- Norway

- /

- Construction

- /

- OB:MULTI

Multiconsult (OB:MULTI) Net Margin Decline Challenges Bullish Earnings Growth Narrative

Reviewed by Simply Wall St

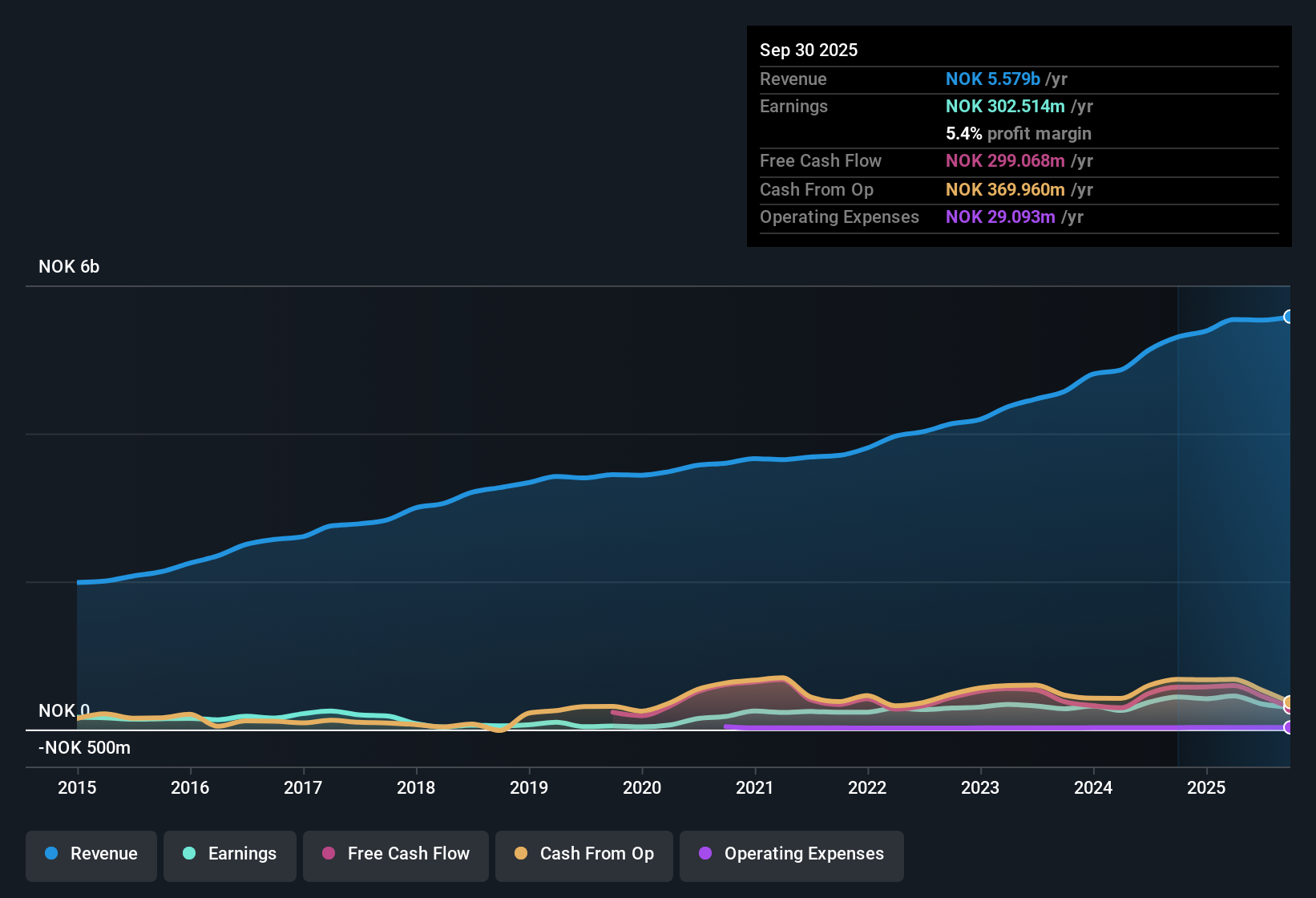

Multiconsult (OB:MULTI) saw earnings forecasted to grow at 17% per year, surpassing the Norwegian market average of 16.6%. Revenue is expected to climb 8.1% annually compared to the broader market's 2.4% projection. Despite a five-year average earnings growth rate of 12%, the most recent period was marked by a decline in net profit margin to 5.4% and negative earnings growth, making historic comparisons less meaningful. The setup for investors is a mix of long-term growth optimism and short-term profitability concerns, with the stock trading at NOK166, below the discounted cash flow value but carrying a price-to-earnings ratio higher than the sector average.

See our full analysis for Multiconsult.Next up, we will see how these headline numbers line up against the most widely held narratives and which expectations the results actually challenge or reinforce.

See what the community is saying about Multiconsult

Cost Control and Margin Pressures Remain Central

- Net profit margin declined from 8.3% to 5.4% over the past year, signaling higher operational costs that have begun to erode Multiconsult’s earnings quality relative to its five-year average growth.

- According to the analysts' consensus view, Multiconsult's focus on cost control and integration of acquisitions is meant to offset wage inflation and rising expenses.

- Consensus narrative points to a record order backlog and ongoing cost control measures as supporting factors for margin recovery, despite short-term compression.

- However, consensus also highlights that persistent cost inflation and reliance on large public sector projects could continue to pressure net margins and leave Multiconsult vulnerable to swings in government spending.

Future Profits Tied to Modest Margin Recovery

- Analysts forecast that profit margins will rise modestly from 6.2% today to 6.4% in three years, suggesting management's cost discipline is expected to drive only a slight improvement over current compressed levels.

- Analysts' consensus view emphasizes ongoing investments in digital capabilities and workforce development to support efficiency gains.

- While consensus sees these efforts as positioning Multiconsult for future growth, it also flags that recent cost rises have outpaced revenue gains, creating a tension between the company’s growth strategy and cost containment.

- Increasing operational complexity from acquisitions and new markets could make profit expansion slower or bumpier than analysts hope.

Valuation Gaps: Share Price vs. DCF and Peers

- Multiconsult’s share price of NOK166 trades well below the DCF fair value estimate of NOK454.55, but its price-to-earnings ratio of 14.8x is still higher than the 13.9x industry average, even as peers trade at 17.9x.

- According to the consensus narrative, the current discount to DCF fair value and analyst price targets reflects the market’s mixed view on Multiconsult’s balancing act between steady growth and margin risk.

- Consensus suggests that for the stock to close this valuation gap, investors need to believe that revenues will reach NOK7.0 billion and earnings NOK450.5 million by 2028, on a PE of 15.0x.

- Given the share price lags well behind both DCF and analyst target levels, confidence in profit improvement and cost control will be key to a re-rating.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Multiconsult on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a fresh perspective on the figures? In just a few minutes, you can build your own narrative and share your unique take. Do it your way

A great starting point for your Multiconsult research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Multiconsult’s shrinking profit margins and uncertain cost discipline raise concerns about its ability to deliver steady and predictable earnings in the years ahead.

If reliable performance matters, use our stable growth stocks screener (2080 results) to spot companies with proven consistency in revenue and profit regardless of market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:MULTI

Multiconsult

Engages in the provision of engineering design, consultancy, and architecture services in Norway, Sweden, Denmark, Poland, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives