- Norway

- /

- Aerospace & Defense

- /

- OB:KOG

Why Kongsberg Gruppen (OB:KOG) Jumped After Splitting Into Two Companies Amid Strong Q3 Results

Reviewed by Sasha Jovanovic

- Kongsberg Gruppen recently reported third quarter results, posting sales of NOK13.3 billion and net income of NOK1.7 billion, alongside an announcement to split into two focused and independent companies pursuing global growth.

- This combination of robust financial results and significant organizational restructuring suggests a major inflection point for the company's operational direction and market positioning.

- We'll explore how Kongsberg Gruppen's decision to separate into two companies may influence its investment prospects and future earnings trajectory.

AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Kongsberg Gruppen Investment Narrative Recap

To be a shareholder in Kongsberg Gruppen, you need to believe that enduring global demand for advanced defense and maritime technology, supported by persistent geopolitical tensions and ambitious decarbonization efforts, can generate multi-year revenue and margin growth. The recent split into two focused companies may sharpen each unit’s global competitiveness, but for now it does not materially alter the most important near-term catalyst: sustaining strong order intake in both defense and maritime segments. The greatest risk remains the possibility of shifting government procurement priorities, should environmental policy or arms export scrutiny tighten, which could seriously restrain future order flows.

Among recent news, the announcement to establish Kongsberg Sensors & Robotics as a separate business area stands out. This move ties directly into the company’s ambition to capture rising global demand for innovative underwater and autonomous systems, a potential catalyst, especially as regulatory and ESG trends reshape the maritime sector and create further sales opportunities in automation, sensors, and AI-driven products. But for investment returns to materialize, attention must stay fixed on execution and customer adoption as these new business areas scale.

Yet, investors should not overlook the risk that if government budgets shift away from defense procurement faster than expected…

Read the full narrative on Kongsberg Gruppen (it's free!)

Kongsberg Gruppen's outlook anticipates NOK83.8 billion in revenue and NOK9.2 billion in earnings by 2028. This is based on a 16.4% annual revenue growth rate and represents an increase of NOK2.5 billion in earnings from the current NOK6.7 billion.

Uncover how Kongsberg Gruppen's forecasts yield a NOK325.17 fair value, a 35% upside to its current price.

Exploring Other Perspectives

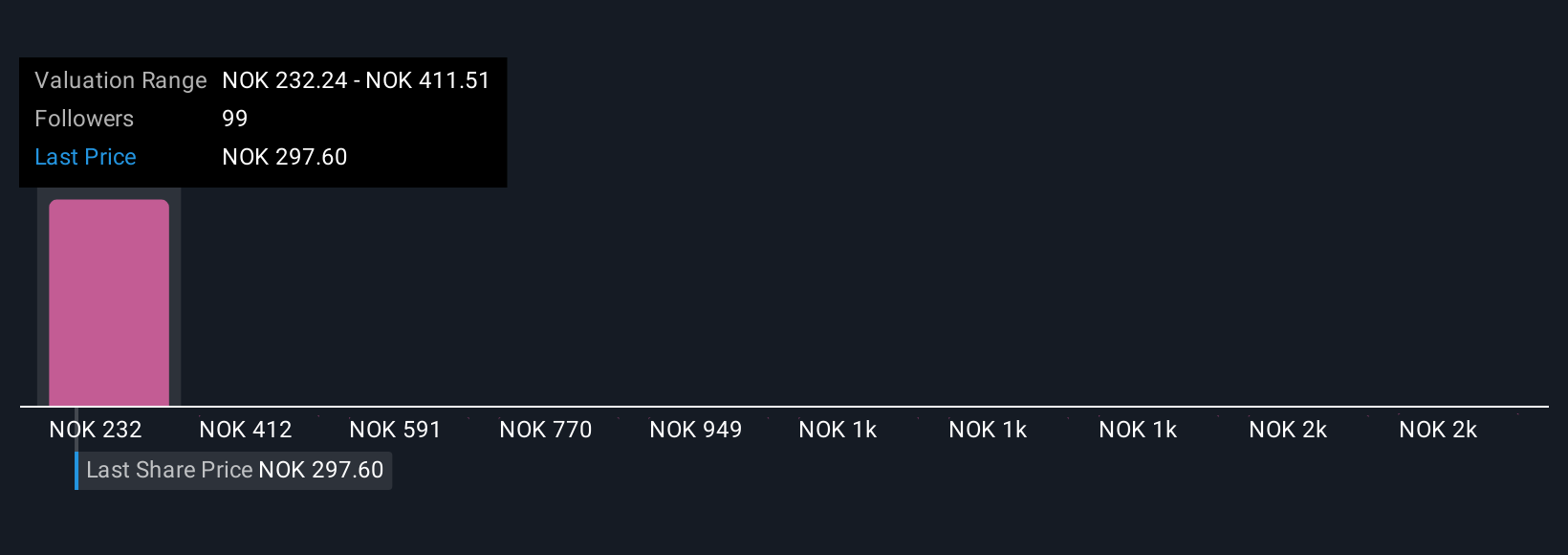

Simply Wall St Community members contributed 12 fair value estimates for Kongsberg Gruppen, spanning NOK232 to NOK2,025 per share. With such a wide range of views, it is clear that many weigh the potential for recurring government contracts against the uncertainty of future political spending shifts, explore these differing opinions for a broader understanding of Kongsberg's outlook.

Explore 12 other fair value estimates on Kongsberg Gruppen - why the stock might be worth over 8x more than the current price!

Build Your Own Kongsberg Gruppen Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kongsberg Gruppen research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Kongsberg Gruppen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kongsberg Gruppen's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kongsberg Gruppen might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KOG

Kongsberg Gruppen

Provides high-tech systems and solutions primarily to customers in the maritime and defense markets.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives