- Norway

- /

- Energy Services

- /

- OB:DOFG

Why DOF Group (OB:DOFG) Is Up 9.1% After bp Contract Win and Q3 Dividend Announcement

Reviewed by Sasha Jovanovic

- In recent developments, DOF Group ASA announced a multi-year subsea services contract with bp set to begin in early 2026, new contract extensions for joint-venture pipelay support vessels with Petrobras in Brazil, and a decision to distribute a quarterly dividend of US$0.35 per share. The company also reported third quarter sales of US$465 million and net income of US$107 million, both meaningfully higher than the same period last year.

- These updates reflect DOF Group's expanding contract backlog and increased earnings, highlighting improved revenue visibility and management's confidence through continued dividend payments.

- We'll explore how the new bp contract and rising earnings further strengthen DOF Group's investment narrative for long-term growth and stability.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

DOF Group Investment Narrative Recap

To be a DOF Group shareholder, you need to believe in the ongoing strength of its multi-year contract backlog and the company's ability to balance growth with capital discipline, particularly in key markets like Brazil and the Atlantic. The recent bp contract win and Petrobras extensions provide meaningful near-term revenue stability, but do not materially lower the main risk: high exposure to concentrated geographies and clients, which could amplify the effects of any disruptions in those core regions.

Among the latest announcements, the extension of joint-venture pipelay support vessel contracts with Petrobras stands out as highly relevant. These not only add approximately US$100 million to DOF Group's backlog but also reinforce the company’s position in Brazil, sustaining vessel utilization and supporting revenue visibility, both of which are key catalysts alongside the new bp contract just announced.

Yet, in contrast to these growth drivers, investors should be aware that concentrated exposure to a handful of major clients and geographies means ...

Read the full narrative on DOF Group (it's free!)

DOF Group's outlook anticipates $2.1 billion in revenue and $462.6 million in earnings by 2028. This scenario assumes an annual revenue growth rate of 8.9%, with earnings rising by $85.6 million from the current $377.0 million.

Uncover how DOF Group's forecasts yield a NOK125.00 fair value, a 25% upside to its current price.

Exploring Other Perspectives

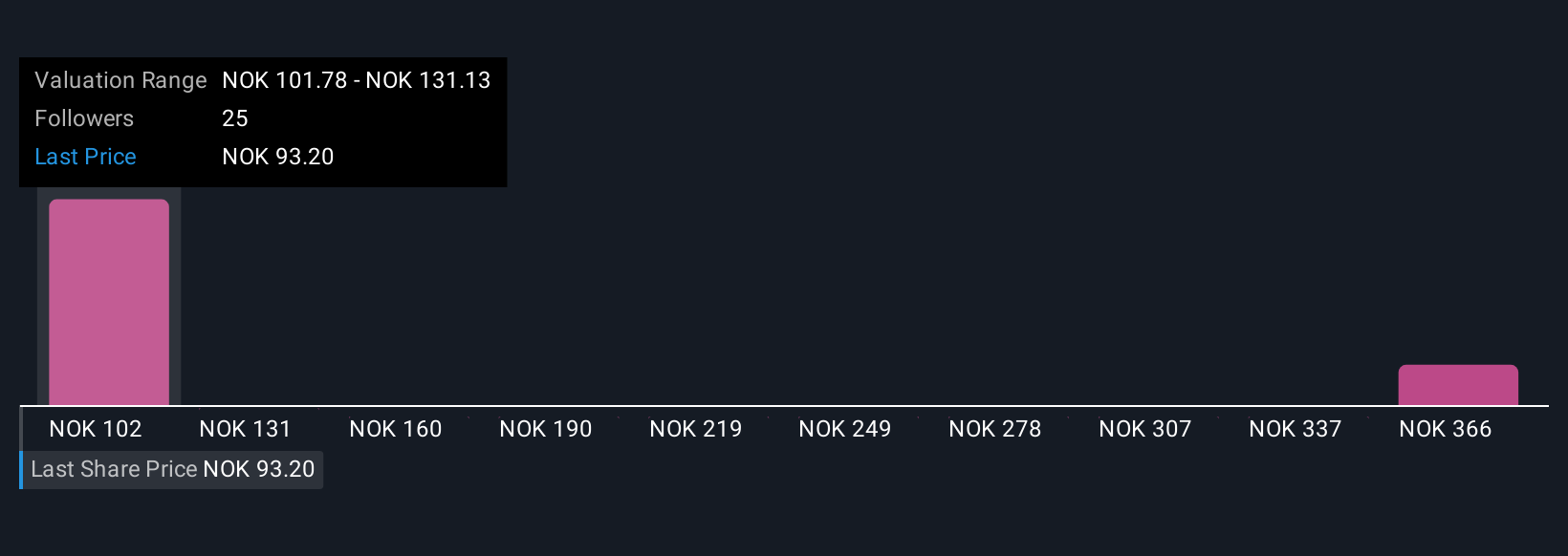

Five individual fair value estimates from the Simply Wall St Community range from US$101.78 to US$432.50 per share. While many see potential in the company’s growing contract backlog, opinions differ sharply on how much this reduces the impact of geographic concentration risks.

Explore 5 other fair value estimates on DOF Group - why the stock might be worth just NOK101.78!

Build Your Own DOF Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DOF Group research is our analysis highlighting 5 key rewards and 3 important warning signs that could impact your investment decision.

- Our free DOF Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DOF Group's overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Find companies with promising cash flow potential yet trading below their fair value.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DOFG

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives