- Norway

- /

- Oil and Gas

- /

- OB:DNO

DNO (OB:DNO) Trades North Sea Assets With Aker BP Are Portfolio Reshuffles Shaping Its Growth Ambitions?

Reviewed by Sasha Jovanovic

- On November 6, 2025, Aker BP ASA announced a series of agreements with DNO ASA to exchange ownership interests across several North Sea licenses, including transferring development-phase operatorship of the Kjøttkake discovery to Aker BP and divesting its Verdande field interest to DNO.

- This collaboration enhances operational focus for both companies and enables Aker BP to leverage rapid development capabilities while giving DNO increased stakes in producing fields.

- We’ll explore how DNO’s expanded North Sea positions through these agreements could reshape its long-term growth outlook and portfolio balance.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

DNO Investment Narrative Recap

To own DNO, you need to believe its expanded North Sea footprint and increased production capacity can offset persistent risks from geopolitical instability and payment issues in Kurdistan. The recent asset swap with Aker BP further positions DNO in producing fields but does not change the fact that near-term production reliability and payment flows from Kurdistan remain the biggest catalyst and risk, respectively, these dynamics are unchanged by the news.

Among DNO’s recent updates, the company’s Q4 2025 production guidance, which targets a marked increase in North Sea output following the Sval Energi and Verdande integrations, closely ties to the significance of this new agreement. Steadier North Sea operations could help stabilize earnings as DNO manages volatile Kurdistan performance and awaits resolution on outstanding receivables there.

However, despite this North Sea growth, ongoing payment uncertainties from the Kurdistan regional and central governments present a continuing risk investors should keep in mind, especially as...

Read the full narrative on DNO (it's free!)

DNO's narrative projects $2.7 billion in revenue and $453.5 million in earnings by 2028. This requires 50.4% yearly revenue growth and a $544.3 million increase in earnings from the current -$90.8 million.

Uncover how DNO's forecasts yield a NOK18.17 fair value, a 19% upside to its current price.

Exploring Other Perspectives

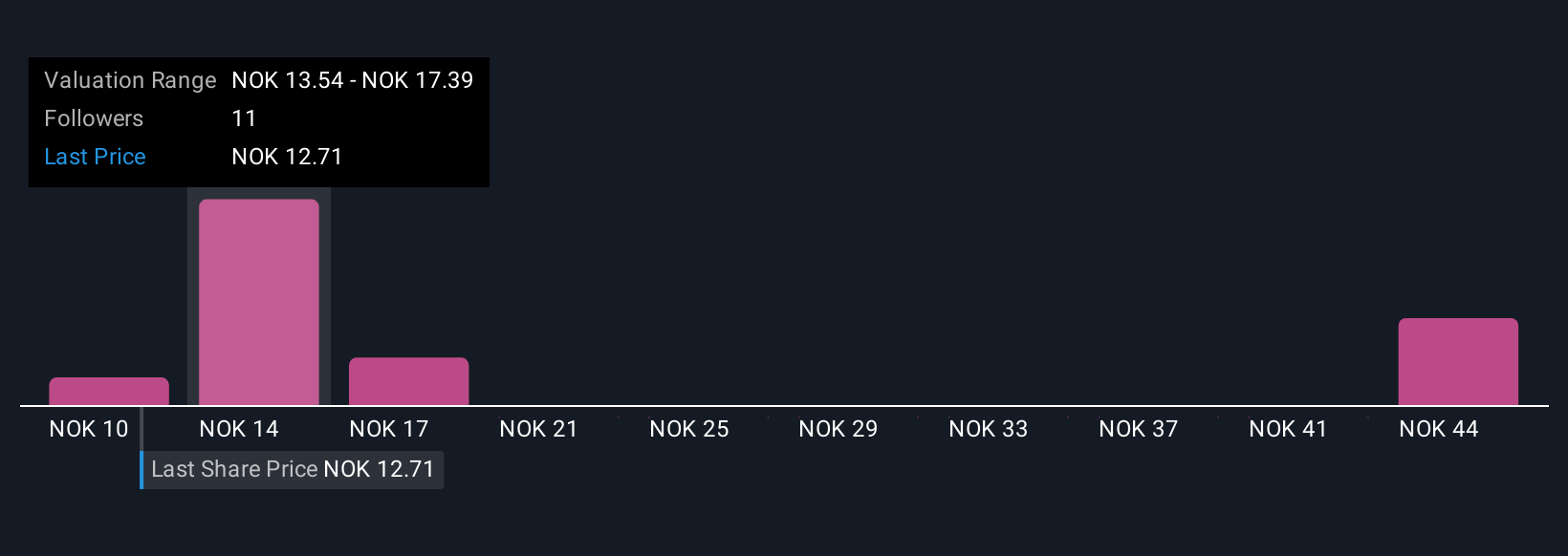

Simply Wall St Community members provided six fair value estimates for DNO, ranging from NOK9.68 to NOK57.16 per share. As you consider these diverse views, remember current production growth may be tempered if key Middle East market uncertainties persist.

Explore 6 other fair value estimates on DNO - why the stock might be worth 37% less than the current price!

Build Your Own DNO Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DNO research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free DNO research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DNO's overall financial health at a glance.

Seeking Other Investments?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:DNO

DNO

Engages in the exploration, development, and production of oil and gas assets in the Middle East, the North Sea, and West Africa.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives