Stock Analysis

- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

Exploring Three Top Growth Companies With High Insider Ownership On Euronext Amsterdam

Reviewed by Simply Wall St

Amidst the broader European market's challenges, including political uncertainties and fluctuating bond yields, the Netherlands stands out with its robust corporate sector. In this context, exploring growth companies with high insider ownership on Euronext Amsterdam offers a unique perspective on firms deeply rooted in their management's commitment to success.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| BenevolentAI (ENXTAM:BAI) | 27.8% | 62.8% |

| Envipco Holding (ENXTAM:ENVI) | 15.1% | 68.9% |

| Ebusco Holding (ENXTAM:EBUS) | 31.4% | 115.2% |

| MotorK (ENXTAM:MTRK) | 35.8% | 105.8% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 66.1% |

| PostNL (ENXTAM:PNL) | 30.8% | 24.2% |

Let's take a closer look at a couple of our picks from the screened companies.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Envipco Holding N.V. specializes in designing, developing, manufacturing, and selling or leasing reverse vending machines for recycling used beverage containers, operating mainly in the Netherlands, North America, and Europe with a market cap of approximately €351.91 million.

Operations: The company primarily generates revenue through the design, development, manufacture, and sale or lease of reverse vending machines in the Netherlands, North America, and Europe.

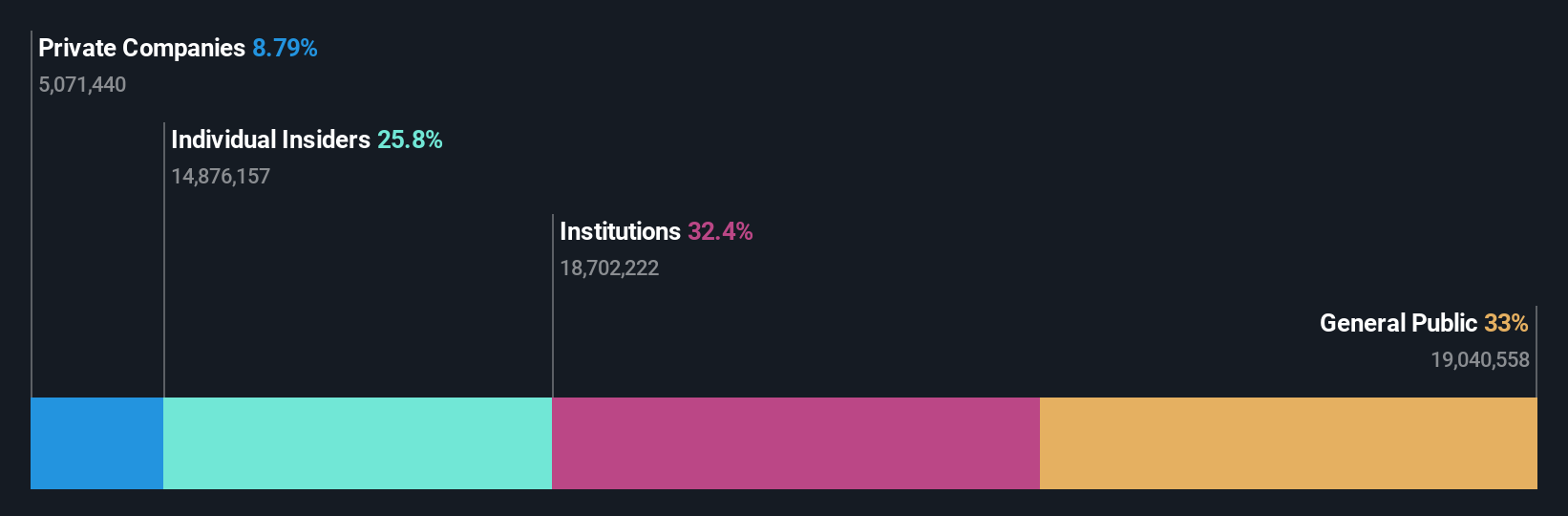

Insider Ownership: 15.1%

Earnings Growth Forecast: 68.9% p.a.

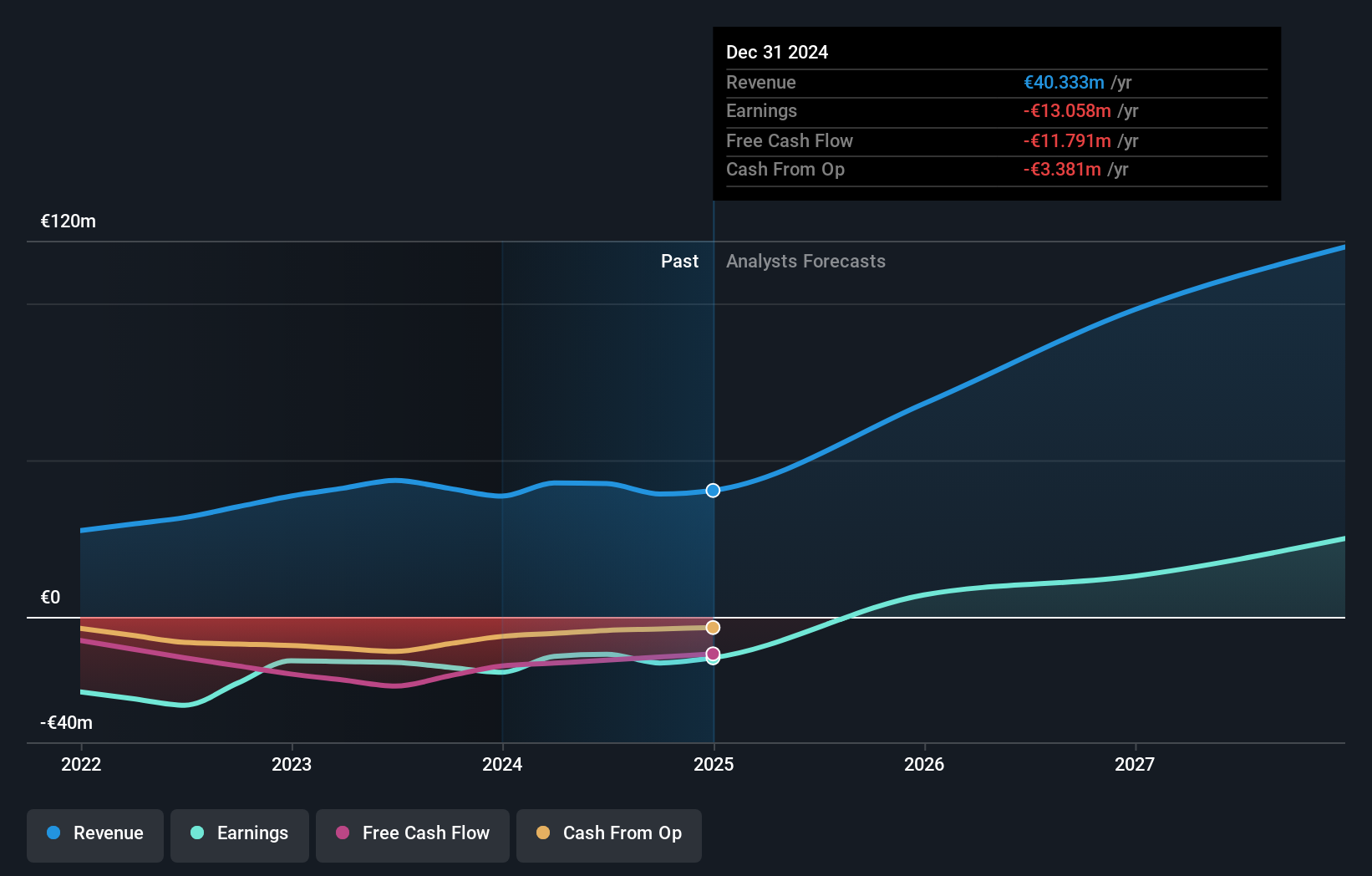

Envipco Holding N.V. has shown promising growth, with earnings expected to increase by 68.9% annually, significantly outpacing the Dutch market's 16.4%. Despite trading at 76.7% below its estimated fair value and experiencing high share price volatility recently, the company's revenue growth also exceeds market expectations at an annual rate of 33.6%. Notably, Envipco turned profitable this year with a substantial increase in sales to €27.44 million in Q1 2024 from €10.41 million the previous year, alongside a shift from a net loss to a net income of €0.147 million.

- Unlock comprehensive insights into our analysis of Envipco Holding stock in this growth report.

- Our comprehensive valuation report raises the possibility that Envipco Holding is priced higher than what may be justified by its financials.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MotorK plc operates as a provider of software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market capitalization of approximately €272.10 million.

Operations: The company generates its revenue primarily from software and programming services, totaling €42.94 million.

Insider Ownership: 35.8%

Earnings Growth Forecast: 105.8% p.a.

MotorK, amidst recent executive changes, is poised for notable growth with its revenue forecast to rise by 24% annually, outpacing the Dutch market average of 9.5%. Despite a slight decline in Q1 2024 revenues to €11.25 million from €11.43 million year-over-year and shareholder dilution over the past year, earnings are expected to surge by approximately 105.85% annually over the next three years as it moves towards profitability.

- Get an in-depth perspective on MotorK's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report MotorK implies its share price may be too high.

PostNL (ENXTAM:PNL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PostNL N.V. offers postal and logistics services across the Netherlands, Europe, and globally, with a market capitalization of approximately €0.69 billion.

Operations: The company's revenue is generated from two primary segments: Packages (€2.25 billion) and Mail in the Netherlands (€1.35 billion).

Insider Ownership: 30.8%

Earnings Growth Forecast: 24.2% p.a.

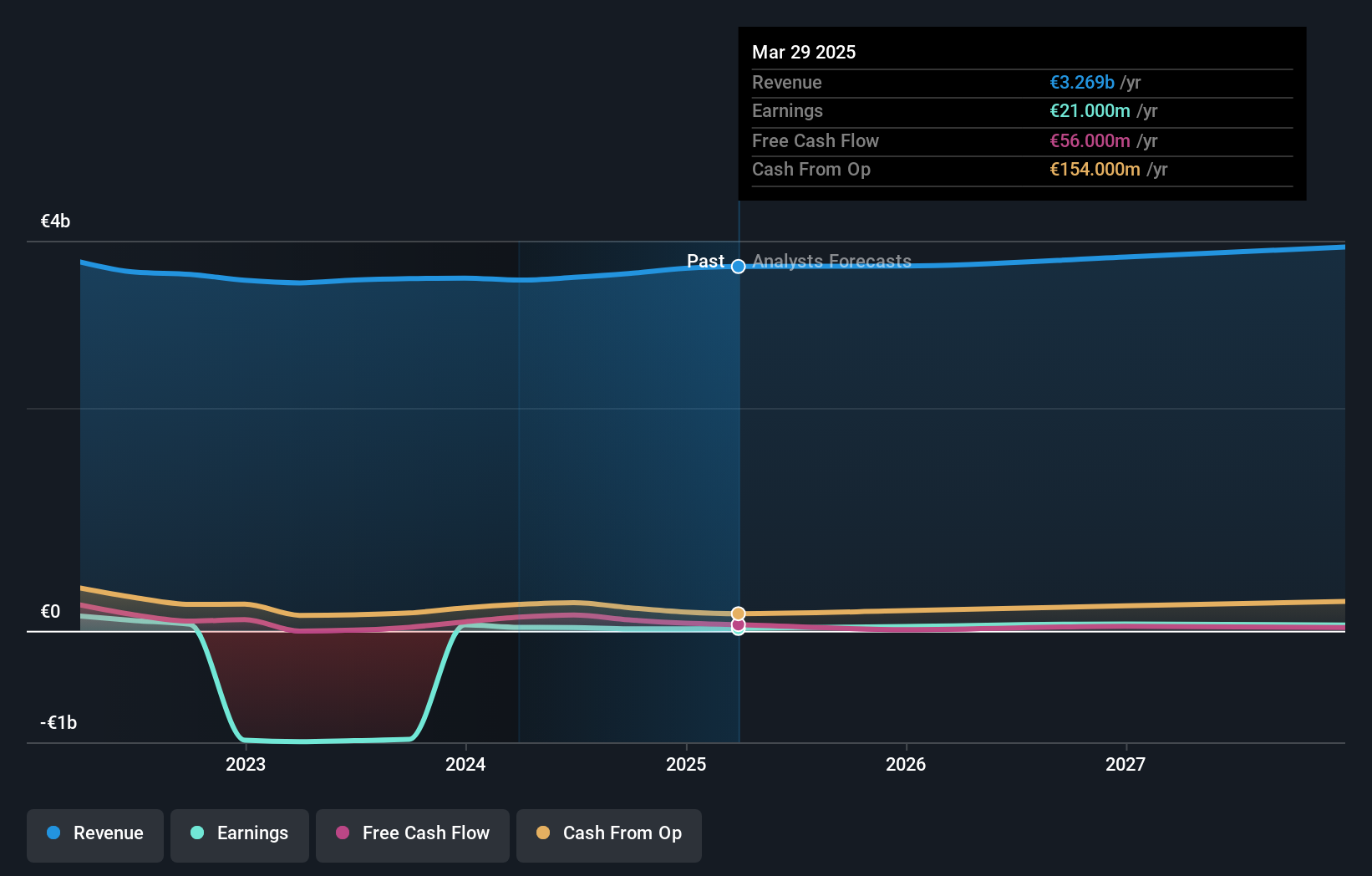

PostNL, despite a challenging first quarter in 2024 with sales dropping to €763 million and a net loss of €20 million, is anticipated to see earnings growth outpace the broader Dutch market. Expected annual profit growth is forecasted at 24.2% per year against the market's 16.4%. However, revenue growth projections remain modest at 3.4% annually, below the Dutch average of 9.5%. The company recently engaged in sustainable bond offerings totaling nearly €300 million, underscoring its commitment to sustainability despite financial volatility and high debt levels.

- Click here and access our complete growth analysis report to understand the dynamics of PostNL.

- Insights from our recent valuation report point to the potential undervaluation of PostNL shares in the market.

Next Steps

- Click here to access our complete index of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether Envipco Holding is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, and sells or leases reverse vending machines (RVM) for the collection and processing of used beverage containers primarily in the Netherlands, North America, and Europe.

High growth potential with excellent balance sheet.