- Norway

- /

- Industrials

- /

- OB:AKER

Aker (OB:AKER) Valuation in Focus Following Strong Share Price Momentum

Reviewed by Simply Wall St

See our latest analysis for Aker.

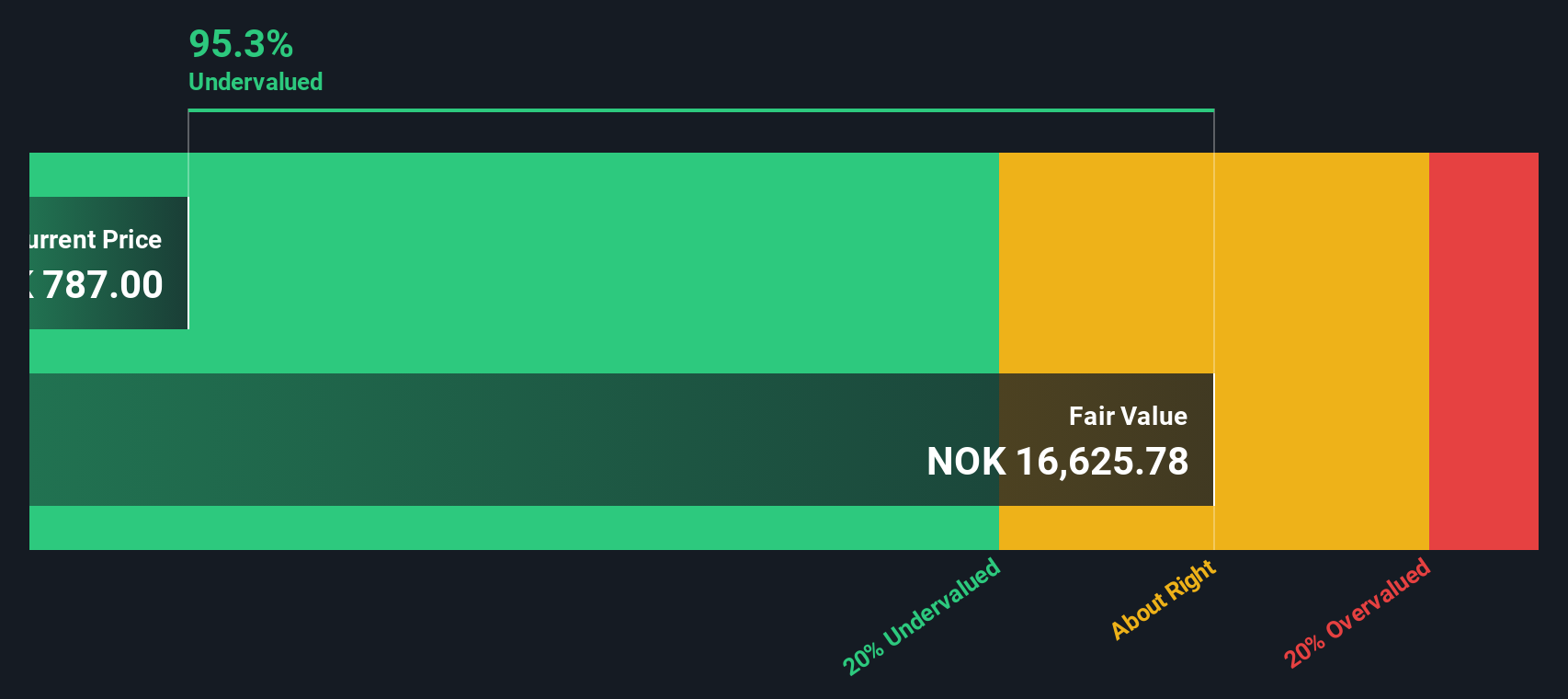

Aker's latest price movement suggests momentum is still building, with a 15.2% share price return over the past 90 days adding to a remarkable one-year total shareholder return exceeding 52%. With the share price now at NOK 787.0, investor sentiment seems to be improving as confidence in Aker’s outlook grows.

If you’re searching for more standout performers, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With Aker’s shares near all-time highs, the big question is whether the current price reflects the company’s future earning power or if there is still an opportunity for investors to benefit from further upside.

Price-to-Sales Ratio of 4.3x: Is it justified?

Aker's shares are currently trading at a price-to-sales (P/S) ratio of 4.3x, significantly higher than both the peer and industry averages. At the recent close of NOK 787.0, this valuation signals the market is pricing in more optimistic revenue expectations compared to other companies in the sector.

The price-to-sales ratio measures how much investors are willing to pay for each unit of revenue a company generates. It is an important benchmark for businesses where earnings may fluctuate or be impacted by one-off factors, as it strips away profit volatility and focuses on top-line performance. For industrials, a high multiple like this might suggest either strong confidence in future growth or a heated market.

The current P/S ratio of 4.3x stands out versus the European Industrials industry average of just 0.9x and the peer average of 2.8x. This suggests investors are showing a clear preference for Aker, perhaps due to perceived resilience or unique growth opportunities. However, the premium sets a high expectation, and unless there is fundamental outperformance, valuations at this level often face scrutiny.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 4.3x (OVERVALUED)

However, risks such as over-optimistic growth assumptions or sector volatility could quickly challenge Aker’s high valuation and current investor sentiment.

Find out about the key risks to this Aker narrative.

Another View: Deep Discount or Deeper Concern?

While the price-to-sales ratio presents Aker as expensive compared to its peers, our DCF model offers a distinct perspective. According to this approach, Aker’s current share price is trading well below our estimated fair value. Could the market be overlooking long-term value, or are there risks hidden beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Aker for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 840 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Aker Narrative

If you have a different perspective or want to interpret the data in your own way, you can craft your unique take in just a few minutes. Do it your way

A great starting point for your Aker research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let potential winners pass you by. Uncover fresh opportunities and build a smarter portfolio with these unique stock ideas. Your next great investment story may be closer than you think.

- Tap into real returns by browsing these 840 undervalued stocks based on cash flows, where high-quality businesses may be trading below their true worth. This offers you the chance to buy value at the right price.

- Seize gains from the next wave in artificial intelligence with these 26 AI penny stocks, highlighting companies breaking new ground and capturing growth in this rapidly evolving industry.

- Maximize your income potential by scanning these 22 dividend stocks with yields > 3%, focused on strong, stable yields above 3% for those who want their portfolio to pay off now and in the long term.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:AKER

Aker

Operates as an industrial investment company in Norway, Europa, North America, South America, and internationally.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives