- Netherlands

- /

- Machinery

- /

- ENXTAM:ENVI

October 2024's High Insider Ownership Growth Stocks On Euronext Amsterdam

Reviewed by Simply Wall St

As geopolitical tensions in the Middle East escalate, European markets, including those in the Netherlands, have experienced increased caution among investors. Despite these challenges, growth companies with high insider ownership on Euronext Amsterdam continue to attract attention due to their potential for resilience and alignment of interests between management and shareholders. In such uncertain times, stocks that demonstrate strong insider ownership can be appealing as they often indicate confidence from those with intimate knowledge of the company's prospects.

Top 5 Growth Companies With High Insider Ownership In The Netherlands

| Name | Insider Ownership | Earnings Growth |

| Envipco Holding (ENXTAM:ENVI) | 36.7% | 82.7% |

| Ebusco Holding (ENXTAM:EBUS) | 31% | 107.8% |

| MotorK (ENXTAM:MTRK) | 35.7% | 108.4% |

| Basic-Fit (ENXTAM:BFIT) | 12% | 77.7% |

| CVC Capital Partners (ENXTAM:CVC) | 20.2% | 31% |

| PostNL (ENXTAM:PNL) | 35.6% | 36.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Basic-Fit (ENXTAM:BFIT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Basic-Fit N.V., along with its subsidiaries, operates fitness clubs and has a market capitalization of approximately €1.63 billion.

Operations: The company's revenue segments include €505.17 million from the Benelux region and €626.41 million from France, Spain, and Germany.

Insider Ownership: 12%

Earnings Growth Forecast: 77.7% p.a.

Basic-Fit, a growth-oriented company in the Netherlands, is forecasted to achieve significant annual earnings growth of 77.7%, outpacing the Dutch market's average. However, its revenue growth at 14.8% annually lags behind this pace and profit margins have decreased to 0.7%. Despite activist investor Buckley Capital Management urging management to explore a sale for value maximization, Basic-Fit reported improved financials with H1 2024 net income of €4.18 million from a prior loss.

- Click here to discover the nuances of Basic-Fit with our detailed analytical future growth report.

- The analysis detailed in our Basic-Fit valuation report hints at an inflated share price compared to its estimated value.

Envipco Holding (ENXTAM:ENVI)

Simply Wall St Growth Rating: ★★★★★☆

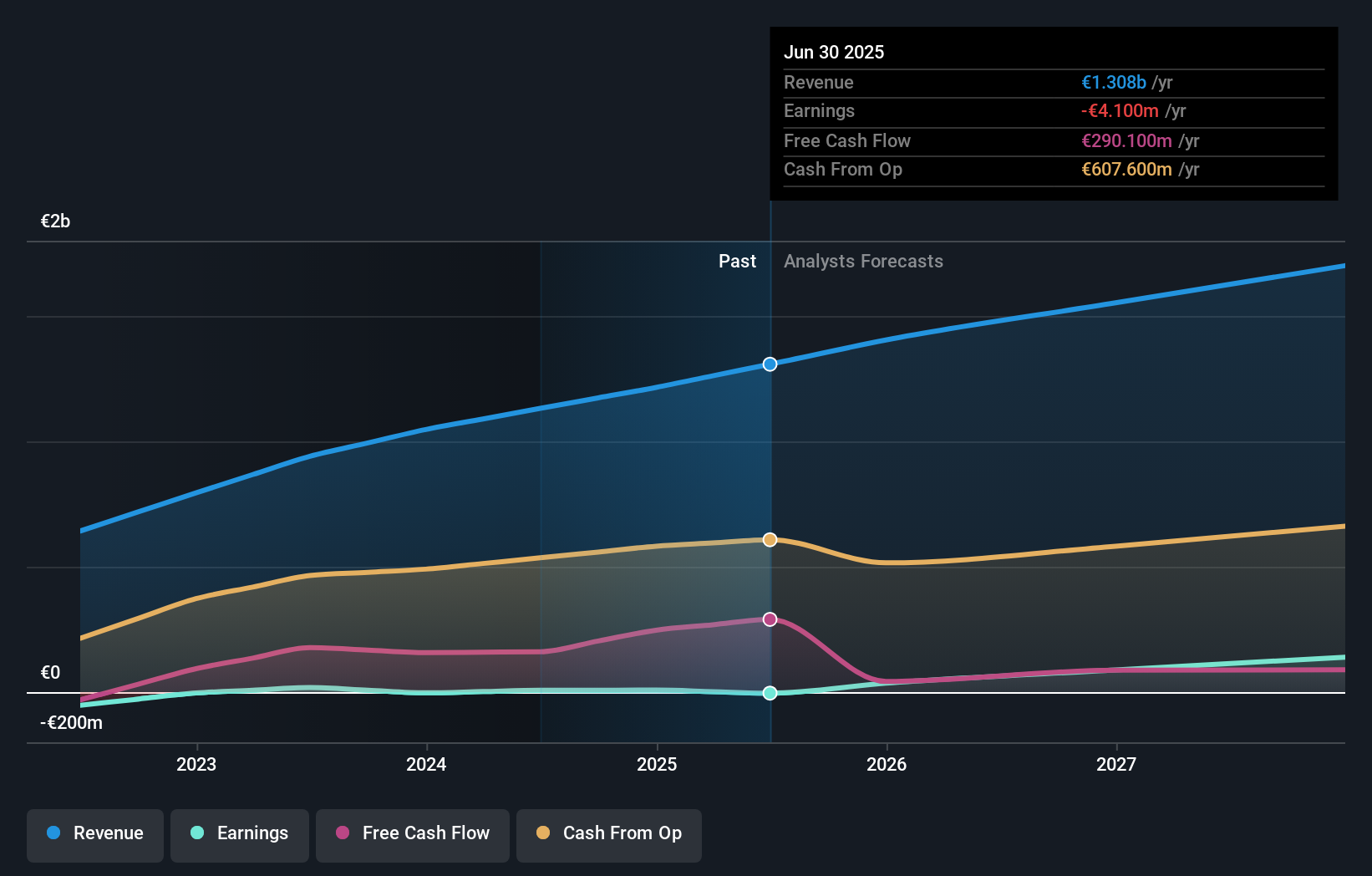

Overview: Envipco Holding N.V. specializes in the design, development, manufacturing, assembly, marketing, sales, leasing, and servicing of reverse vending machines for collecting and processing used beverage containers across the Netherlands, North America, and Europe with a market cap of €297.11 million.

Operations: Envipco generates revenue through the design, development, and support of reverse vending machines that are used for collecting and processing beverage containers in regions including the Netherlands, North America, and Europe.

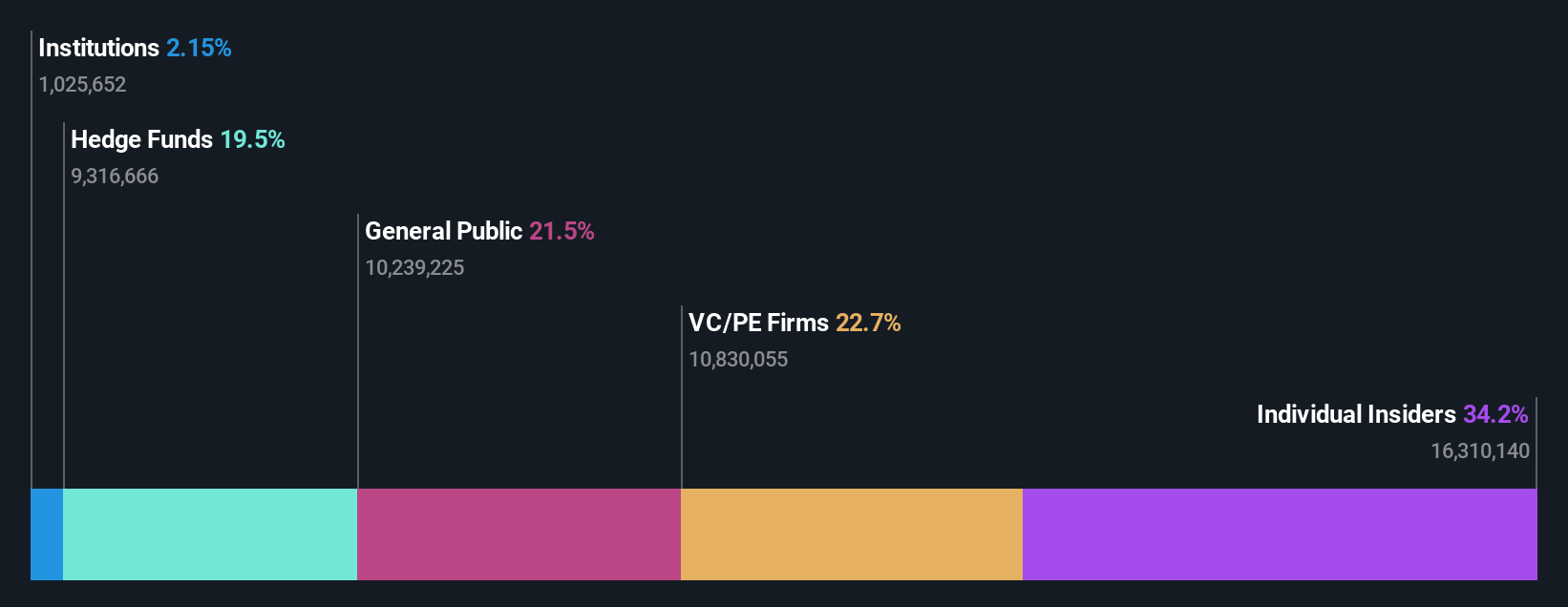

Insider Ownership: 36.7%

Earnings Growth Forecast: 82.7% p.a.

Envipco Holding, with substantial insider ownership, is positioned for significant growth in the Netherlands. Its earnings are forecasted to grow at 82.7% annually, surpassing the Dutch market average. Despite past shareholder dilution and high share price volatility, recent financials show improved performance with reduced net losses and increased sales to €54.01 million in H1 2024. The company secured a follow-on order in Romania for over 140 Optima RVMs, indicating strong demand momentum.

- Click here and access our complete growth analysis report to understand the dynamics of Envipco Holding.

- Our expertly prepared valuation report Envipco Holding implies its share price may be too high.

MotorK (ENXTAM:MTRK)

Simply Wall St Growth Rating: ★★★★★☆

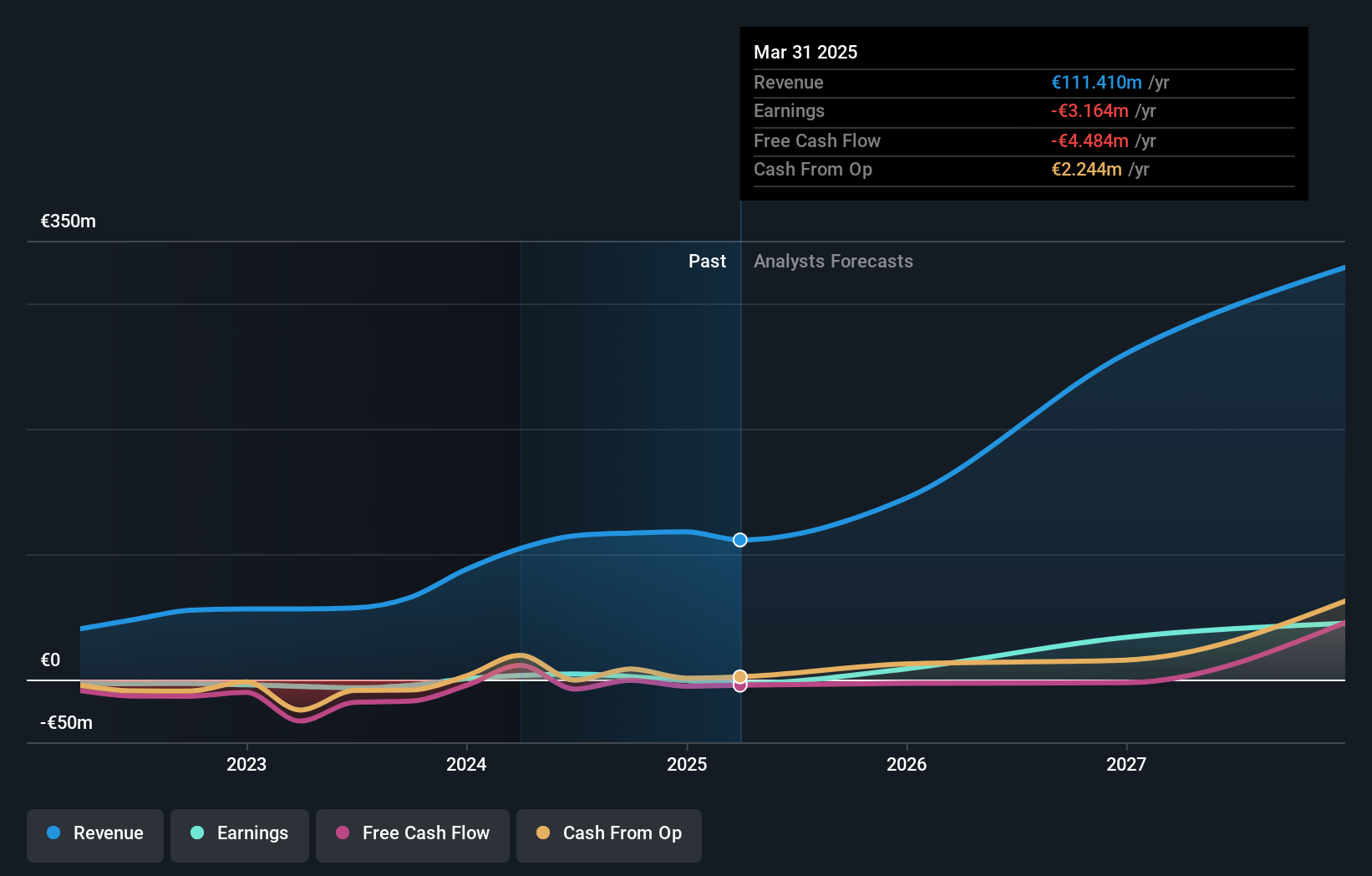

Overview: MotorK plc offers software-as-a-service solutions for the automotive retail industry across Italy, Spain, France, Germany, and the Benelux Union, with a market cap of €263.80 million.

Operations: The company's revenue primarily comes from its Software & Programming segment, which generated €42.50 million.

Insider Ownership: 35.7%

Earnings Growth Forecast: 108.4% p.a.

MotorK, with significant insider ownership, is set for rapid growth in the Netherlands. Its revenue is forecast to grow at 22.1% annually, outpacing the Dutch market. Despite recent shareholder dilution and a net loss of €6.48 million in H1 2024, losses have decreased compared to last year. The company anticipates profitability within three years, aided by strategic leadership changes including a new CFO from Sportradar joining soon.

- Get an in-depth perspective on MotorK's performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that MotorK's share price might be on the expensive side.

Where To Now?

- Delve into our full catalog of 6 Fast Growing Euronext Amsterdam Companies With High Insider Ownership here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Envipco Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ENVI

Envipco Holding

Designs, develops, manufactures, assembles, markets, sells, leases, and services reverse vending machines (RVM) to collect and process used beverage containers primarily in the Netherlands, North America, and rest of Europe.

High growth potential with adequate balance sheet.