- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASML

Does ASML’s Recent 51% Rally Signal a Hidden Opportunity for 2025?

Reviewed by Bailey Pemberton

- Ever find yourself wondering if ASML Holding is trading at a fair price, or if you might be missing out on a hidden opportunity in the semiconductor space?

- ASML's stock is on the move, climbing 2.0% in the past week and rallying an impressive 51.3% over the past year, which is sure to catch investors' attention.

- That jump has come amid surging interest in AI-related technologies and global efforts to boost chip manufacturing capacity. Both factors have kept ASML firmly in the spotlight. The company's critical role in the semiconductor equipment supply chain has turned headlines about chip shortages and expanded government support into catalysts for the stock.

- But what about value? According to our checks, ASML scores a 2 out of 6 for undervaluation. While there is clear growth momentum, the next step is to dig into the details of how valuation is assessed and, later, introduce an even smarter way to think about what ASML is really worth.

ASML Holding scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: ASML Holding Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a business is worth today by projecting its future cash flows and discounting them back to their present value. This gives investors a sense of the company's underlying, intrinsic value, independent of market swings.

According to the DCF model, ASML Holding generated €8.56 billion in free cash flow over the last twelve months. Analyst projections show that this figure is expected to rise to €14.71 billion by the end of 2029. The model uses a two-stage approach that relies on analyst forecasts for the next five years and then extrapolates based on reasonable growth assumptions for subsequent years.

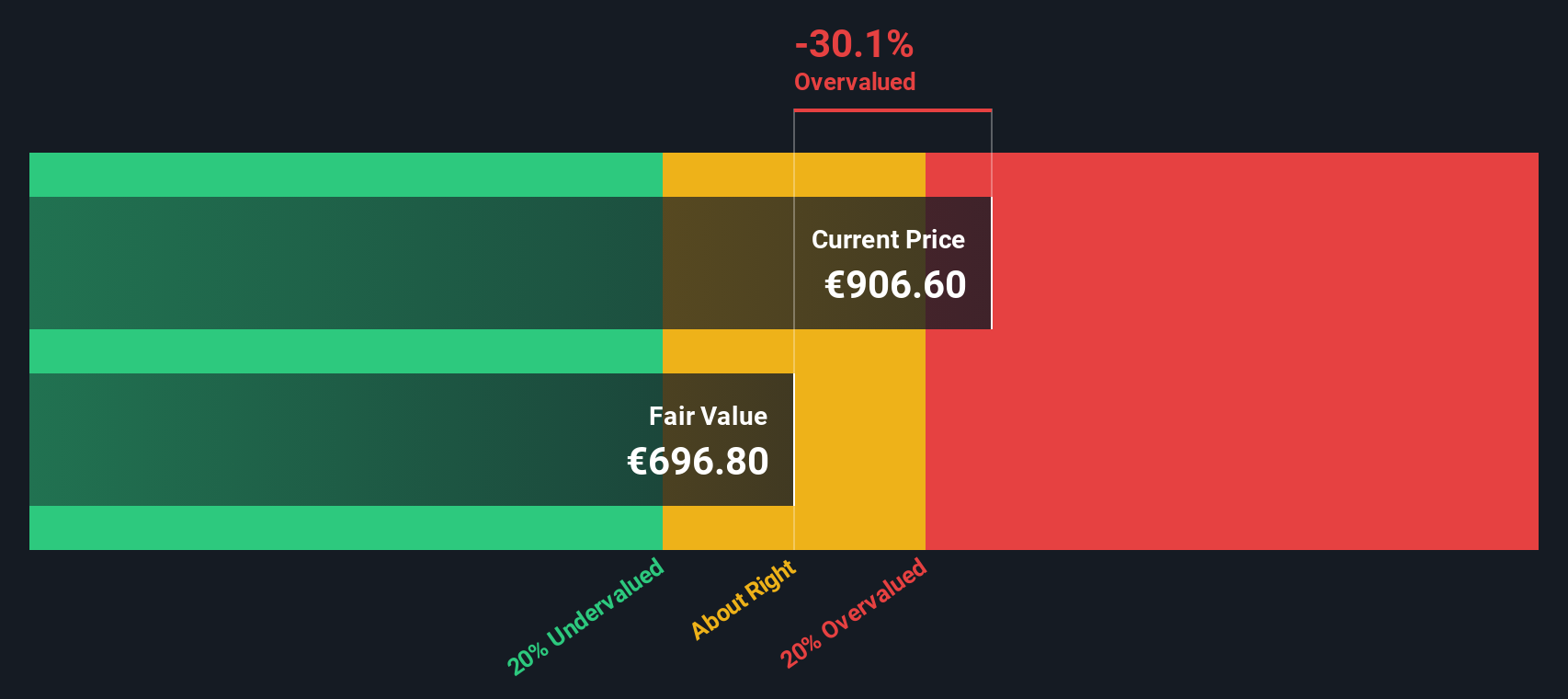

When all projected cash flows are discounted back to their value today, the estimated fair value for ASML Holding is €642.61 per share. However, this valuation implies the stock is trading at a 44.2% premium to its intrinsic value, suggesting it is currently overvalued based on future cash flows.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests ASML Holding may be overvalued by 44.2%. Discover 839 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: ASML Holding Price vs Earnings

For established and profitable companies like ASML Holding, the Price-to-Earnings (PE) ratio is a widely trusted valuation tool. It measures how much investors are paying today for each euro of last year’s profits, making it simple to compare companies within the same sector.

The "right" PE ratio for a stock is rarely one-size-fits-all. Companies expected to grow quickly often command higher PE multiples, while those with more risk or slower growth tend to trade at lower ratios. That is why industry averages and direct peer comparisons are helpful, but not complete.

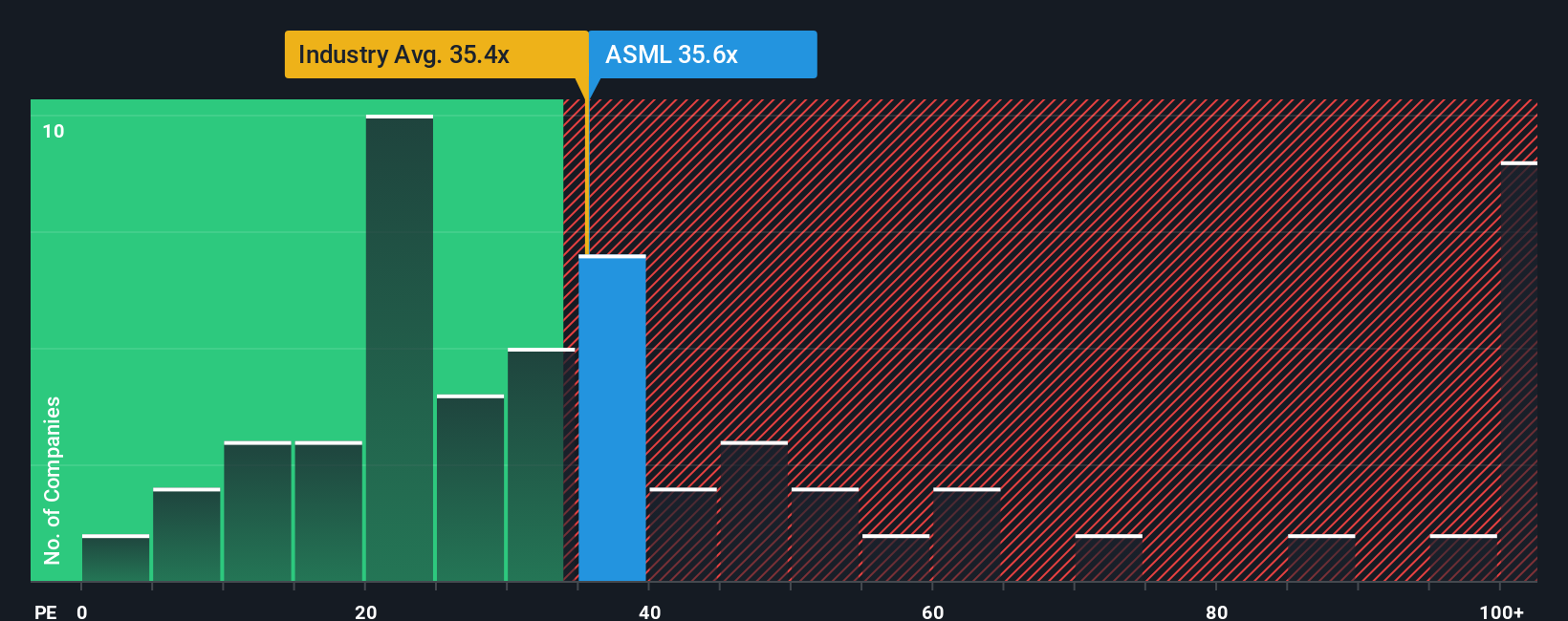

Currently, ASML’s PE ratio is 37.92x. This is below the average for its peers (43.51x) and slightly below the broader semiconductor industry’s average of 39.04x. On the surface, it seems attractively priced compared to its rivals.

However, Simply Wall St’s Fair Ratio for ASML incorporates a deeper set of factors such as the company’s earnings growth, industry trends, profit margin, market cap, and unique risk profile to arrive at a fair multiple of 50.28x. This approach goes beyond a quick comparison and helps investors avoid pitfalls from one-dimensional benchmarks.

Since ASML’s current PE ratio of 37.92x is meaningfully below its calculated Fair Ratio of 50.28x, the stock appears undervalued by this measure.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1408 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your ASML Holding Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your personal story or thesis about a company, bringing together your view of its business prospects, assumptions about future growth, and the unique risks and drivers you see ahead. With Narratives, you link the story you believe in to a specific financial forecast and a target fair value. This makes sense of the numbers in a way that is tailored to your own perspective.

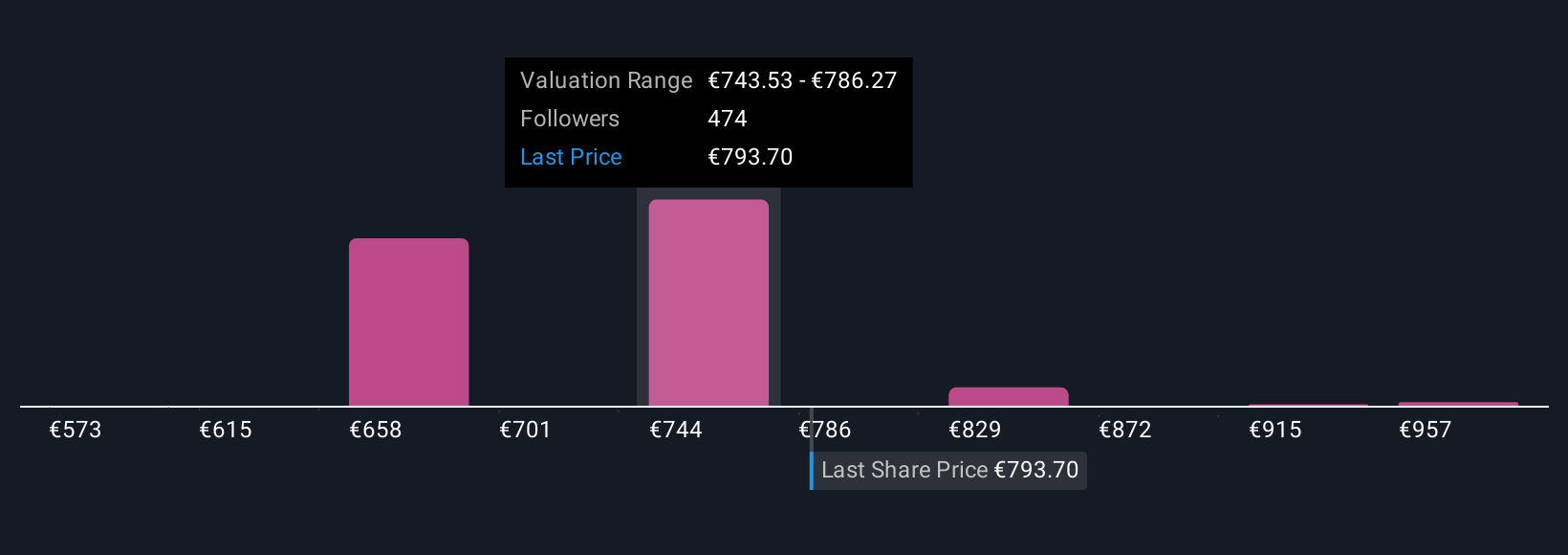

Narratives are easy to create and compare using Simply Wall St’s Community page, where millions of investors contribute their own models and fair value estimates. This tool helps you visualize different opinions, compare your Narrative to others, and see how your fair value stacks up against the current market price, empowering you to make more confident buy or sell decisions.

What makes Narratives especially powerful is that they update automatically when news, earnings, or forecasts change. This helps your analysis stay relevant.

For example, some investors see huge long-term upside for ASML Holding, with bullish Narratives forecasting share values near €1,000, while more cautious users expect fair value closer to €500. Narratives let you see the full range of views at a glance so you can decide which story and which fair value you believe best reflects ASML’s future.

For ASML Holding, however, we'll make it really easy for you with previews of two leading ASML Holding Narratives:

- 🐂 ASML Holding Bull Case

Fair value: €1,000.00

Current price is 7.4% below this narrative's fair value

Revenue growth rate: 17.26%

- ASML's monopoly in extreme ultraviolet lithography makes it essential to next-generation chip manufacturing and keeps its competitive moat strong.

- The company demonstrates recurring, high-margin revenue, robust backlog, growing service income, and ongoing returns to shareholders via buybacks and dividends.

- Bullish investors believe recent share price weakness is a long-term buying opportunity, with secular tailwinds in AI and semiconductor demand supporting sustained growth.

- 🐻 ASML Holding Bear Case

Fair value: €864.91

Current price is 7.1% above this narrative's fair value

Revenue growth rate: 9.65%

- ASML's dominant position and technological edge ensure market leadership and high recurring revenues, but also attract strategic competition, particularly from China.

- Geopolitical challenges and export restrictions heighten risk. Expanding demand from the US and Europe may offset regional sales declines.

- The narrative sees intrinsic value below the current market price, suggesting caution due to elevated valuation and growing macro risks despite a strong business model.

Do you think there's more to the story for ASML Holding? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASML

ASML Holding

Provides lithography solutions for the development, production, marketing, sales, upgrading, and servicing of advanced semiconductor equipment systems.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives