Benign Growth For Hexagon Composites ASA (OB:HEX) Underpins Stock's 32% Plummet

Unfortunately for some shareholders, the Hexagon Composites ASA (OB:HEX) share price has dived 32% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 85% share price decline.

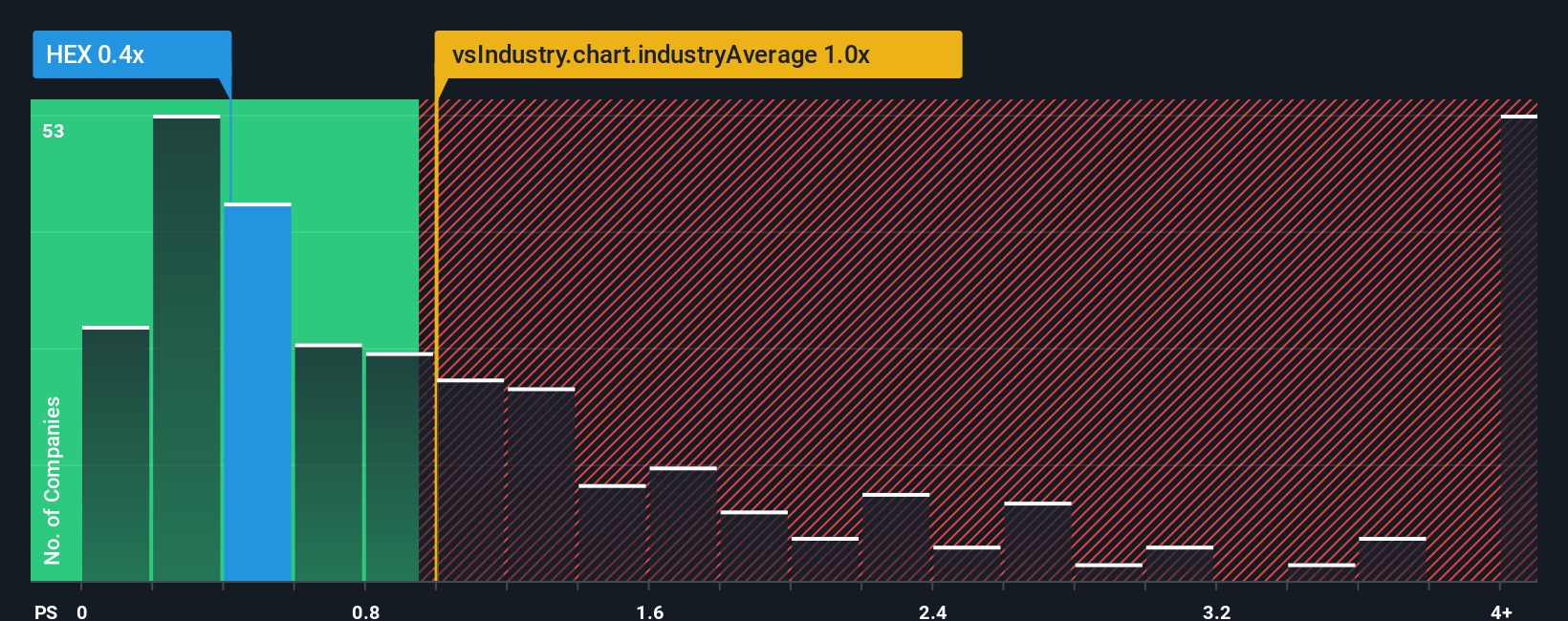

Since its price has dipped substantially, Hexagon Composites' price-to-sales (or "P/S") ratio of 0.4x might make it look like a buy right now compared to the Machinery industry in Norway, where around half of the companies have P/S ratios above 1x and even P/S above 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Hexagon Composites

What Does Hexagon Composites' Recent Performance Look Like?

Recent times haven't been great for Hexagon Composites as its revenue has been falling quicker than most other companies. Perhaps the market isn't expecting future revenue performance to improve, which has kept the P/S suppressed. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the revenue slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Hexagon Composites.Is There Any Revenue Growth Forecasted For Hexagon Composites?

In order to justify its P/S ratio, Hexagon Composites would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 3.4%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.8% in total. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 17% as estimated by the four analysts watching the company. Meanwhile, the broader industry is forecast to expand by 13%, which paints a poor picture.

With this in consideration, we find it intriguing that Hexagon Composites' P/S is closely matching its industry peers. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Hexagon Composites' P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Hexagon Composites' P/S is on the lower end of the spectrum. As other companies in the industry are forecasting revenue growth, Hexagon Composites' poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 2 warning signs for Hexagon Composites that we have uncovered.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if Hexagon Composites might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About OB:HEX

Hexagon Composites

Provides alternative fuel systems and solutions to commercial vehicles and gas distribution companies worldwide.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives