- China

- /

- Paper and Forestry Products

- /

- SZSE:002043

Aker Solutions And 2 Other Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the challenges posed by rising U.S. Treasury yields and tepid economic growth, investors are increasingly looking for stability and income in their portfolios. Dividend stocks, such as Aker Solutions and others, can offer a reliable income stream and potential resilience against market volatility, making them an attractive option in today's uncertain economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.08% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.93% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.90% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.55% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Kwong Lung Enterprise (TPEX:8916) | 6.35% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.87% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 2013 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

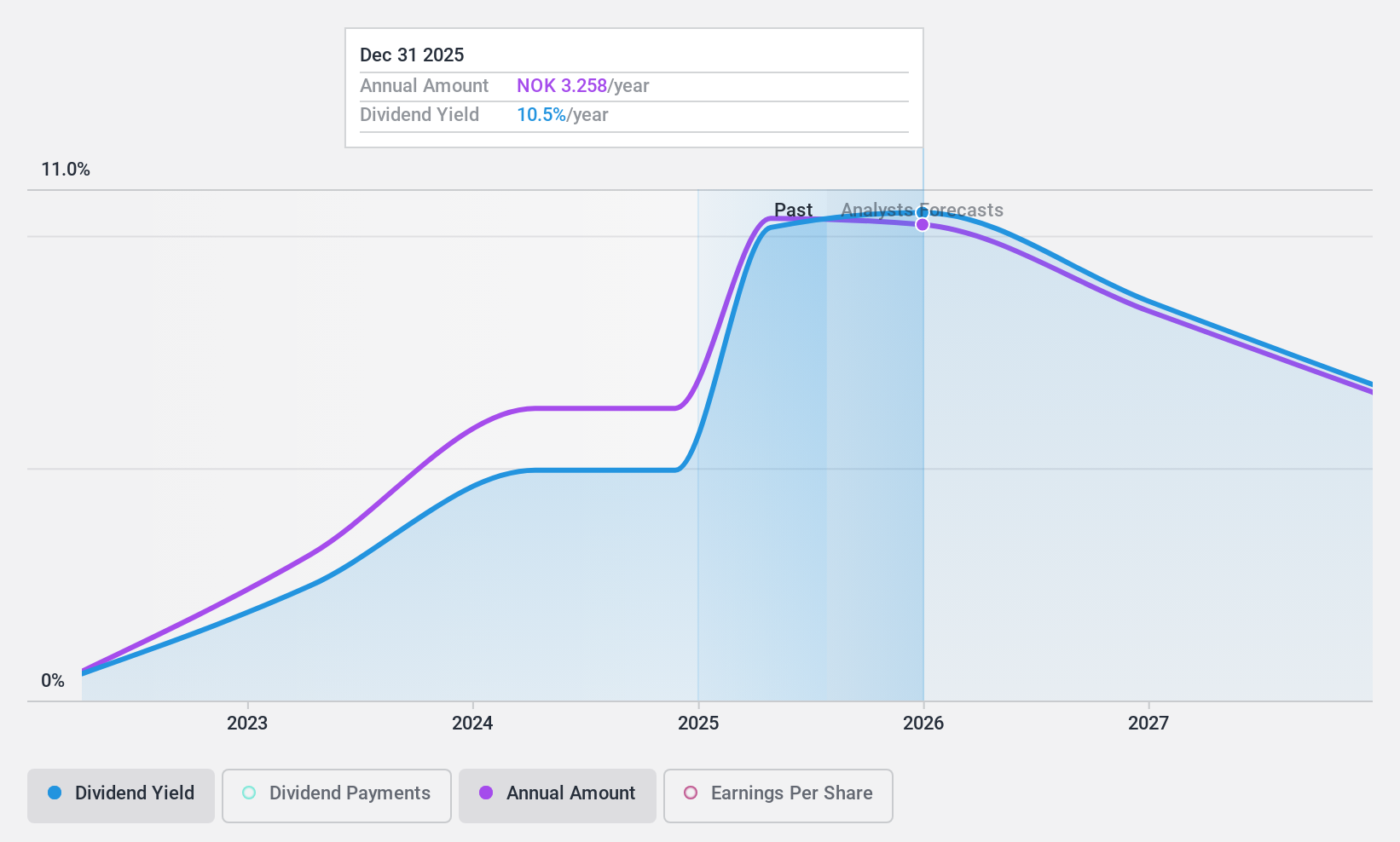

Aker Solutions (OB:AKSO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aker Solutions ASA offers solutions, products, systems, and services to the oil and gas industry across various countries including Norway, the United States, Brazil, and others, with a market cap of NOK22.01 billion.

Operations: Aker Solutions ASA's revenue is primarily derived from its Life Cycle segment, which generated NOK12.77 billion, and its Renewables and Field Development segment, contributing NOK29.77 billion.

Dividend Yield: 4.3%

Aker Solutions' dividend payments are covered by earnings and cash flows, with a payout ratio of 65.6% and a cash payout ratio of 36%. However, the dividends have been unstable over the past decade. Recently profitable, AKSO announced an extraordinary NOK 10 billion dividend pending approval in November 2024. Despite its low yield compared to top-tier Norwegian payers, this special dividend highlights potential for periodic shareholder returns amidst ongoing operational contracts like the Troll A project with Equinor.

- Take a closer look at Aker Solutions' potential here in our dividend report.

- Our valuation report here indicates Aker Solutions may be overvalued.

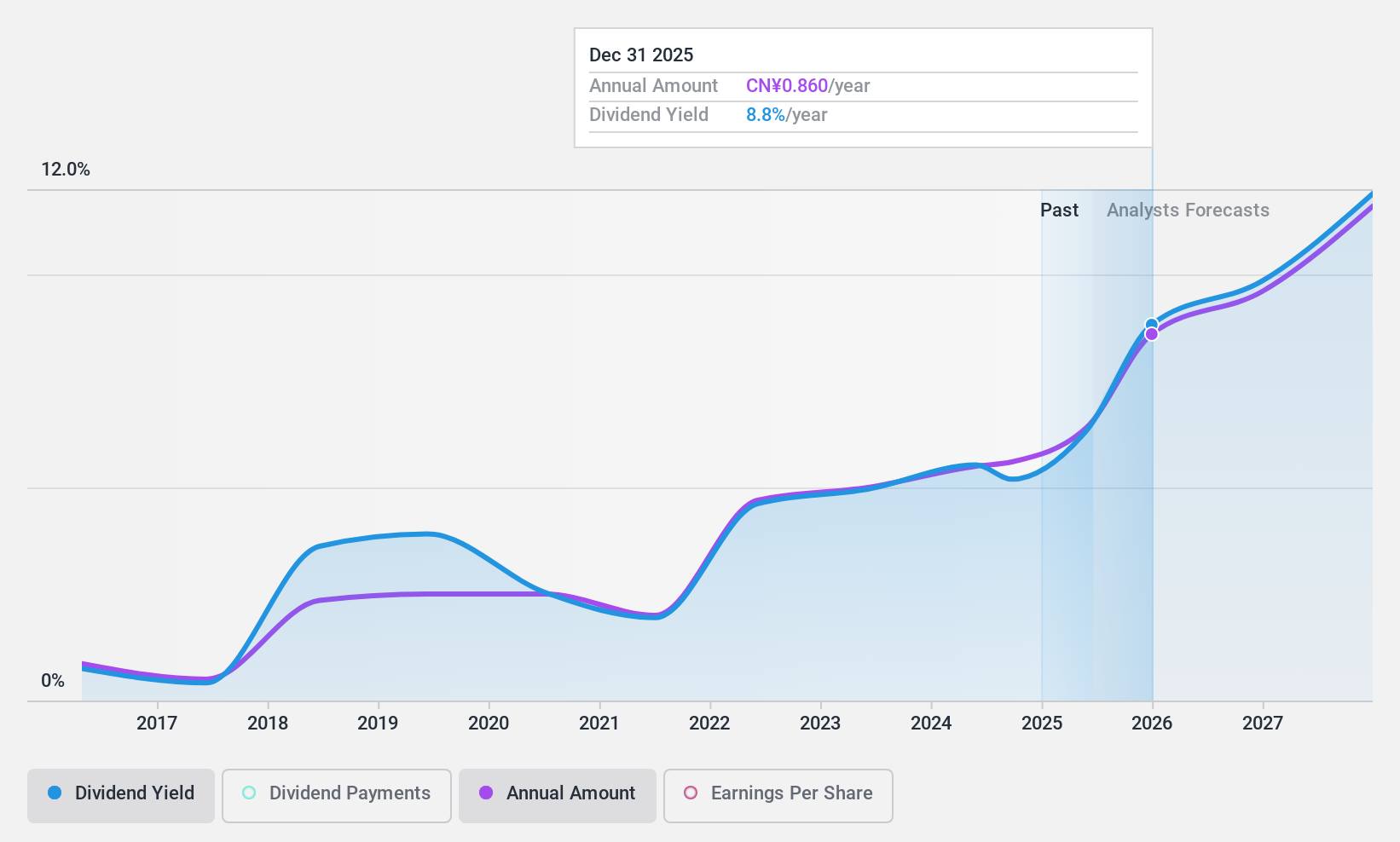

DeHua TB New Decoration MaterialLtd (SZSE:002043)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DeHua TB New Decoration Material Co., Ltd specializes in the production and sale of environmentally friendly furniture panels both in China and internationally, with a market cap of CN¥10.28 billion.

Operations: DeHua TB New Decoration Material Co., Ltd generates its revenue primarily through the production and sale of eco-friendly furniture panels.

Dividend Yield: 4.5%

DeHua TB New Decoration Material Ltd. trades at a significant discount to its estimated fair value, yet its dividend payments are not well-covered by earnings due to a high payout ratio of 93.3%. Although the cash payout ratio is sustainable at 39.3%, dividends have been volatile over the past decade despite recent growth in earnings and revenue. The company's dividend yield of 4.49% ranks in the top quarter among Chinese payers, but reliability remains an issue.

- Click here to discover the nuances of DeHua TB New Decoration MaterialLtd with our detailed analytical dividend report.

- Our expertly prepared valuation report DeHua TB New Decoration MaterialLtd implies its share price may be lower than expected.

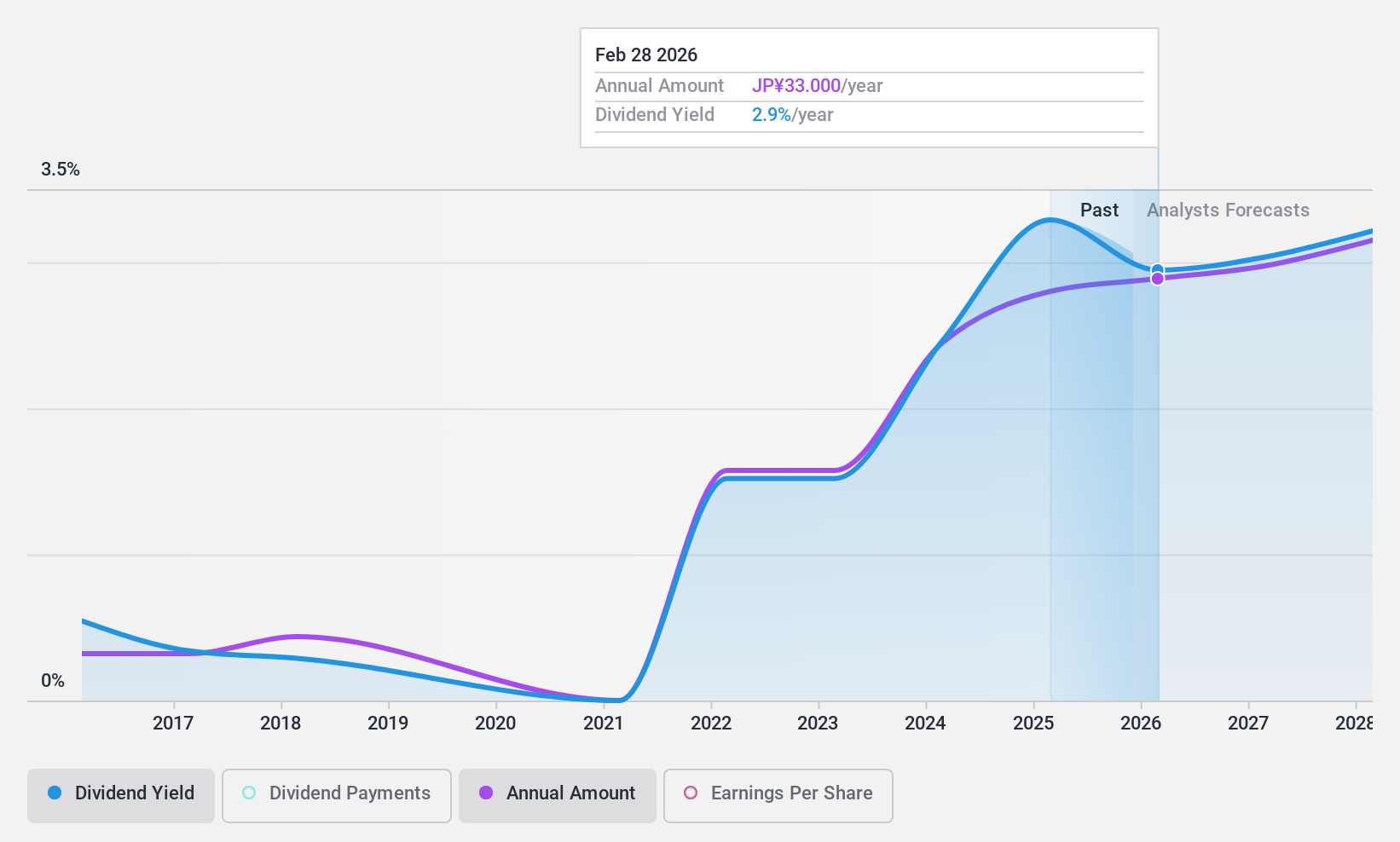

Vector (TSE:6058)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Vector Inc. operates in public relations, advertising, press release and video distribution, direct marketing, media, investment, and human resources across Japan, China, and internationally with a market cap of ¥45.08 billion.

Operations: Vector Inc.'s revenue segments include public relations and advertising at ¥24.50 billion, press release distribution at ¥4.75 billion, video release distribution at ¥3.20 billion, direct marketing at ¥12.10 billion, media at ¥8.55 billion, investment activities generating ¥2.90 billion, and human resources contributing ¥1.65 billion in revenue.

Dividend Yield: 3.3%

Vector Inc. offers a mixed picture for dividend investors. While trading at a significant discount to its estimated fair value and maintaining sustainable payout ratios with earnings (28.1%) and cash flows (37.6%), its dividends have been volatile over the past decade. Recent policy changes increased the dividend forecast to JPY 32 per share, up from JPY 31, highlighting a focus on enhancing shareholder returns despite lowered earnings guidance for fiscal year-end February 2025.

- Click to explore a detailed breakdown of our findings in Vector's dividend report.

- Upon reviewing our latest valuation report, Vector's share price might be too pessimistic.

Seize The Opportunity

- Navigate through the entire inventory of 2013 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002043

DeHua TB New Decoration MaterialLtd

Produces and sells environmentally friendly furniture panels in China and internationally.

Outstanding track record with flawless balance sheet and pays a dividend.