- Netherlands

- /

- Software

- /

- ENXTAM:TOM2

TomTom And 2 Other High Growth Tech Stocks In Europe

Reviewed by Simply Wall St

Amid a backdrop of mixed performance in European markets, with the pan-European STOXX Europe 600 Index slightly lower and national indexes showing varied results, investors are closely monitoring monetary policy decisions and economic indicators that could impact small-cap companies. In this environment, identifying high growth tech stocks like TomTom and others can be crucial for investors seeking opportunities in sectors poised to benefit from technological advancements and adaptive business strategies.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 31.53% | 46.86% | ★★★★★★ |

| argenx | 21.57% | 26.38% | ★★★★★★ |

| KebNi | 21.99% | 63.71% | ★★★★★★ |

| Bonesupport Holding | 25.26% | 59.45% | ★★★★★★ |

| Comet Holding | 10.37% | 35.47% | ★★★★★☆ |

| Hacksaw | 26.01% | 37.61% | ★★★★★★ |

| CD Projekt | 35.15% | 43.54% | ★★★★★★ |

| SyntheticMR | 18.81% | 47.40% | ★★★★★☆ |

| Aelis Farma | 108.74% | 130.33% | ★★★★★☆ |

| Yubico | 15.46% | 33.06% | ★★★★★☆ |

Let's uncover some gems from our specialized screener.

TomTom (ENXTAM:TOM2)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TomTom N.V. is a company that develops and sells navigation and location-based products and services globally, with a market capitalization of approximately €679.41 million.

Operations: TomTom generates revenue primarily from its Location Technology segment, which contributed €508.32 million, and the Consumer segment with €79.82 million. The company operates in Europe, the Americas, and internationally, focusing on navigation and location-based products and services.

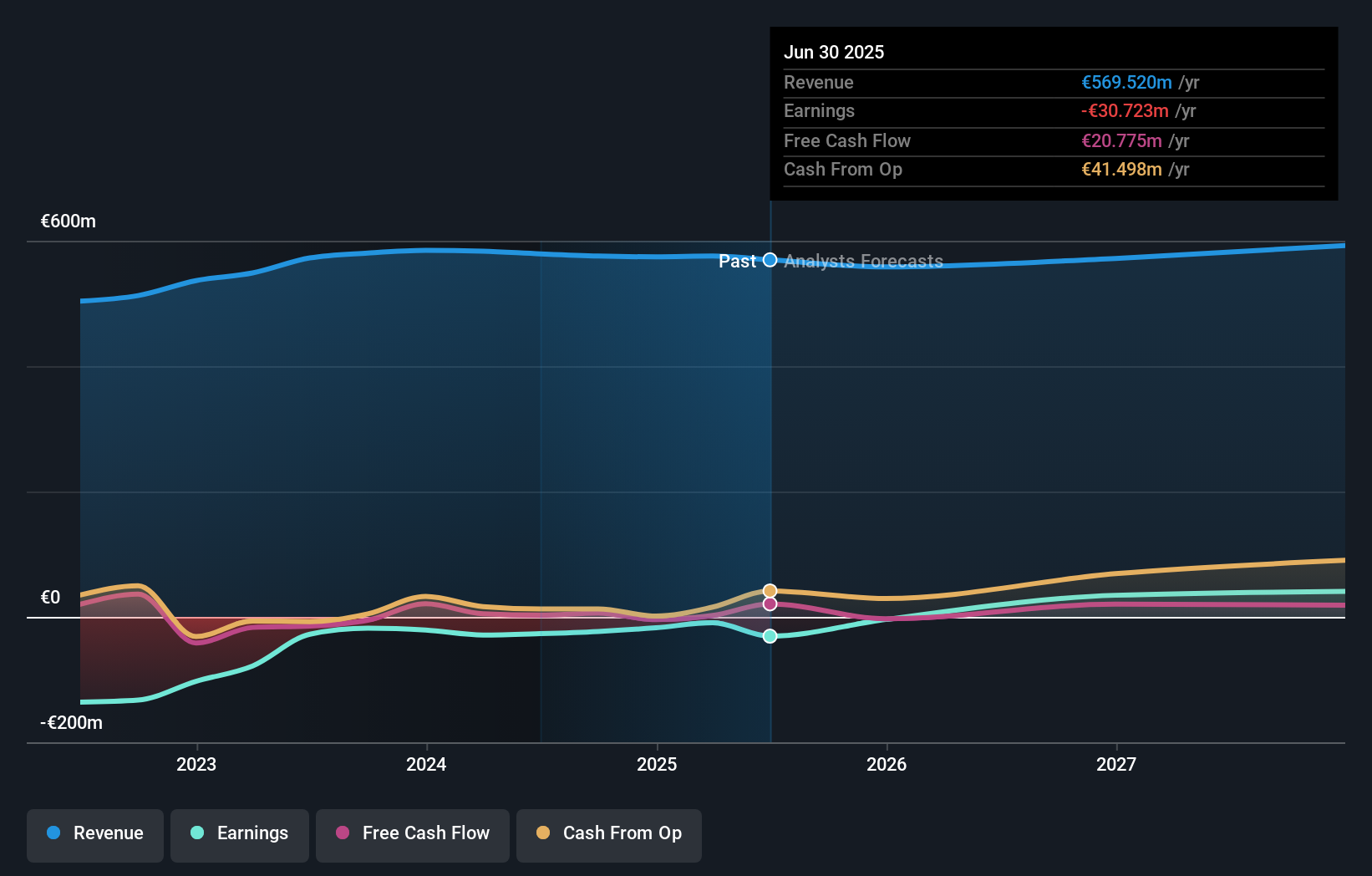

TomTom's recent launch of its Automotive Navigation Application highlights its strategic focus on enhancing in-car systems, a critical area as software-defined vehicles gain traction. This new product integrates seamlessly with TomTom Orbis Maps and offers automakers a plug-and-play solution that emphasizes customization and rapid deployment—key in an industry where speed to market is increasingly vital. Despite facing a challenging financial period with a net loss of EUR 23.63 million in Q2 2025, the company is poised for recovery, projecting annual revenues between EUR 535 million and EUR 565 million for the year. Moreover, TomTom's commitment to R&D is evident as it continues to innovate within the navigation sector, aiming to transform automotive travel experiences fundamentally.

- Click here to discover the nuances of TomTom with our detailed analytical health report.

Assess TomTom's past performance with our detailed historical performance reports.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pexip Holding ASA is a video technology company offering an end-to-end video conferencing platform and digital infrastructure across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of NOK6.42 billion.

Operations: The company generates revenue primarily from the sale of collaboration services, amounting to NOK1.19 billion.

Pexip Holding's recent performance underscores its emerging strength in the tech sector, with a notable 20.7% expected annual earnings growth outpacing the Norwegian market's 13.3%. This growth is supported by an impressive increase in net income to NOK 43.88 million from NOK 7.03 million year-over-year for Q2 2025, reflecting robust operational efficiency and market adaptation. Furthermore, Pexip's strategic share repurchases, totaling 1,685,437 shares for NOK 99.9 million, signify a confident reinvestment back into the company’s core capabilities and future potential in software solutions—a sector where innovation directly translates to competitive advantage and customer value.

BioGaia (OM:BIOG B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: BioGaia AB (publ) is a healthcare company that develops, manufactures, markets, and sells probiotic products for gut, oral, and immune health across various regions including Europe and the United States; it has a market cap of approximately SEK11.07 billion.

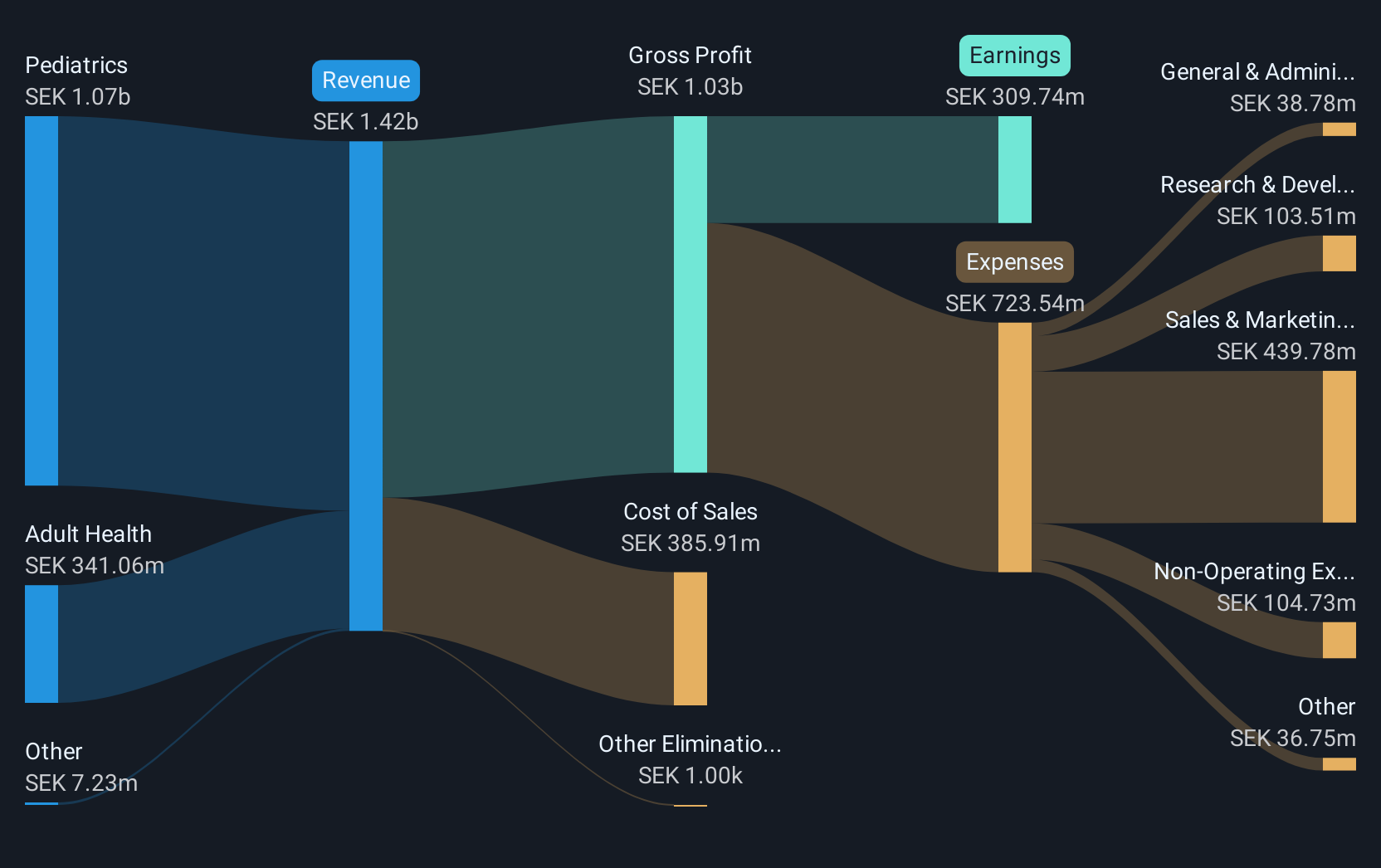

Operations: BioGaia generates revenue primarily through its Pediatrics segment, which accounts for SEK1.08 billion, followed by the Adult Health segment at SEK352.62 million. The company's operations span multiple regions, focusing on probiotic products for various health applications.

BioGaia's strategic expansion into direct distribution in Germany and Austria, starting early 2026, leverages its strong position in the probiotics market, projected to grow at a 5% CAGR until 2030. Despite a recent dip in net income from SEK 111.01 million to SEK 87.91 million year-over-year for Q2 2025, the company's earnings are expected to surge by an impressive annual rate of 21.3%. This growth is underpinned by BioGaia's commitment to R&D, notably its PEARL study outcomes which enhance its reputation in pediatric care through proven probiotic benefits.

- Delve into the full analysis health report here for a deeper understanding of BioGaia.

Review our historical performance report to gain insights into BioGaia's's past performance.

Taking Advantage

- Navigate through the entire inventory of 52 European High Growth Tech and AI Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TomTom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:TOM2

TomTom

Develops and sells navigation and location-based products and services in Europe, the Americas, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives