- Norway

- /

- Oil and Gas

- /

- OB:AKRBP

How Investors Are Reacting To Aker BP (OB:AKRBP) Expanding Alvheim Interests and Taking Over Kjottkake

Reviewed by Sasha Jovanovic

- Aker BP announced that it has entered agreements with DNO ASA to strengthen its position in the Alvheim area and take over operatorship of the Kjottkake discovery, while divesting its interest in the Verdande field in exchange for increased stakes in Vilje, Kveikje, and additional exploration licences.

- This collaboration expands Aker BP’s asset base and allows the company to leverage its project development expertise, potentially accelerating resource development and integration with existing infrastructure.

- We’ll now examine how Aker BP’s operatorship of Kjottkake and expanded Alvheim presence could influence its future investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Aker BP Investment Narrative Recap

To consider being a shareholder in Aker BP, investors need to believe in the company’s ability to efficiently grow production through asset optimization and integrated project development, while navigating sector risks such as market volatility, emissions costs, and operational concentration in key fields. The recent agreement with DNO strengthens Aker BP’s core Alvheim area and adds operating control of the Kjottkake discovery, but does not materially alter the primary short-term catalyst, project execution and timely development in key growth hubs, nor does it diminish the main risk of heavy reliance on a concentrated asset base. Among recent developments, Aker BP’s successful refinancing of US$3,225 million in revolving credit facilities provides additional financial flexibility that underpins its project development ambitions. This expanded capacity may support the company’s ability to deliver on its production growth targets, which remains central to its investment thesis and key near-term catalysts. In contrast, investors should not overlook the persistent risk that high project concentration brings to Aker BP's future revenue stability, especially if...

Read the full narrative on Aker BP (it's free!)

Aker BP's outlook anticipates $12.1 billion in revenue and $1.6 billion in earnings by 2028. This is based on a 1.0% annual revenue growth rate and an $872.7 million increase in earnings from the current level of $727.3 million.

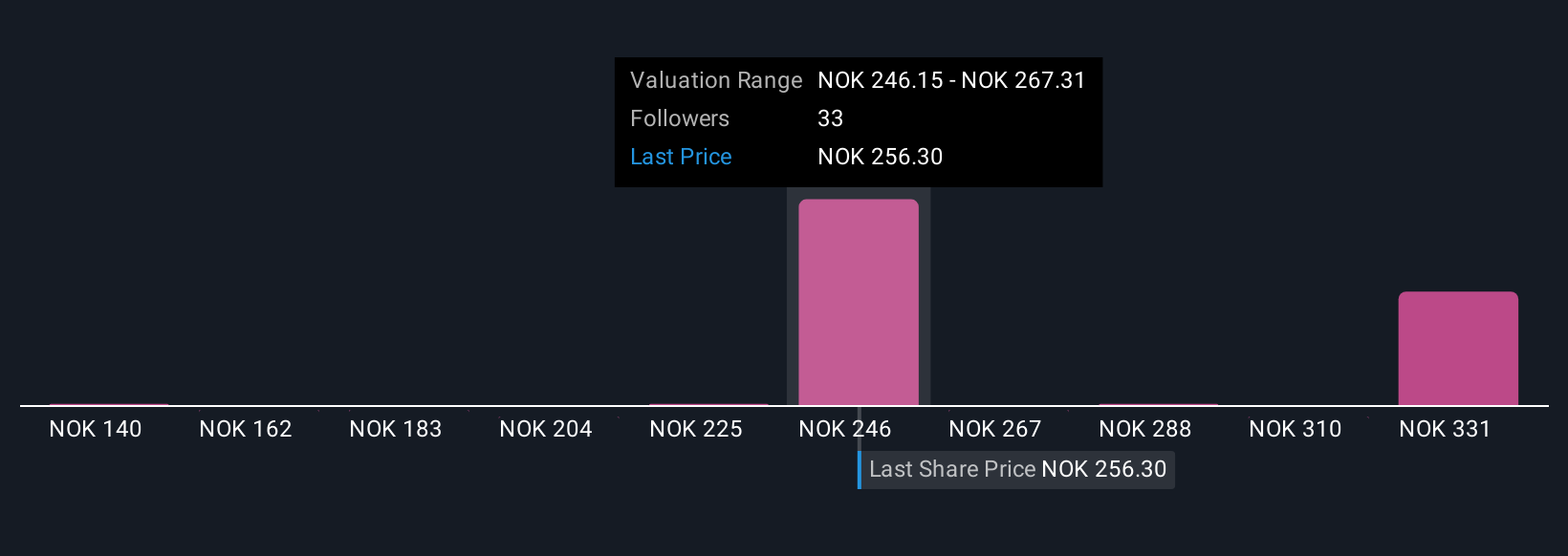

Uncover how Aker BP's forecasts yield a NOK260.53 fair value, in line with its current price.

Exploring Other Perspectives

Ten separate fair value estimates from the Simply Wall St Community range from NOK140.37 up to NOK790.94 per share. With asset concentration identified as a risk, these differences show how investors may weigh near-term execution versus long-term stability.

Explore 10 other fair value estimates on Aker BP - why the stock might be worth over 2x more than the current price!

Build Your Own Aker BP Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aker BP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Aker BP research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aker BP's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKRBP

Aker BP

Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives