- Netherlands

- /

- Semiconductors

- /

- ENXTAM:ASM

A Fresh Look at ASM International (ENXTAM:ASM) Valuation Following Recent Share Price Rally

Reviewed by Simply Wall St

See our latest analysis for ASM International.

Momentum has clearly returned to ASM International, with the stock’s recent rally building on a robust 90-day share price return of nearly 36%. That short-term surge builds on an already strong foundation. Three- and five-year total shareholder returns of 167% and 328% show the company has rewarded long-term investors plenty, even if short-term moves sometimes pause.

If the latest semiconductor surge has you wondering what else is out there, consider expanding your search and discover See the full list for free.

The question now is whether ASM International’s rapid gains make it a bargain awaiting further upside, or if the market has already priced in all of its growth prospects ahead. Could there still be a buying opportunity here?

Most Popular Narrative: 5.2% Undervalued

According to the most widely followed narrative, ASM International's fair value estimate stands at €597.4, which is about 5% higher than its latest closing price of €566.4. Market watchers are split on what drives this gap, as ambitious future growth projections and recent guidance adjustments play central roles.

The ramp-up of advanced nodes (2nm and 1.4nm gate-all-around) in logic/foundry, driven by accelerating AI and high-performance computing needs, is structurally expanding ASM International's served available market and increasing deposition intensity, directly supporting above-industry revenue growth and resilient orders.

Curious what powers this ambitious price tag? It all comes down to bold revenue bets, extraordinary margin leaps, and a profit outlook that could reshape how investors see the future. These are projections you won’t want to miss. Find out what the narrative is really banking on.

Result: Fair Value of €597.4 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing uncertainty in China and recent dips in order intake could pressure ASM International’s growth outlook if these trends continue.

Find out about the key risks to this ASM International narrative.

Another View: What Our DCF Model Suggests

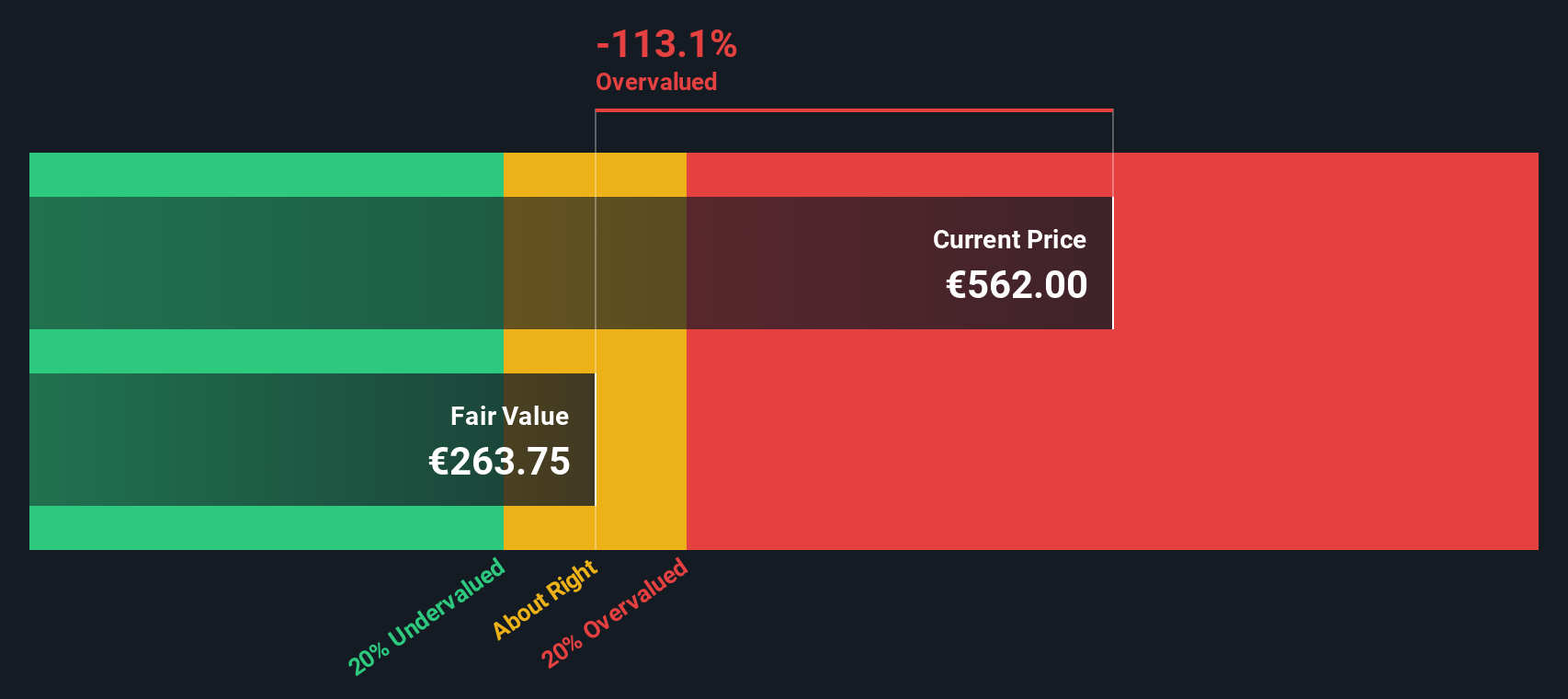

To challenge the fair value based on future earnings, the SWS DCF model takes a different path by focusing on the company’s long-term cash flows. In this approach, the calculated fair value is much lower than the current share price, which suggests ASM International may be trading above its intrinsic value. Could this indicate caution for investors despite the growth optimism?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ASM International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ASM International Narrative

If the story above does not fit with your view, or you would rather investigate for yourself, it is quick and easy to craft your own perspective. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding ASM International.

Looking for More Smart Investment Ideas?

Make your next move count by checking out more stock opportunities. Missing out now could mean leaving future gains on the table.

- Capitalize on attractive yields and secure your portfolio with these 24 dividend stocks with yields > 3% that boast payouts above 3% and steady fundamentals.

- Tap into the power of innovation by targeting these 26 AI penny stocks that are reshaping industries and setting the pace in artificial intelligence growth.

- Unlock value with these 848 undervalued stocks based on cash flows that show strong cash flow potential and might be flying under the market’s radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ASM

ASM International

Engages in the research, development, manufacture, marketing, and servicing of equipment and materials used to produce semiconductor devices in Europe, the United States, and Asia.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives