- Norway

- /

- Energy Services

- /

- OB:DVD

Deep Value Driller (OB:DVD) Margins Improve, Challenging Bearish Growth Narratives

Reviewed by Simply Wall St

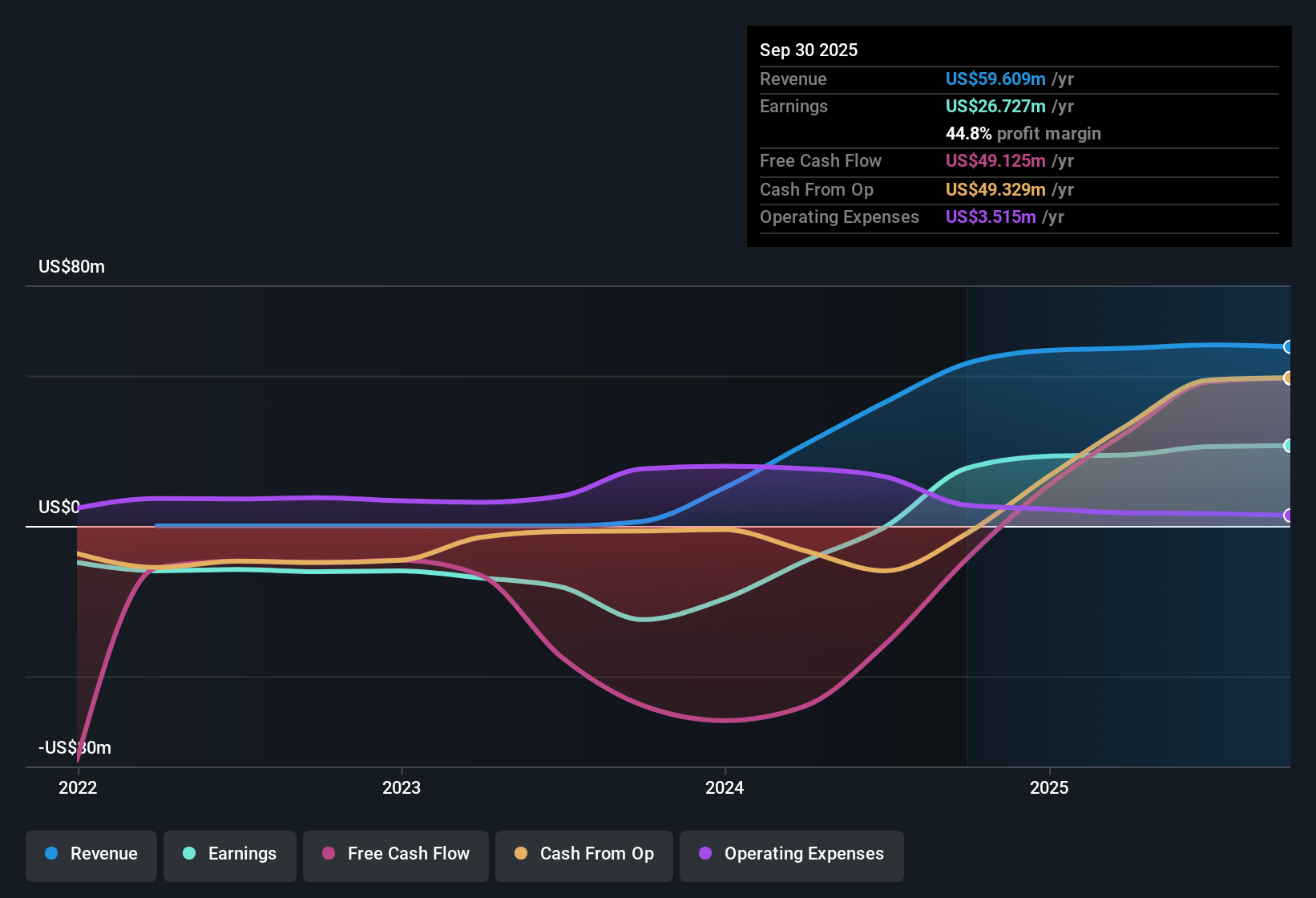

Deep Value Driller (OB:DVD) posted net profit margins of 44.8%, climbing from last year’s 35.5%, while annual earnings growth landed at 39.1%. This is a solid result, though it trails the five-year average of 71.3%. The company is now trading at a P/E ratio of 6.7x, which is below the peer group’s 8.1x average, but commands a slight premium to the wider Norwegian Energy Services sector at 6.1x. With healthy profitability and upbeat value metrics, DVD’s results catch the eye, even as headwinds are forecast for both revenue and earnings in the years ahead.

See our full analysis for Deep Value Driller.Now it’s time to see how these headline numbers stack up against the main narratives that investors are following. Next up, we compare the earnings results to those prevailing views.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margins Hold Firm Despite Growth Slowdown

- Net profit margins improved to 44.8% for Deep Value Driller, marking another year of strong profitability even as annual earnings growth of 39.1% fell below the five-year average of 71.3%.

- Forecasts for the next three years point to declining top and bottom lines, with revenues expected to decrease at 12.9% annually and earnings projected to shrink by 28.8% per year.

- This sharp reversal challenges any notion of smooth compounding. While margins remain high for now, sustained pressure clouds the durability of DVD's recent profitability streak.

- Supporting the optimistic angle, the current margin resilience signals robust operating leverage. However, the magnitude of the forecast declines means even upbeat investors must consider how long this advantage can last.

Peer Discount, Sector Premium in P/E

- With a Price-to-Earnings ratio of 6.7x, DVD trades at a notable discount to the peer average of 8.1x, but still commands a slight premium over the broader Norwegian Energy Services sector's 6.1x.

- Valuation tensions emerge as the company’s forward outlook dampens what might at first look like clear bargain pricing.

- It is noteworthy that there is a persistent premium to the sector average, suggesting investors still price in some resilience uniquely to DVD despite negative growth forecasts.

- This premium P/E could change quickly if the predicted declines in revenues and earnings materialize and peers or the sector outperform.

DCF Valuation Shows Deep Undervaluation

- The discounted cash flow (DCF) model places fair value for Deep Value Driller’s shares at NOK65.14, far above the current market price of NOK19.34.

- This apparent disconnect between intrinsic value and market price puts the spotlight on whether structural risks, such as the projected 28.8% annual earnings decline, are already priced in or if investors are heavily underestimating future recovery potential.

- The DCF premium to market is striking. However, skepticism is warranted if the bearish case for earnings pressure plays out as forecast and erodes much of this implied future upside.

- Investors must weigh whether the deep discount offers genuine contrarian opportunity or simply reflects justified caution amid sector headwinds.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Deep Value Driller's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Deep Value Driller faces significant uncertainty as forecasts predict declining revenues and shrinking earnings. This raises questions about the sustainability of its strong margins.

If you want companies showing steadier results, focus on those delivering consistent growth and performance across cycles by using stable growth stocks screener (2099 results).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DVD

Deep Value Driller

Engages in owning, contracting, and managing drilling rigs in West Africa, International Waters, and Norway.

Proven track record and fair value.

Market Insights

Community Narratives