- Norway

- /

- Oil and Gas

- /

- OB:DNO

DNO (OB:DNO): Valuation in Focus After Strong Sales Growth, New Assets, and Strategic Aker BP Agreements

Reviewed by Simply Wall St

DNO (OB:DNO) drew market attention after it posted sharp gains in quarterly sales, issued fresh production guidance, and unveiled new strategic agreements with Aker BP. The company also affirmed a dividend, concluding a busy week for investors.

See our latest analysis for DNO.

After a flurry of positive news, DNO’s momentum has ramped up, with a year-to-date share price return of 34.2% reflecting renewed optimism and a five-year total shareholder return of nearly 296%. Investors seem to be weighing steady long-term gains along with a boost in confidence driven by recent deals and guidance.

If the latest moves in energy have you reevaluating your options, now is an ideal time to broaden your search and discover fast growing stocks with high insider ownership

But after such a robust run, is DNO’s current valuation still attractive for new buyers or is the recent wave of positive news already fully reflected in the stock price, leaving little room for upside ahead?

Most Popular Narrative: 18% Undervalued

With the most popular narrative pegging DNO’s fair value at NOK 18.17, there is a significant gap compared to the last close of NOK 14.90. This draws attention to why analysts see further upside following the latest surge.

The transformational acquisition of Sval Energi materially increases DNO's long-term production base and reserves in the North Sea. This positions the company to benefit from persistent energy demand tied to global population growth and a slow energy transition in many markets, which may support higher future revenues and stable cash generation.

Curious how a major M&A deal and bold growth projections could lead to a fair value almost 20% above today's price? The answer hinges on aggressive forecasts for revenue, margins, and strategic cost-cutting. Find out which forward-looking assumptions power this narrative's upside outlook.

Result: Fair Value of $18.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, there are still material risks, such as ongoing regional instability in Kurdistan and uncertain payments from local authorities. These factors could challenge DNO’s growth outlook.

Find out about the key risks to this DNO narrative.

Another View: What Does the DCF Model Say?

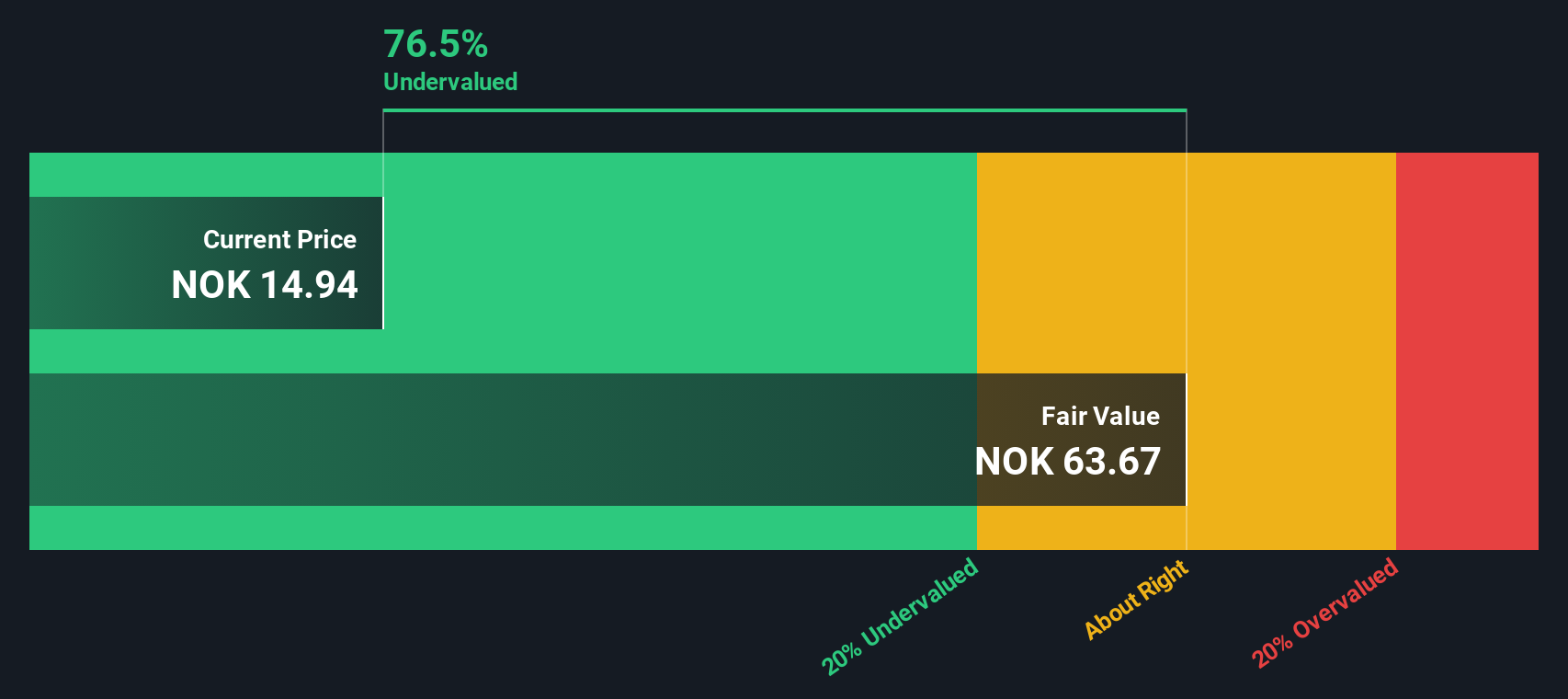

While price-to-sales comparisons suggest DNO is trading at fair value relative to industry averages, the SWS DCF model presents a more optimistic picture. According to our DCF, DNO is deeply undervalued, with the share price significantly below the model's fair value estimate. Could the market be overlooking the company's future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own DNO Narrative

If you want to dig deeper or have your own take on DNO’s outlook, you can build and share your perspective in just a few minutes. Do it your way

A great starting point for your DNO research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t hesitate. Expand your portfolio today with exciting new trends and overlooked market gems using the Simply Wall Street Screener. Unlock tomorrow’s leaders before everyone else catches on.

- Tap into the world of steady income by checking out these 16 dividend stocks with yields > 3%, packed with opportunities for robust yields and reliable cash flow.

- Spot the next tech disruptors early as you browse these 25 AI penny stocks, where artificial intelligence companies are forging the future of innovation.

- Seize rare chances to buy strong businesses below their intrinsic value by exploring these 872 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DNO

DNO

Engages in the exploration, development, and production of oil and gas assets in the Middle East, the North Sea, and West Africa.

Exceptional growth potential and undervalued.

Similar Companies

Market Insights

Community Narratives