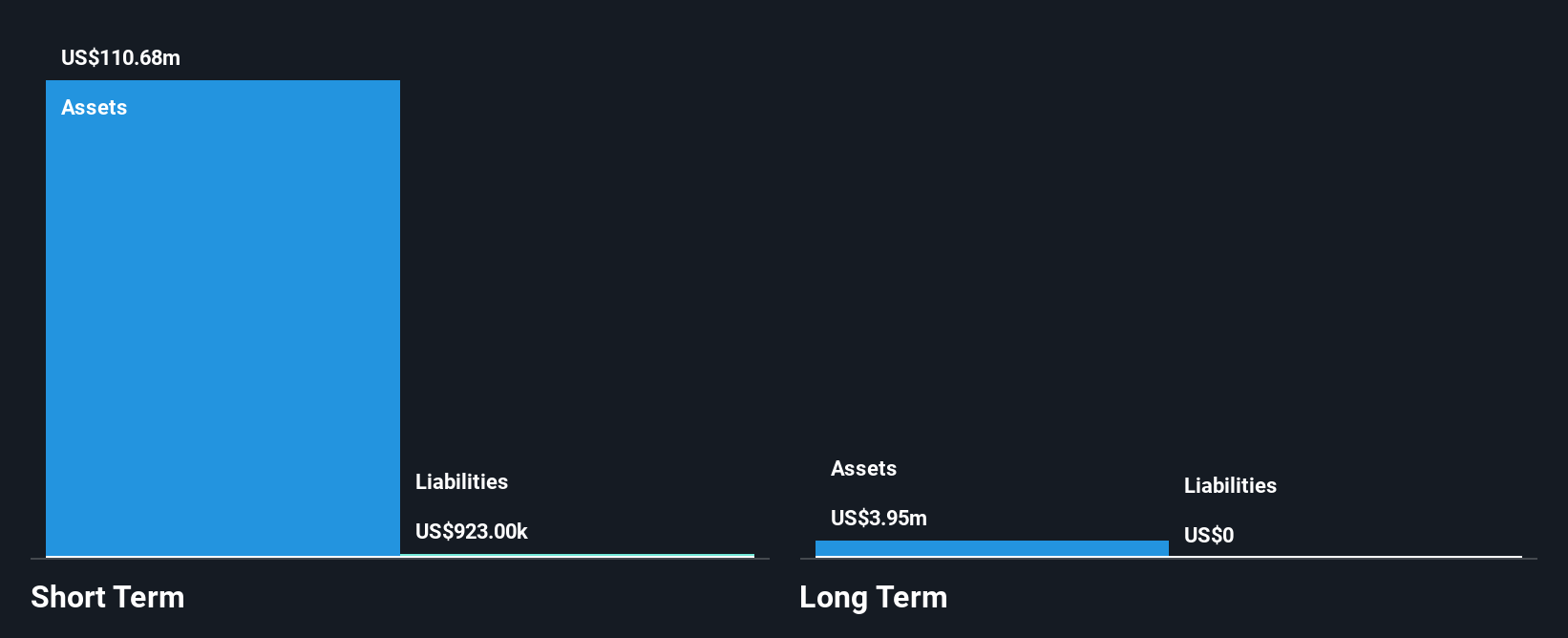

S.D. Standard ETC Plc, with a market cap of NOK959.80 million, has shown significant improvement in its financial performance. Despite being pre-revenue and unprofitable, the company reported a positive net income of US$4.74 million for Q2 2025 compared to a net loss the previous year, highlighting an effective turnaround. The management team is seasoned with an average tenure of 8.3 years, contributing to strategic stability. With no long-term liabilities or debt and sufficient cash runway for over three years due to positive free cash flow growth, S.D. Standard ETC maintains financial resilience amidst volatility in penny stock markets.

- Click here to discover the nuances of S.D. Standard ETC with our detailed analytical financial health report.

- Learn about S.D. Standard ETC's historical performance here.

BoMill (OM:BOMILL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BoMill AB (publ) develops and sells sorting equipment for grain and the food industries across Sweden, Europe, and North America, with a market cap of SEK73.31 million.

Operations: The company's revenue is generated entirely from its Machinery & Industrial Equipment segment, amounting to SEK6.54 million.

Market Cap: SEK73.31M

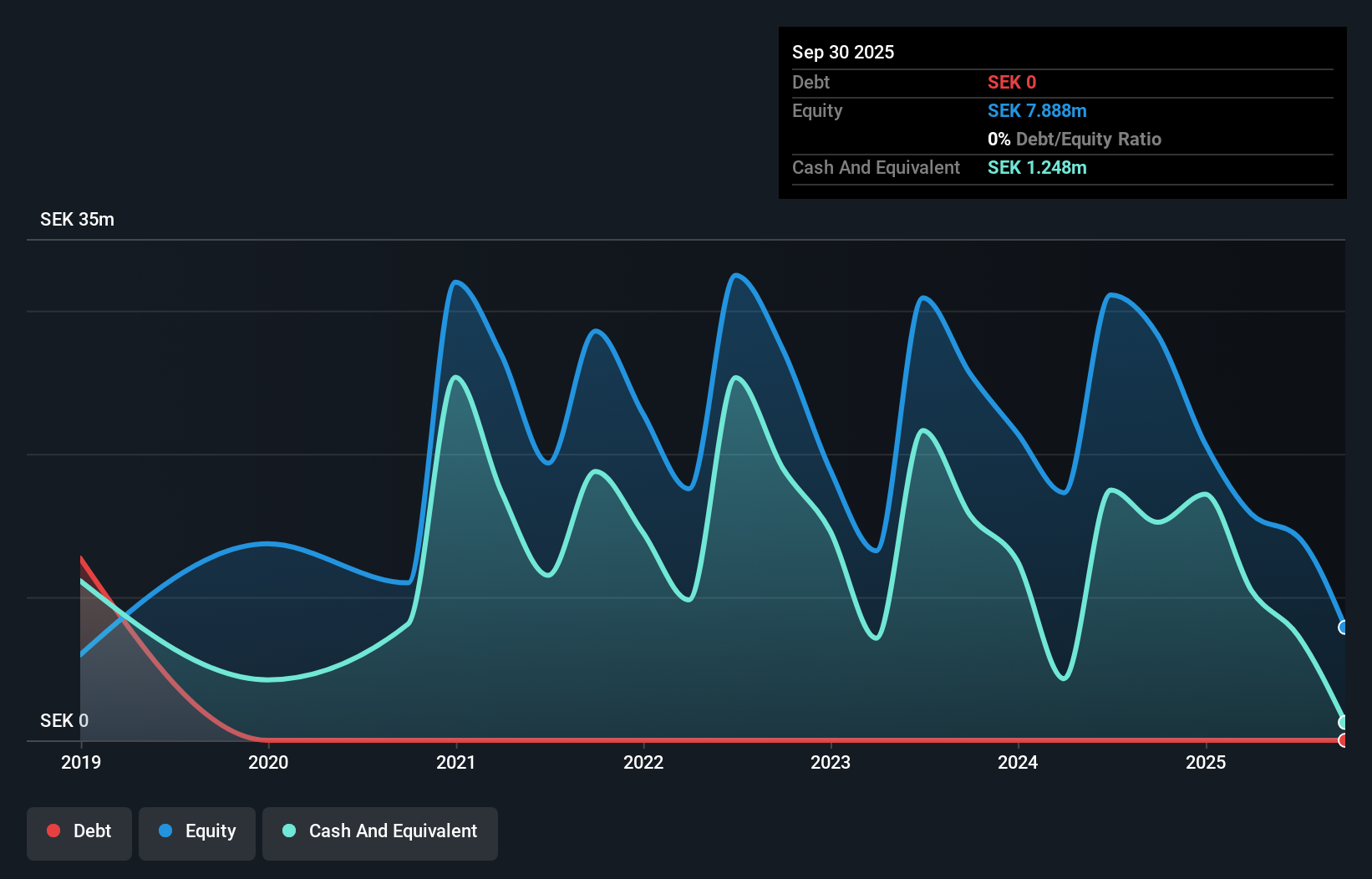

BoMill AB, with a market cap of SEK73.31 million, is navigating challenges typical of penny stocks. The company reported a significant drop in Q3 2025 revenue to SEK0.13 million from SEK3.71 million the previous year, reflecting volatility and operational hurdles. Despite securing substantial orders from Anheuser-Busch InBev and a Saudi Arabian flour mill group, BoMill remains unprofitable with negative return on equity and less than a year of cash runway based on current free cash flow trends. However, its experienced management team and debt-free status provide some stability amidst financial uncertainties common in this sector.

- Navigate through the intricacies of BoMill with our comprehensive balance sheet health report here.

- Explore historical data to track BoMill's performance over time in our past results report.

Summing It All Up

- Unlock our comprehensive list of 277 European Penny Stocks by clicking here.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BoMill might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BOMILL

BoMill

Develops and sells sorting equipment for grain and the food industries in Sweden, Europe, and North America.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives