- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

Has the ASML Rally in 2025 Lifted Its Share Price Too Far?

Reviewed by Bailey Pemberton

- Wondering if ASML Holding is still a good value pick, after all that hype around semiconductor stocks? You are not alone, and the numbers might surprise you.

- ASML’s stock has charged upwards by 24.7% so far this year and delivered a hefty 35.7% return over the past 12 months, though there have been some small dips with a -0.6% move this week.

- Market buzz has been driven by ongoing global investment in advanced chip technology and optimism surrounding artificial intelligence. For example, governments and major tech firms have continued to increase orders for ASML’s cutting-edge lithography machines, reinforcing the company's pivotal role in the chip supply chain.

- ASML currently clocks a 3 out of 6 valuation score, landing right in the middle of our valuation checks. Let’s break down what this means and explore the typical methods for assessing ASML’s price, before spotlighting an even more complete approach you will want to see at the end.

Approach 1: ASML Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true worth by projecting its future cash flows and then discounting those values back to today’s terms. This is done using a rate that reflects the risk of those cash flows. This approach gives investors a clearer picture of whether a stock is trading above or below its fair value.

Currently, ASML Holding generates €8.56 billion in free cash flow. Analyst estimates project substantial growth, with free cash flow expected to reach €17.10 billion by 2029. Further extrapolated increases are based on industry trends and internal estimates. Most projections rely on analyst data for the coming five years, with longer-term figures extrapolated by Simply Wall St to highlight expected growth over the next decade.

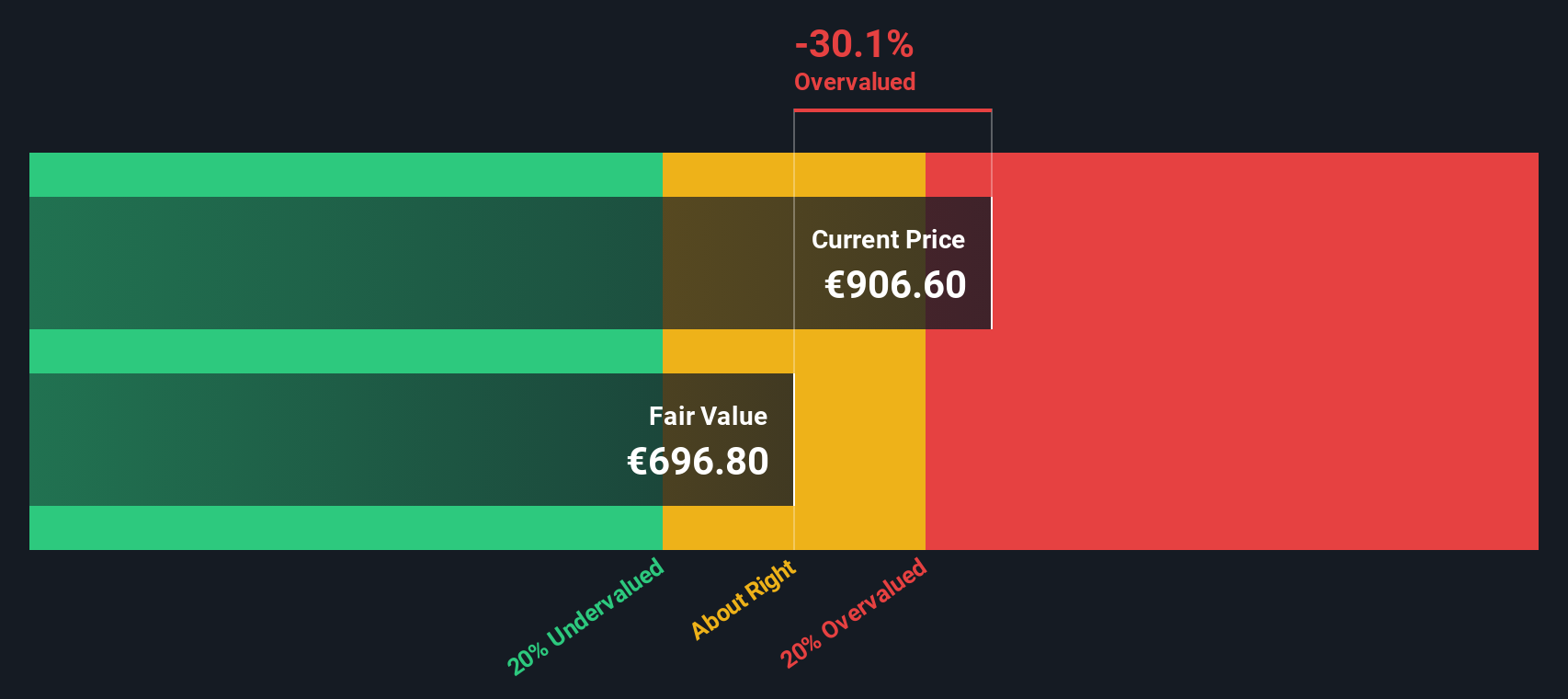

Based on the DCF model, ASML Holding’s fair value per share is calculated at €690.87. Compared to the current stock price, this implies the shares are trading about 24.5% above their intrinsic value. This suggests the stock appears overvalued on this basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASML Holding may be overvalued by 24.5%. Discover 929 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ASML Holding Price vs Earnings (PE)

The price-to-earnings (PE) ratio is the preferred multiple for valuing profitable companies like ASML Holding. This metric helps investors understand how much the market is willing to pay for each euro of the company’s earnings, making it a go-to tool for comparing stocks in the same sector.

A fair or “normal” PE ratio can vary significantly depending on how quickly a company is expected to grow and the risks it faces. Higher growth prospects or lower risk profiles usually warrant higher PE ratios, whereas slower growth or higher risk typically lead to lower multiples.

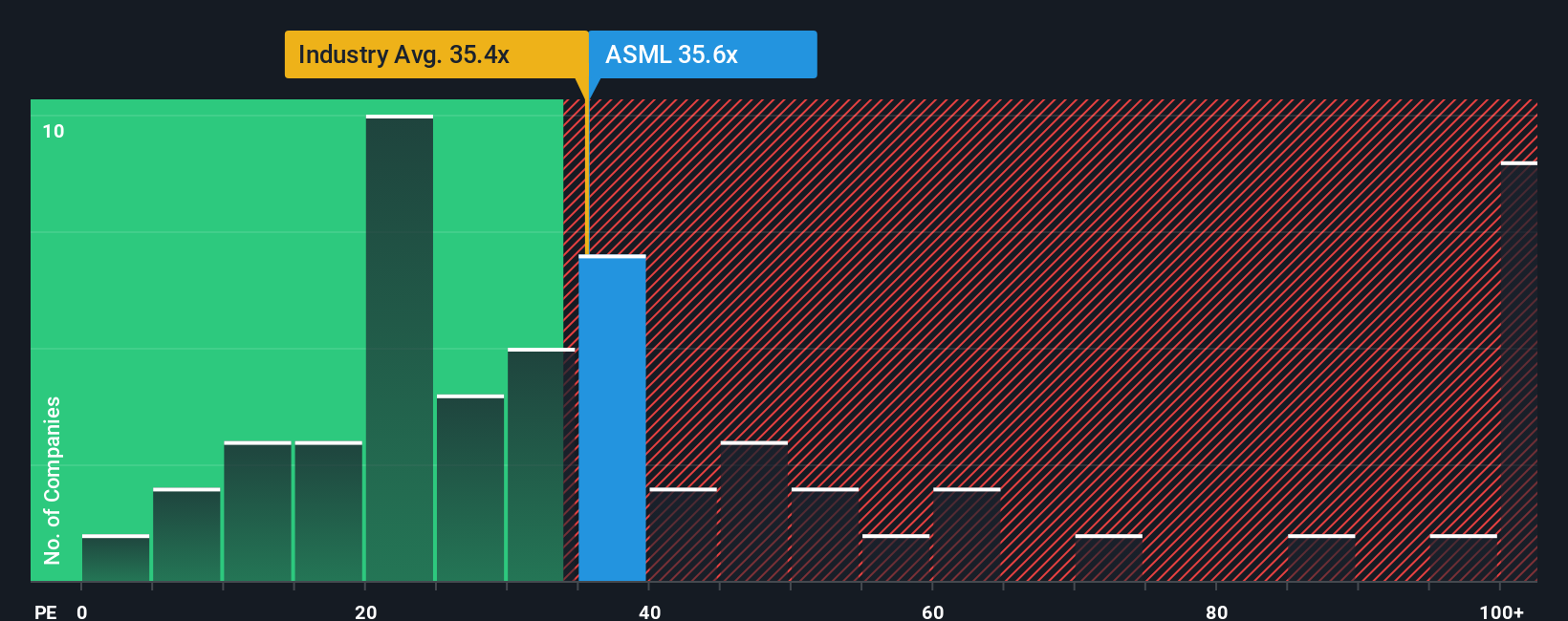

ASML is currently trading at a PE ratio of 35.21x. This compares closely to the semiconductor industry average of 34.11x and is below the peer group average of 38.61x. However, these generic benchmarks do not reflect the entire picture because they miss out on company-specific nuances.

This is where the Simply Wall St "Fair Ratio" comes in. The Fair Ratio for ASML is calculated at 50.92x, factoring in the company’s earnings growth, profit margins, size, risk profile, and its overall position in the semiconductor sector. This customized benchmark is more insightful than simply comparing to the industry or peers, as it adjusts for what actually makes ASML unique.

Comparing ASML's current PE (35.21x) to its Fair Ratio (50.92x), the shares look undervalued on this basis and may offer better value than headline multiples suggest.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASML Holding Narrative

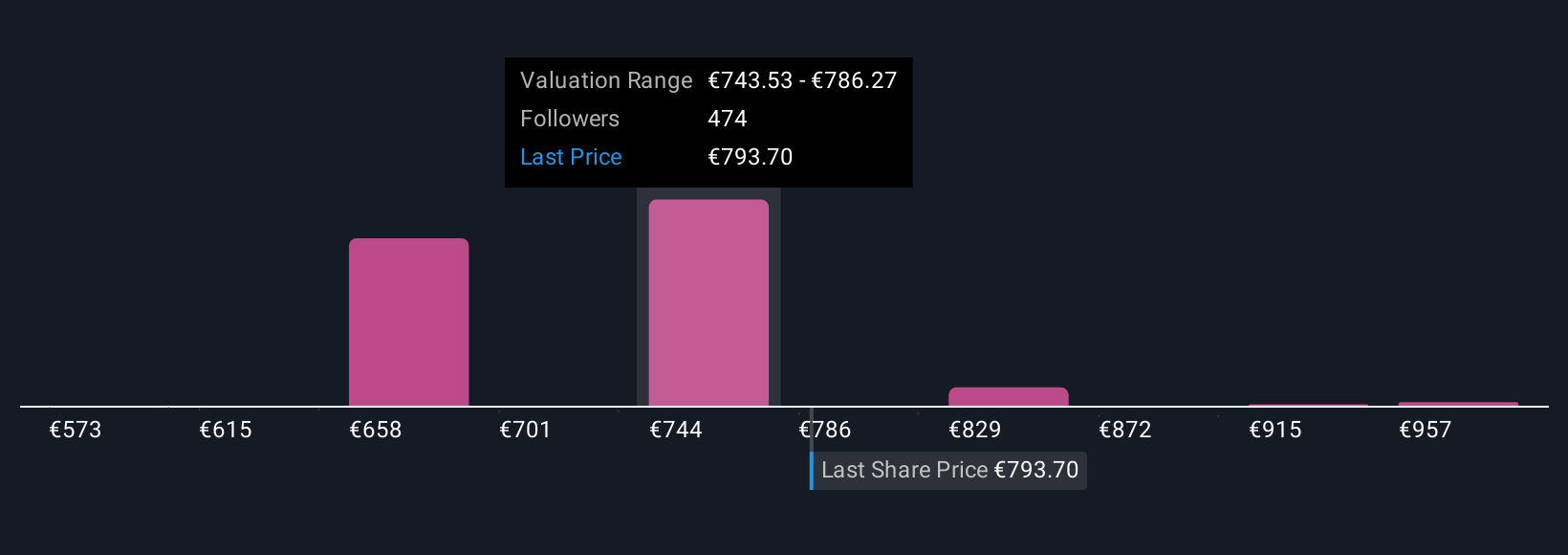

Earlier we mentioned there is a better way to understand valuation. Let’s introduce you to Narratives. A Narrative is your unique investment story, combining personal views on a company’s future with your own fair value and forecasts for revenue, earnings, and margins. By linking the company’s story directly to a dynamic financial model and a fair value calculation, Narratives offer a holistic way to guide your buy or sell decisions.

Unlike static metrics, Narratives are living forecasts you can create and explore within the Simply Wall St Community page, used by millions of investors. You can instantly see how your Narrative’s fair value compares to today’s share price. As new news or earnings are released, Narratives update automatically so you’re never working with stale assumptions.

For example, using Narratives, one investor might set a bullish fair value for ASML Holding at €1,000, seeing strong growth from AI and ongoing technology leadership. Another, more conservative investor, might view €500 as fair given macroeconomic risks and sector uncertainty. These differences show how Narratives let you choose your own thesis and act when opportunity knocks.

Do you think there's more to the story for ASML Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success