- Netherlands

- /

- Logistics

- /

- ENXTAM:INPST

InPost (ENXTAM:INPST): Assessing Valuation After Strong Sales Growth and Profit Decline in Latest Results

Reviewed by Simply Wall St

InPost (ENXTAM:INPST) has just reported its most recent half-year earnings, and investors are taking notice. The company delivered strong sales growth compared to last year, with revenue jumping to PLN 6,485.3 million from PLN 5,048.7 million. However, despite those gains at the top line, net income and earnings per share fell sharply, raising pressing questions about InPost’s profitability. This kind of split between higher revenue and lower profits often signals either strategic investment for future growth or emerging pressures on margins.

Against this backdrop, InPost’s share price performance over the past year looks mixed. Shares have slid steadily, down around 36% over twelve months, even as the company has posted long-term gains of over 80% in the past three years. Recent quarterly declines suggest momentum has stalled since spring, reflecting investor caution as earnings have become less predictable. This makes the latest results even more relevant as investors look for signs of either stabilization or renewed risk.

After such a turbulent year and the latest earnings twist, is InPost an overlooked growth story trading at a bargain, or is the market already accounting for all the company’s future gains?

Most Popular Narrative: 37.7% Undervalued

The prevailing narrative among analysts suggests that InPost shares are materially undervalued, with the current price well below their estimated fair value based on long-term growth drivers and future profitability projections.

Ongoing expansion and network densification across key European markets, especially via M&A (Yodel, Sending) and rapid APM (locker) deployment, including battery-powered units from Bloq.it, are allowing InPost to capture outsized parcel volume growth and extend its out-of-home leadership. This supports sustained double-digit revenue growth and operating leverage.

Want to know what’s powering this bold undervaluation call? There is a tightly held narrative here, built on aggressive earnings projections and margin improvements that could change the company’s future. Eager to see the forecasted metrics and the ambitious price target that might just turn the tables for InPost? Discover the financial assumptions that make this valuation stand out.

Result: Fair Value of PLN18.94 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent integration challenges with recent acquisitions, along with intensifying competition from major e-commerce players, could undermine InPost’s growth ambitions and margin prospects.

Find out about the key risks to this InPost narrative.Another View: How Does InPost Really Stack Up?

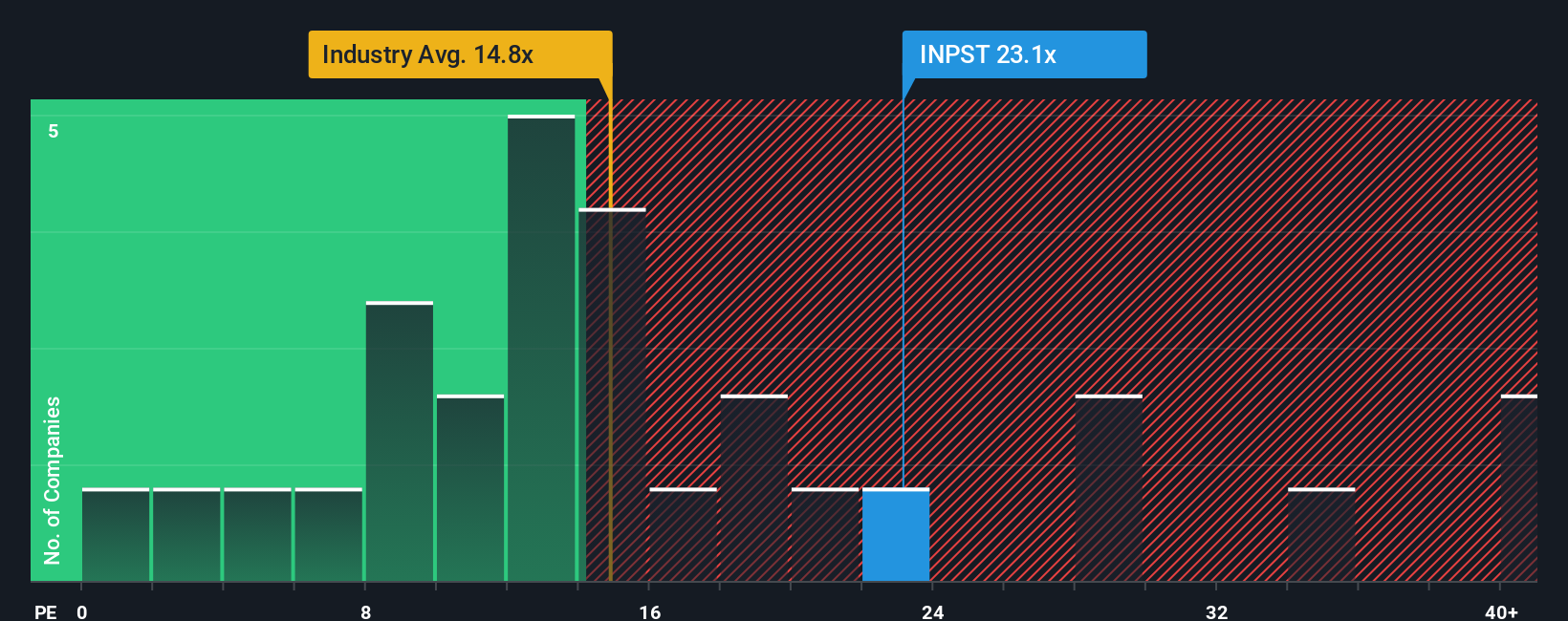

Looking at InPost through the lens of price-to-earnings benchmarks in its global industry tells a more cautious story, with shares appearing relatively expensive. Could market optimism be running ahead of fundamentals? Is growth potential still flying under the radar?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding InPost to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own InPost Narrative

If you see the story differently or want to uncover insights with your own research, you can build a narrative yourself in just a few minutes: Do it your way.

A great starting point for your InPost research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Curious about where else big opportunities might be hiding? Expand your horizon and don’t miss out on standout stocks identified by our powerful screeners.

- Unlock potential gains by targeting undervalued stocks based on cash flows with our undervalued stocks based on cash flows and spot companies the market might be overlooking.

- Get ahead of the curve by tapping into healthcare trailblazers harnessing artificial intelligence. Find your next pick with our healthcare AI stocks.

- Supercharge your income strategy and secure yields above 3% by searching for high-dividend opportunities using our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTAM:INPST

InPost

Operates as an out-of-home e-commerce enablement platform providing parcel locker services in Poland and other European countries.

High growth potential and good value.

Market Insights

Community Narratives