- Norway

- /

- Energy Services

- /

- OB:ODL

Odfjell Drilling (OB:ODL): Assessing Valuation After Recent Share Price Movements

Reviewed by Simply Wall St

See our latest analysis for Odfjell Drilling.

After a solid run so far in 2024, Odfjell Drilling’s momentum is still in play, with the shares gaining over 45% year-to-date and an impressive 67.8% total shareholder return over the past year. The latest moves seem to reflect ongoing investor confidence alongside renewed optimism about the company’s growth prospects.

If you’re looking to expand beyond energy stocks like Odfjell Drilling, now is the perfect time to discover fast growing stocks with high insider ownership.

With shares still trading below analyst targets and strong gains logged this year, the question remains: Is Odfjell Drilling still undervalued, or are investors already pricing in all the potential upside ahead?

Most Popular Narrative: 15.9% Undervalued

Odfjell Drilling’s most popular narrative implies notable upside from today’s closing price of NOK80, as the estimated fair value stands at NOK95.10. This perspective draws on long-term growth catalysts and industry fundamentals to underpin its fair value calculation.

The company has locked in high-quality, long-term contracts with major customers at increasing day rates. Average day rates have risen quarter-on-quarter, and a backlog of $1.7 billion stretches to 2030 for some assets. This enhances revenue visibility and stability for years to come.

Want to know what’s fueling analyst optimism? This narrative hinges on robust earnings potential and margin expansion, grounded in bold projections for contract wins and future profitability. Curious about the financial assumptions shaping this valuation? Dive in for the full story.

Result: Fair Value of NOK95.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, heavy reliance on a few key clients and limited geographic reach could quickly shift the outlook if contract renewals or market needs change.

Find out about the key risks to this Odfjell Drilling narrative.

Another Perspective: Multiples Suggest Expensive Territory

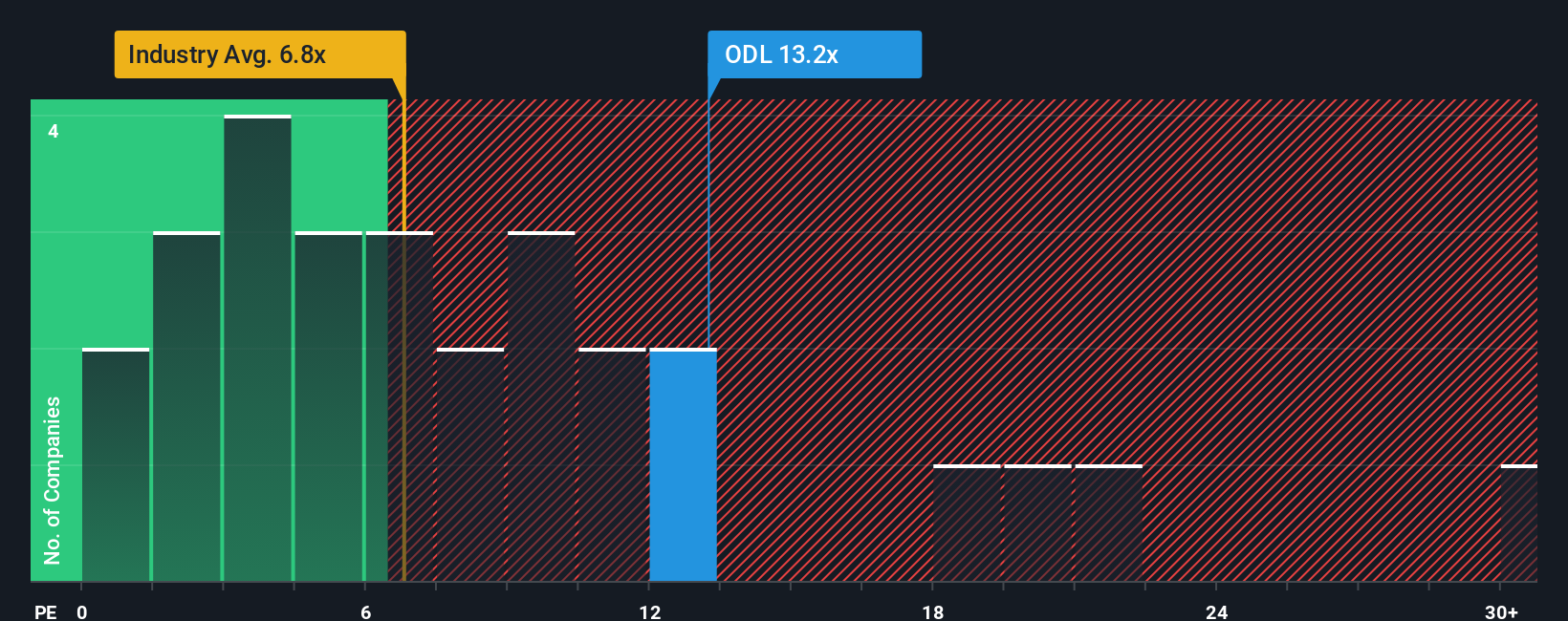

Taking a different approach, a closer look at the price-to-earnings ratio shows Odfjell Drilling trades at 13.2x, which is high compared to both the Norwegian Energy Services industry average of 6.8x and its peer average of 5x. The fair ratio for the company is also lower at 8.5x, highlighting a noticeable premium that investors are currently paying. Does this premium signal real potential, or could the shares be overpriced relative to possibilities?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Odfjell Drilling Narrative

If you think there’s more to the story or want to investigate the numbers on your own terms, you can build your own perspective quickly and easily with just a few clicks. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Odfjell Drilling.

Looking for More Investment Ideas?

Don’t miss your chance to uncover smart new opportunities beyond Odfjell Drilling. Give your portfolio the edge by acting on these hand-picked stock ideas:

- Unlock growth potential with these 860 undervalued stocks based on cash flows, a focus on market leaders trading below their true worth and positioned for potential rebound.

- Capture future trends by checking out these 24 AI penny stocks, which features companies leading the transformation in artificial intelligence.

- Strengthen your income stream by reviewing these 17 dividend stocks with yields > 3%, filled with reliable companies offering attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:ODL

Odfjell Drilling

Engages in owning and operating mobile offshore drilling units primarily in Norway and Namibia.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives