- Norway

- /

- Oil and Gas

- /

- OB:AKRBP

Aker BP (OB:AKRBP) Valuation Spotlight as New DNO Deals Reshape Asset Base and Growth Prospects

Reviewed by Simply Wall St

Aker BP (OB:AKRBP) has entered into a series of agreements with DNO ASA that boost its presence in the Alvheim area and hand it operatorship of the Kjottkake discovery. The move broadens Aker BP’s asset mix and sets the stage for quicker project development and greater resource recovery, thanks to the company’s established fast-track capabilities.

See our latest analysis for Aker BP.

In the broader context, Aker BP’s shares have gained momentum on the back of new area agreements and a major refinancing push, with several successful debt offerings and renewed credit facilities in the past month. The company’s strong news flow is reflected in a robust 12-month total shareholder return of 28.2%, while its long-term track record shows significant value creation as five-year total returns top 120%.

If these strategic moves have you curious about what else is gaining traction, now’s a great time to broaden your outlook and discover fast growing stocks with high insider ownership

But with shares delivering strong returns and positive momentum from the latest agreements, should investors see Aker BP as an undervalued play with more room to run? Or has the market already priced in future growth?

Most Popular Narrative: 1.1% Undervalued

The prevailing narrative sees Aker BP’s fair value nearly matching its current share price, meaning market expectations and analyst forecasts are tightly aligned right now. The modest undervaluation reflects a careful balance between projected growth, sector momentum, and recent developments.

Aker BP’s commitment to digitalization, including developments like Agile Asset Management and the ACE toolkit, aims to optimize operations and enhance efficiency, potentially leading to improved net margins and higher earnings through reduced downtime and streamlined processes.

Want to uncover the numbers that underpin this near-perfect pricing? The big twist lies in expectations of ramped-up profitability and a narrow cushion between future earnings forecasts and the market’s confidence. Bold operational advances and growth predictions are built into this precise narrative calculation. Dive in to catch the full story behind the fair value math.

Result: Fair Value of $260.53 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent concerns such as rising emissions costs and heavy reliance on key assets could challenge the optimistic case and may put pressure on future margins or stability.

Find out about the key risks to this Aker BP narrative.

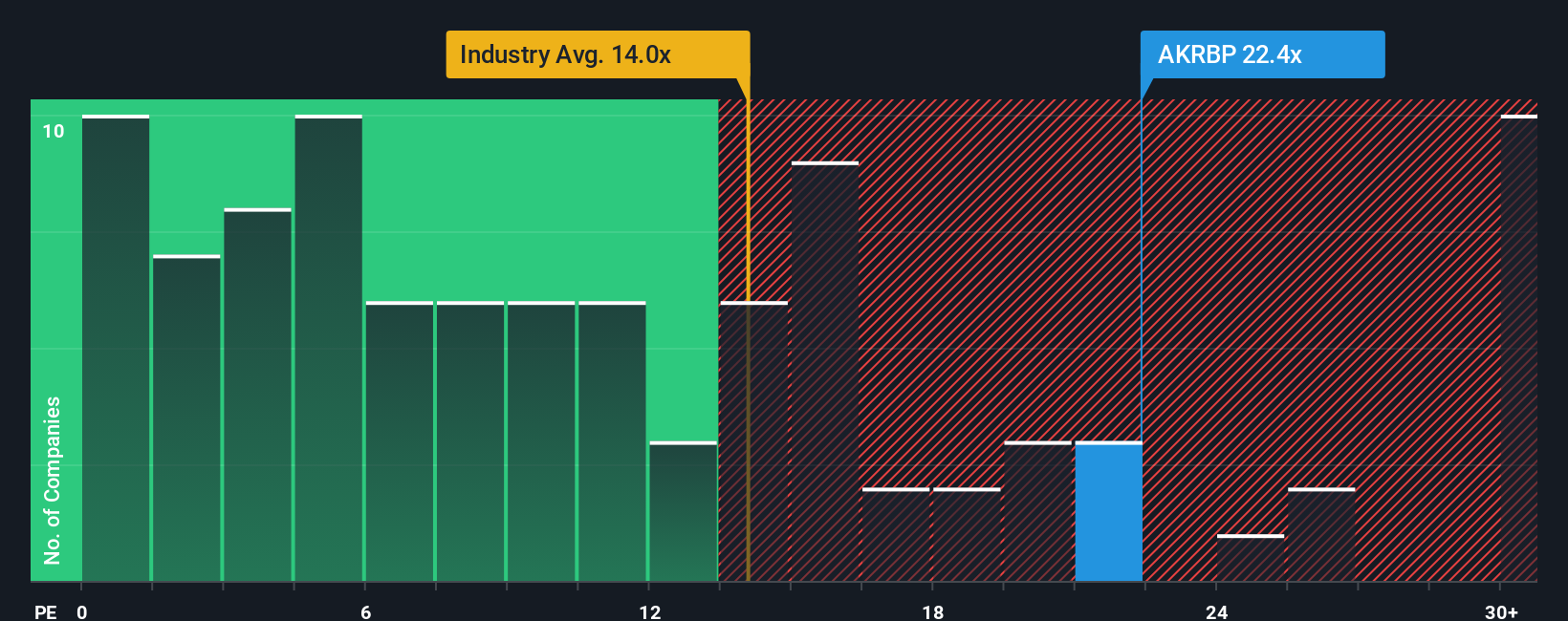

Another View: Multiples Tell a Different Story

While the fair value based on forecasts looks appealing, a glance at Aker BP's price-to-earnings ratio paints a different picture. Shares trade at 19.1 times earnings, which is much higher than both peer (8.1x) and industry (13.3x) averages, and also above the fair ratio of 11.3x. This hefty premium could signal caution for value-focused investors. Is the growth narrative strong enough to outweigh valuation risks?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aker BP Narrative

If you see things differently or want to dig into the numbers yourself, it’s easy to shape your own perspective in just a few minutes. Do it your way

A great starting point for your Aker BP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more smart investment angles?

Don’t miss your chance to move beyond the obvious. The best opportunities often sit just off the beaten path. Expand your research and catch opportunities others overlook using the Simply Wall Street Screener:

- Boost your portfolio with steady income by checking out these 16 dividend stocks with yields > 3% yielding over 3%, and strengthen your returns with dependable cash flow.

- Uncover untapped potential among innovators by searching these 25 AI penny stocks making waves in artificial intelligence and redefining entire industries.

- Position yourself ahead of the curve with these 875 undervalued stocks based on cash flows that may be poised for a value-driven comeback, before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKRBP

Aker BP

Explores for, develops, and produces oil and gas on the Norwegian Continental Shelf.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives