Stock Analysis

- Netherlands

- /

- Telecom Services and Carriers

- /

- ENXTAM:KPN

Koninklijke Heijmans And Two More Leading Dividend Stocks On Euronext Amsterdam

Reviewed by Simply Wall St

Amid recent political uncertainties and fluctuating market conditions across Europe, investors may find solace in the stability offered by dividend stocks. In this context, companies like Koninklijke Heijmans that have a history of consistent dividend payouts could be particularly appealing as they provide potential for steady income in turbulent times.

Top 5 Dividend Stocks In The Netherlands

| Name | Dividend Yield | Dividend Rating |

| Acomo (ENXTAM:ACOMO) | 6.66% | ★★★★★☆ |

| ABN AMRO Bank (ENXTAM:ABN) | 9.82% | ★★★★☆☆ |

| Randstad (ENXTAM:RAND) | 4.96% | ★★★★☆☆ |

| Signify (ENXTAM:LIGHT) | 6.70% | ★★★★☆☆ |

| Koninklijke Heijmans (ENXTAM:HEIJM) | 4.34% | ★★★★☆☆ |

| Koninklijke KPN (ENXTAM:KPN) | 4.20% | ★★★★☆☆ |

We'll examine a selection from our screener results.

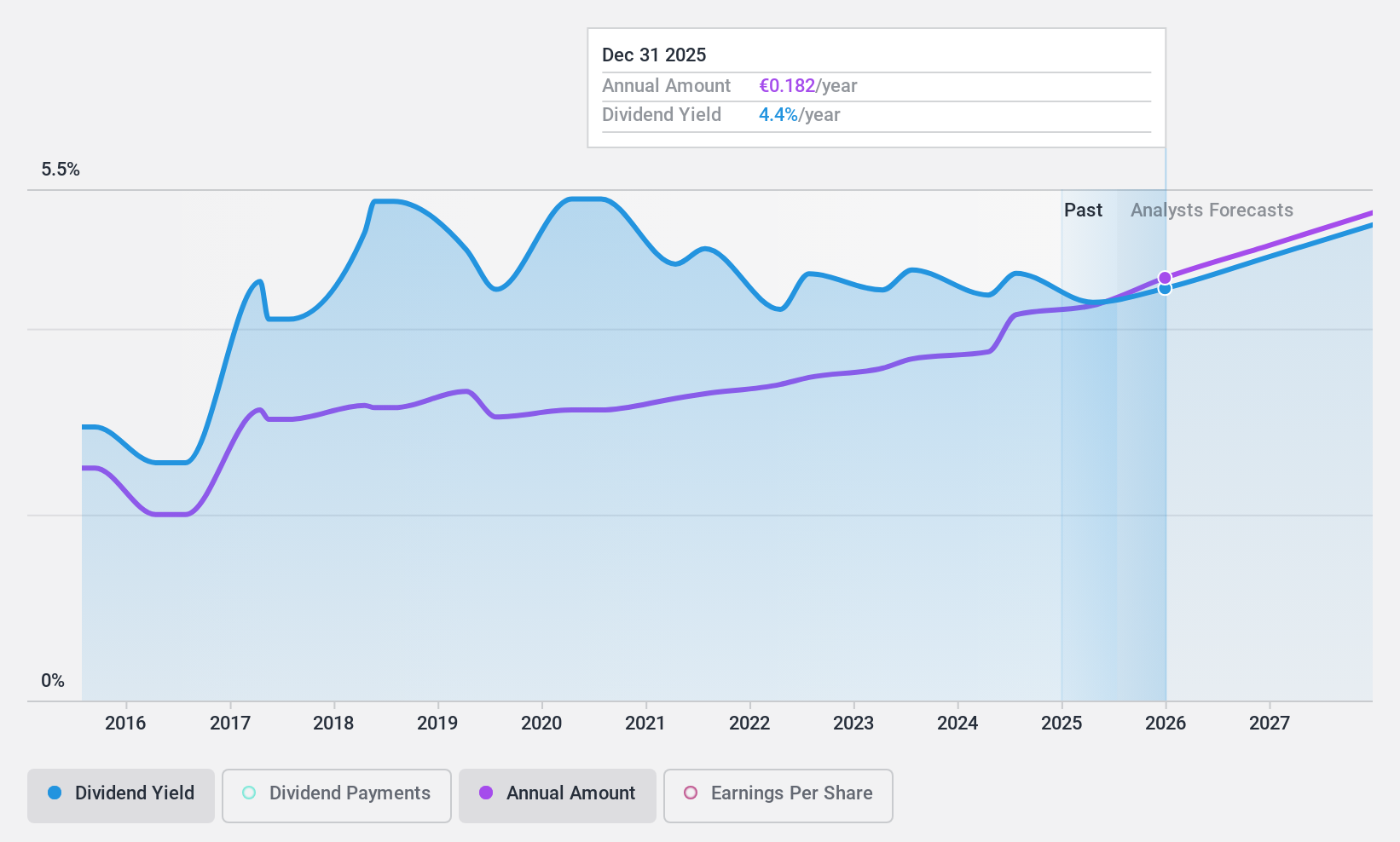

Koninklijke Heijmans (ENXTAM:HEIJM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke Heijmans N.V. is a Dutch company involved in property development, construction, and infrastructure projects both domestically and internationally, with a market capitalization of approximately €549.93 million.

Operations: Koninklijke Heijmans N.V. generates revenue through its Real Estate, Van Wanrooij, Infrastructure Works, and Construction & Technology segments, totaling €411.79 million, €124.76 million, €800.03 million, and €1.08 billion respectively.

Dividend Yield: 4.3%

Koninklijke Heijmans shows a steady financial base for dividends with earnings forecasted to grow by 10.21% annually and a history of dividend growth over the past decade. The dividends are well-supported by both earnings, with a payout ratio of 37.1%, and cash flows, which cover 59% of dividend payments. However, the dividend yield at 4.34% is below the top quartile in the Dutch market, and there's been volatility and unreliability in its dividend distribution history, reflecting potential risks for consistency-seeking investors.

- Click to explore a detailed breakdown of our findings in Koninklijke Heijmans' dividend report.

- Our valuation report here indicates Koninklijke Heijmans may be undervalued.

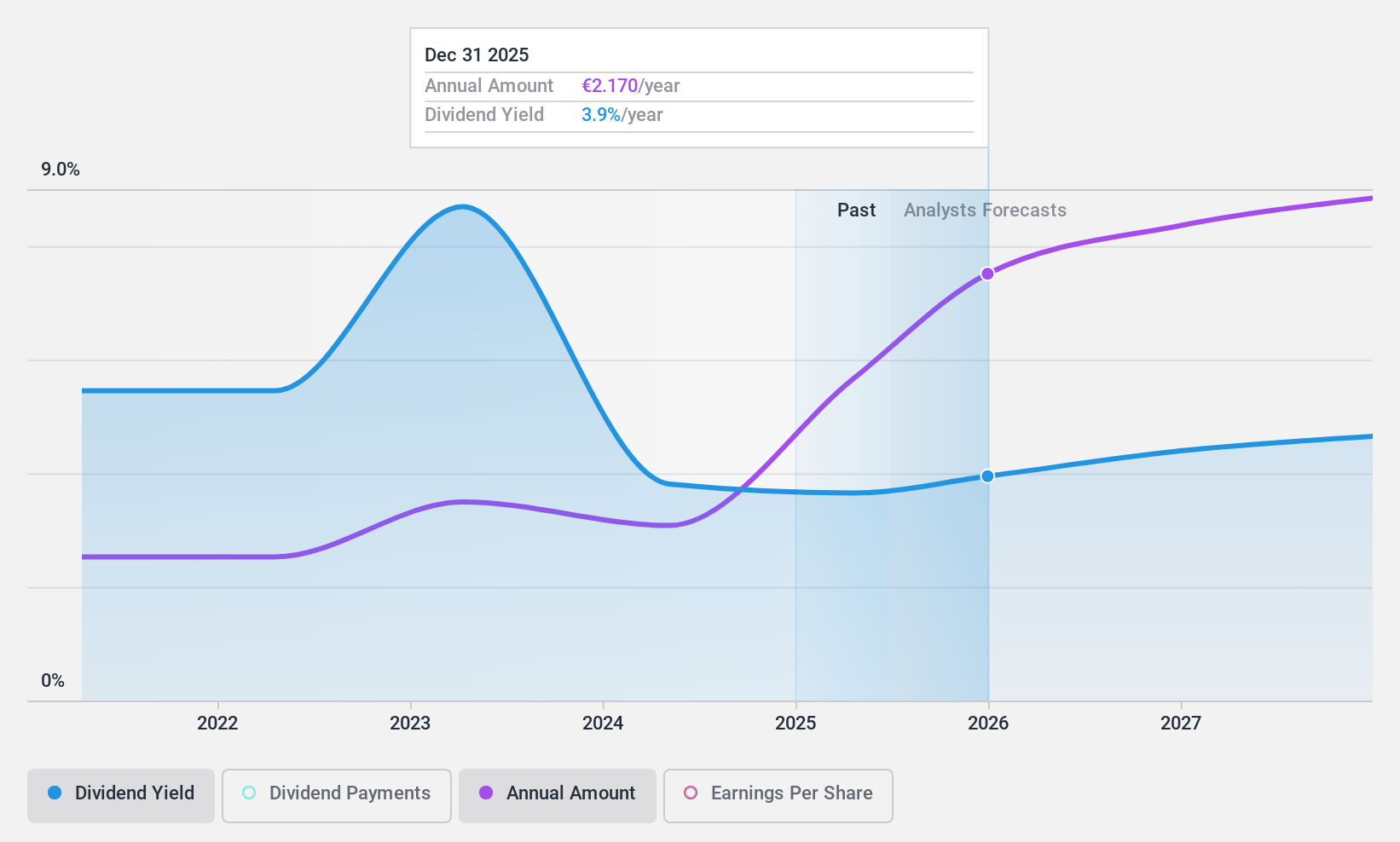

Koninklijke KPN (ENXTAM:KPN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Koninklijke KPN N.V. operates as a telecommunications and IT service provider in the Netherlands, with a market capitalization of approximately €14.04 billion.

Operations: Koninklijke KPN N.V. generates revenue through three primary segments: Business (€1.84 billion), Consumer (€2.93 billion), and Wholesale (€0.70 billion).

Dividend Yield: 4.2%

Koninklijke KPN has a mixed track record for dividend reliability, with payments showing volatility over the past decade. Despite this, dividends are reasonably covered by both earnings and cash flows, with payout ratios of 78.4% and 59.6% respectively. The dividend yield stands at 4.2%, which is lower than the top quartile of Dutch dividend stocks at 5.64%. Recent strategic developments include forming TowerCo with ABP to optimize infrastructure assets, aiming to enhance shareholder value through increased network flexibility and potential growth in tenancy levels, supported by a €120 million upfront investment and projected positive impacts on EBITDA AL (€30 million) and Operating Free Cash Flow (€20 million).

- Unlock comprehensive insights into our analysis of Koninklijke KPN stock in this dividend report.

- In light of our recent valuation report, it seems possible that Koninklijke KPN is trading beyond its estimated value.

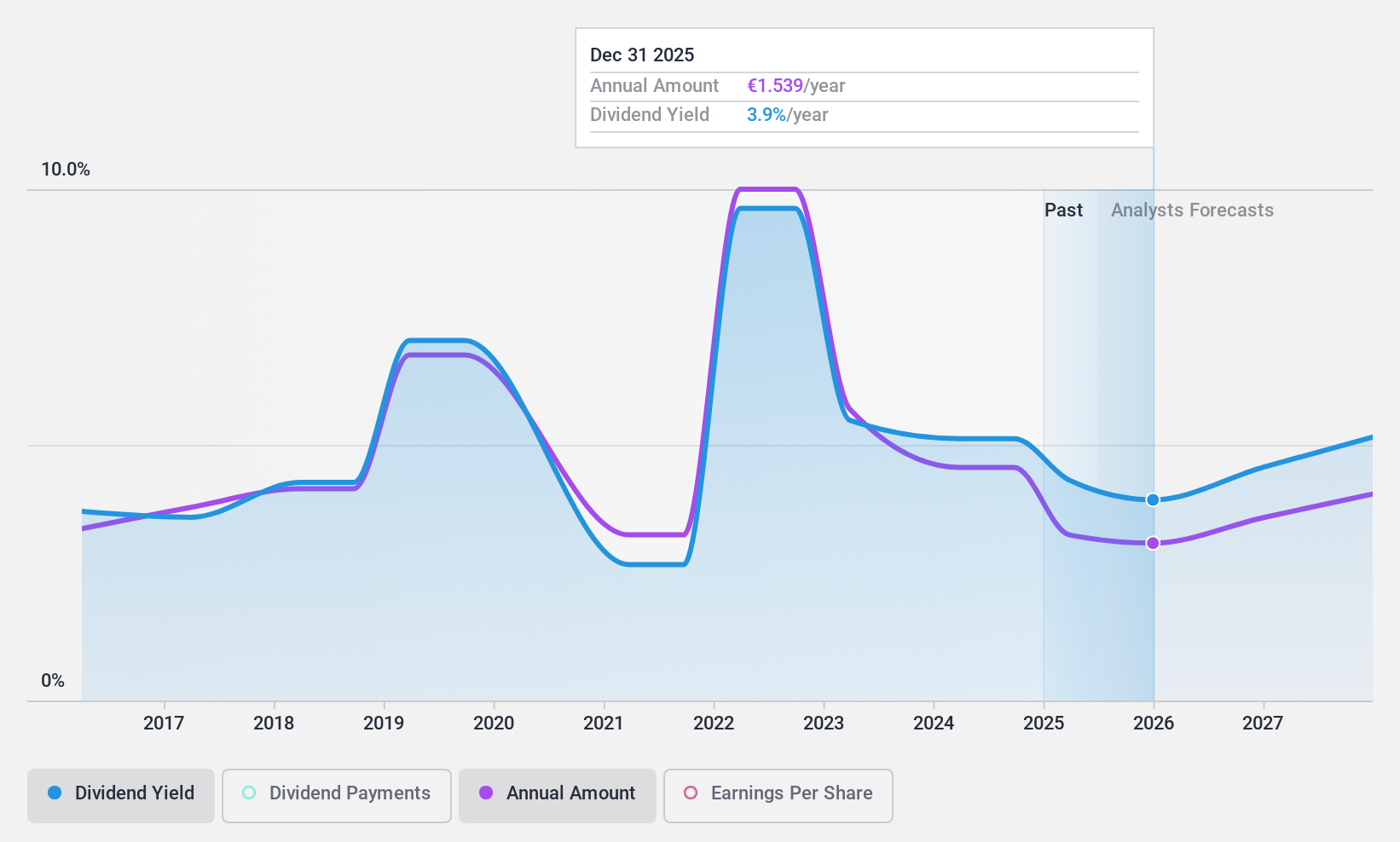

Randstad (ENXTAM:RAND)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Randstad N.V. specializes in offering comprehensive work and human resources services, with a market capitalization of approximately €8.14 billion.

Operations: Unfortunately, the provided text does not include specific details about Randstad N.V.'s revenue segments in terms of numbers. Therefore, I am unable to summarize this aspect of the company's business operations.

Dividend Yield: 5%

Randstad's dividend history is marked by inconsistency, with a volatile pattern over the last decade despite recent increases. Currently, dividends are supported by a payout ratio of 73.4% and a cash payout ratio of 45.9%, indicating coverage by both earnings and cash flows. However, its dividend yield of 4.96% is below the top quartile average in the Dutch market at 5.64%. Recent financials show a decline in sales and net income, with Q1 sales dropping to €5.94 billion from €6.52 billion year-over-year and net income falling to €88 million from €154 million, reflecting potential challenges ahead.

- Click here and access our complete dividend analysis report to understand the dynamics of Randstad.

- Our valuation report unveils the possibility Randstad's shares may be trading at a discount.

Turning Ideas Into Actions

- Reveal the 6 hidden gems among our Top Euronext Amsterdam Dividend Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're helping make it simple.

Find out whether Koninklijke KPN is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:KPN

Koninklijke KPN

Provides telecommunications and information technology (IT) services in the Netherlands.

Adequate balance sheet average dividend payer.