- Norway

- /

- Electrical

- /

- OB:NEL

Nel (OB:NEL): Revenue Forecast to Grow 14.9% Annually, Unprofitability Persists Ahead of Earnings

Reviewed by Simply Wall St

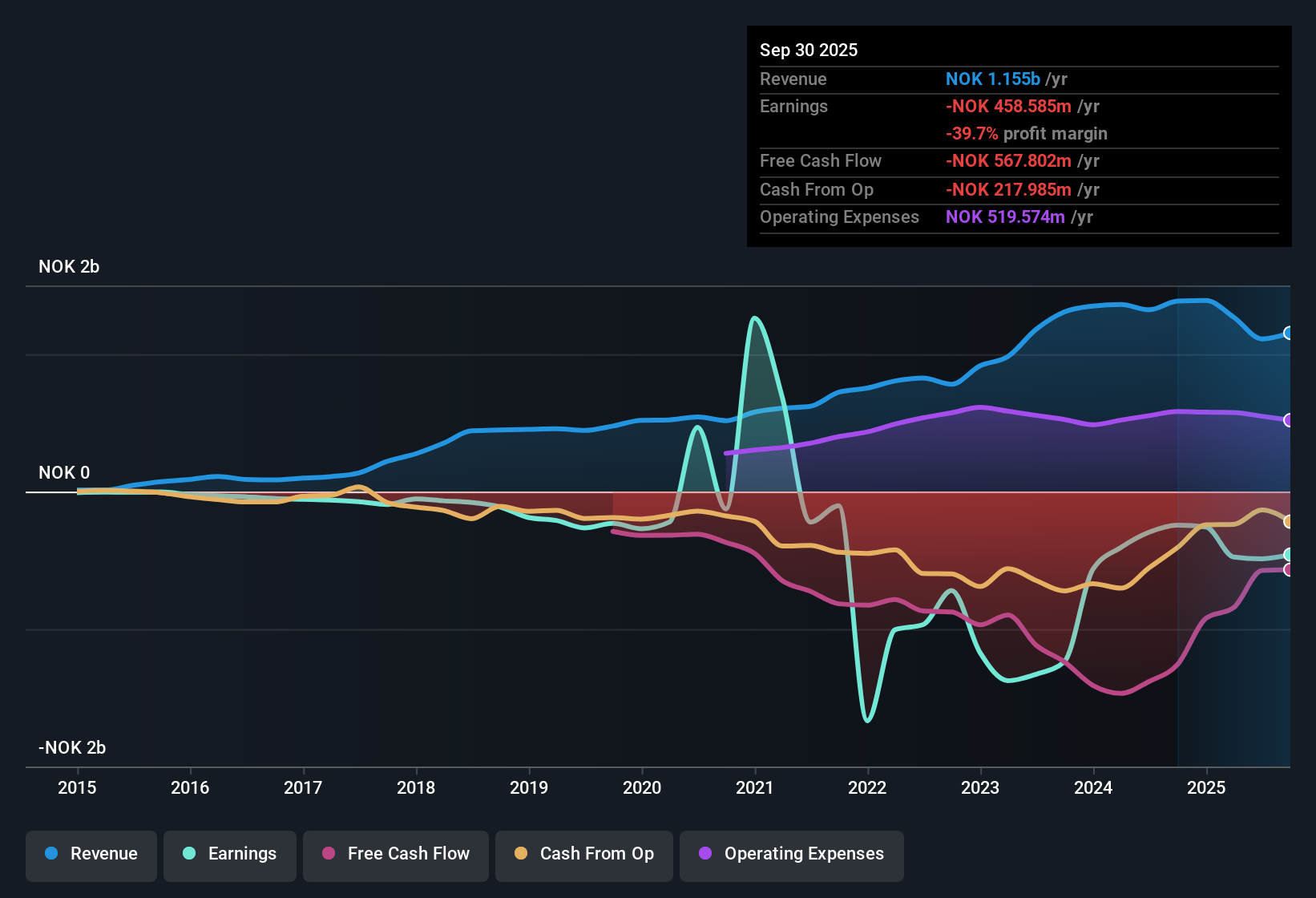

Nel (OB:NEL) remains unprofitable, with losses increasing at an annual rate of 17.3% over the last five years and no visible improvement in net profit margin. Revenue, however, is forecast to grow by 14.9% per year, significantly ahead of the Norwegian market's 2.8% pace. Shares have struggled for direction recently, with the stock price showing little stability over the past three months as investors weigh strong projected revenue growth against ongoing losses and a relatively high Price-To-Sales Ratio of 3.8x.

See our full analysis for Nel.The real question is how these results match up against the most widely held narratives on Simply Wall St. Which stories do the data support, and where do they break with expectations?

See what the community is saying about Nel

Order Backlog Grows Despite Industry Overcapacity

- Nel’s partnerships with major energy and EPC players like Samsung E&A and Saipem have improved the visibility and quality of its order backlog, anchoring expected long-term revenue even as multiple competitors have exited the market due to overcapacity and slow green hydrogen adoption.

- Consensus narrative notes these high-profile alliances position Nel to benefit from robust global demand for hydrogen, but also warn that industry overcapacity and slow commercialization of next-generation systems (scheduled for 2026 to 2027) could undercut margin expansion and lead to underutilized production if the sector does not accelerate as policymakers hope.

- Bears highlight that unresolved regulatory frameworks and customer project delays threaten the consistency of Nel’s backlog and its revenue stability should green hydrogen momentum falter further.

- Analysts' consensus view underscores that while Nel has carved out a strong foundation, actual long-term benefit depends on timely policy execution and commercial project launches.

- Consensus narrative hooks the conversation: Nel’s expanding partnerships and order book create optimism, but will they break the cycle of lumpy revenues and margin challenges? 📊 Read the full Nel Consensus Narrative.

Cost Reduction Initiatives Aim for Margin Turnaround

- Although Nel remains markedly unprofitable and is projected to continue operating at negative EBITDA for at least the next three years, its efforts to reduce personnel expenses and operating costs are improving its operating leverage and could support higher future net margins as revenues recover.

- Consensus narrative highlights that these ongoing cost-cutting measures, including advanced R&D on electrolyser technology, are expected to boost profitability and reinforce Nel’s competitive edge; however, the company’s recent 48% year-over-year revenue decline reveals a tension, suggesting near-term gains from cost savings may be swamped by volatile customer demand.

- What is surprising is that even with a leaner cost structure, persistent net losses and ongoing cash burn outweigh efficiency gains, making eventual profitability highly dependent on renewed project pipeline momentum.

- Bears argue that further equity issuance could dilute earnings per share if cash burn is not stemmed soon, counteracting any operational improvements.

Valuation Premium Hinges on Revenue Outlook

- Nel trades at a Price-To-Sales Ratio of 3.8x, which is significantly higher than the European electrical industry average of 1.3x and its peer average of 1.2x, underlining the market’s willingness to pay a premium for anticipated above-market annual revenue growth of 14.9%.

- Consensus narrative points out this premium is justified only if Nel’s revenues recover quickly and margin expansion materializes; otherwise, current valuation leaves little margin for disappointment, especially with analysts' consensus price target (NOK 2.23) just 7.9% above the current share price of NOK 2.30.

- Consensus narrative challenges whether slower than expected adoption or delayed commercialization of Nel’s next-gen products could disappoint investors and pressure the premium valuation.

- In the absence of DCF fair value data, the close gap between the current share price and analyst target price emphasizes the finely balanced expectations now priced in by the market.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Nel on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Spot a different angle or interpret the numbers in your own way? Shape your unique narrative in just a few minutes. Do it your way.

A great starting point for your Nel research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Nel’s lack of profitability, volatile revenues, and premium valuation indicate challenges in delivering the stable and consistent growth that investors often seek.

If you want companies with a record of reliable revenue and earnings expansion, use our stable growth stocks screener (2112 results) screener to focus your search on steady performers built for the long haul.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:NEL

Nel

A hydrogen company, provides solutions to produce, store, and distribute hydrogen from renewable energy in Norway and internationally.

Flawless balance sheet with very low risk.

Similar Companies

Market Insights

Community Narratives