Zaptec ASA (OB:ZAP) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 156%.

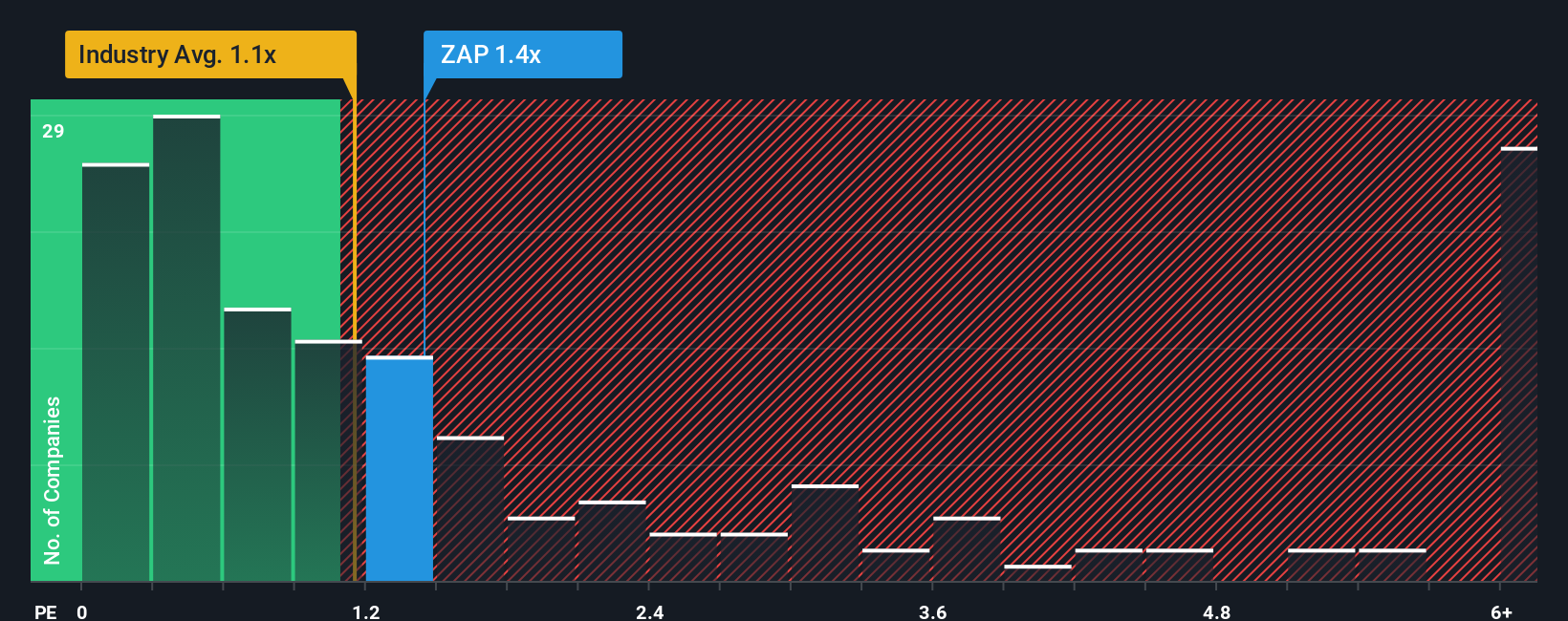

In spite of the heavy fall in price, there still wouldn't be many who think Zaptec's price-to-sales (or "P/S") ratio of 1.4x is worth a mention when the median P/S in Norway's Electrical industry is similar at about 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Zaptec

How Zaptec Has Been Performing

Zaptec certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. Perhaps the market is expecting its current strong performance to taper off in accordance to the rest of the industry, which has kept the P/S contained. Those who are bullish on Zaptec will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Zaptec.Is There Some Revenue Growth Forecasted For Zaptec?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Zaptec's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 7.7%. This was backed up an excellent period prior to see revenue up by 103% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 12% each year as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 8.3% per annum, which is noticeably less attractive.

With this in consideration, we find it intriguing that Zaptec's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

With its share price dropping off a cliff, the P/S for Zaptec looks to be in line with the rest of the Electrical industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Zaptec currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Zaptec with six simple checks.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Zaptec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:ZAP

Zaptec

Engages in the development and sale of chargers, charging systems, and services for electric car charging in Norway, Sweden, Switzerland, Denmark, Iceland, rest of Europe, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives