- Norway

- /

- Construction

- /

- OB:NORCO

Norconsult (OB:NORCO) Profit Growth Surges 92%, Reinforcing Bull Case on Margins Versus Peer Valuations

Reviewed by Simply Wall St

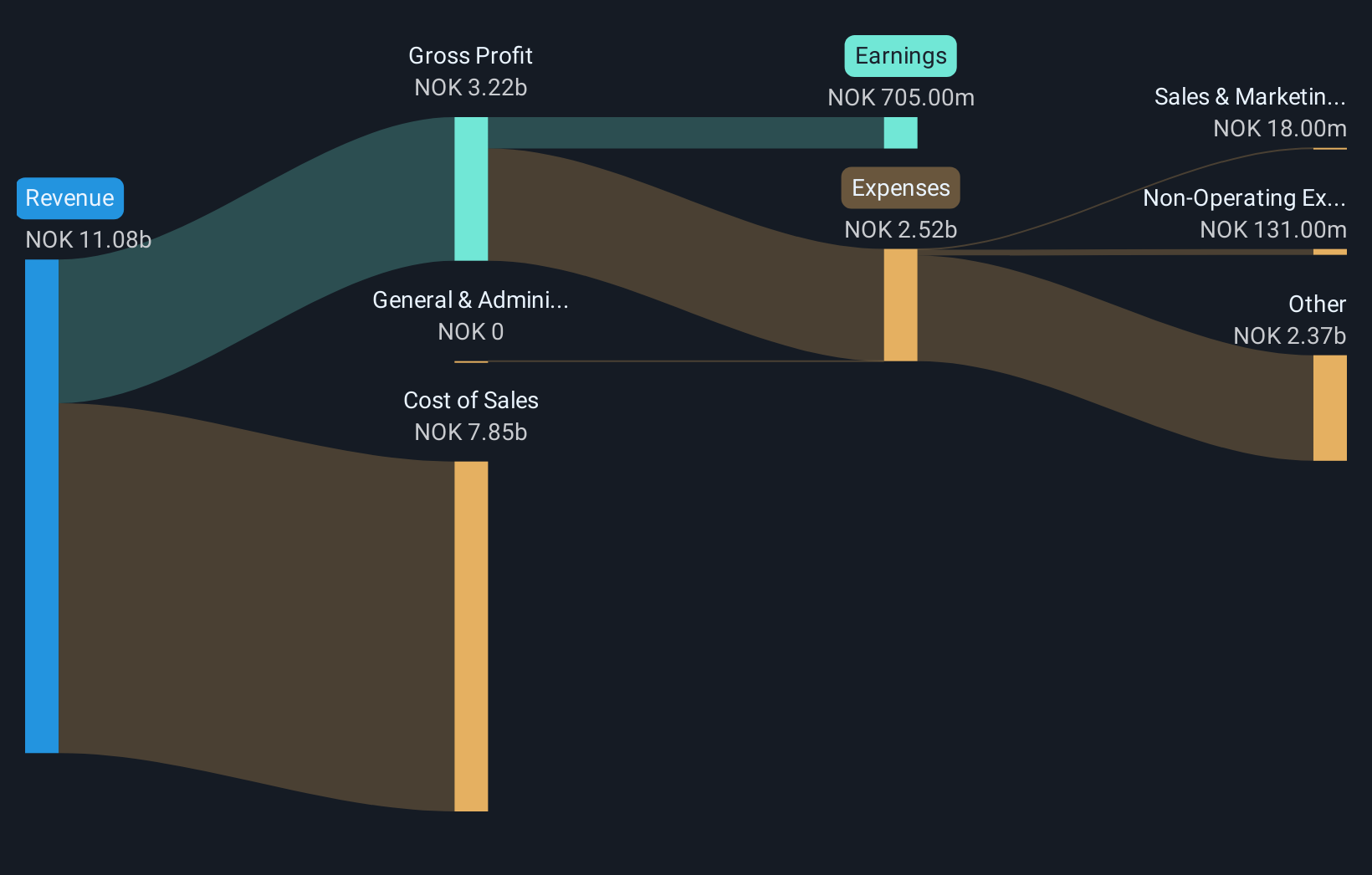

Norconsult (OB:NORCO) delivered standout growth in its latest earnings, with profits rising 92.1% year-over-year and net profit margins improving to 6.4% from last year’s 3.6%. Earnings are forecast to grow 13.1% per year, a solid figure, though below the broader Norwegian market’s 16.6% expected rate. Revenue is anticipated to rise 6.1% annually, easily outpacing the national average. These results highlight a robust trend in profitability, but investors are also weighing premium valuation multiples against sector peers as they look to Norconsult’s ability to maintain this momentum.

See our full analysis for Norconsult.The real test is how these numbers stack up against the widely followed narratives in the market. Some will be affirmed, while others might get challenged.

See what the community is saying about Norconsult

Operational Efficiency Lifts Margins

- Net profit margins improved meaningfully to 6.4%, a notable climb from 3.6% the previous year and ahead of management targets for margin expansion.

- Analysts' consensus view notes that profitability gains are attributed to successful integration of acquisitions and ongoing digitalization, which sharpen operational leverage and increase billing ratios.

- These efficiency gains, together with benefits from higher employee share ownership and segment recovery in markets like Denmark, are expected to drive operating margins even higher, with forecasts targeting 8.5% over the next three years.

- Achieving these targets could help Norconsult defend earnings quality even as competition and sector fee pressures grow.

Consensus narrative says Norconsult’s sharper margins and recent profit surge reinforce its reputation for consistently beating expectations despite industry fee pressure. 📊 Read the full Norconsult Consensus Narrative.

Order Backlog Signals Revenue Durability

- The order backlog stands at NOK 7.1 billion, providing strong visibility into future revenue streams amid ongoing public infrastructure investment in the Nordic region.

- According to analysts' consensus, recurring wins driven by the energy transition and continued modernization efforts position Norconsult for sustainable top-line growth.

- The expansion of high-margin project categories, especially in renewable energy and complex infrastructure, is expected to support both revenue growth and margin improvement going forward.

- A growing share of long-term public sector contracts helps shield revenues from near-term cyclicality in private sectors.

Valuation Premium vs Peers Raises the Bar

- Norconsult trades at a price-to-earnings ratio of 20.8x, above both the European construction industry average (14.2x) and its peer average (13.7x), despite its share price (NOK47.25) sitting well below the DCF fair value of NOK90.70.

- The analysts' consensus perspective warns that maintaining premium multiples will require management to deliver on ambitious earnings and margin targets over the medium term.

- While the current position signals investor confidence in the quality of Norconsult’s growth story, any disappointment on operational or integration outcomes could quickly close the valuation gap.

- The 12.3% upside to the consensus analyst price target (NOK53.50) suggests the market is cautiously optimistic about execution but demands ongoing proof.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Norconsult on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on these results? You can quickly share your perspective by shaping a personal narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Norconsult.

See What Else Is Out There

Norconsult’s valuation now looks demanding, which puts pressure on future execution and increases risk if the company misses growth or margin targets.

If rich valuations or premium pricing make you uneasy, check out these 840 undervalued stocks based on cash flows for stocks trading below fair value and offering a stronger margin of safety right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Norconsult might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NORCO

Norconsult

Provides consultancy services with focus on community planning, engineering design, and architecture in the Nordics and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives