Stock Analysis

- Netherlands

- /

- Entertainment

- /

- ENXTAM:FLE

Shareholders in FL Entertainment (AMS:FLE) are in the red if they invested a year ago

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by FL Entertainment N.V. (AMS:FLE) shareholders over the last year, as the share price declined 18%. That's well below the market return of 15%. FL Entertainment hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for FL Entertainment

SWOT Analysis for FL Entertainment

- No major strengths identified for FLE.

- Interest payments on debt are not well covered.

- Dividend is low compared to the top 25% of dividend payers in the Entertainment market.

- Shareholders have been diluted in the past year.

- Expected to breakeven next year.

- Has sufficient cash runway for more than 3 years based on current free cash flows.

- Good value based on P/S ratio and estimated fair value.

- Significant insider buying over the past 3 months.

- Debt is not well covered by operating cash flow.

- Paying a dividend but company is unprofitable.

Because FL Entertainment made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

FL Entertainment grew its revenue by 12% over the last year. That's not a very high growth rate considering it doesn't make profits. Given this lacklustre revenue growth, the share price drop of 18% seems pretty appropriate. In a hot market it's easy to forget growth is the life-blood of a loss making company. But if you buy a loss making company then you could become a loss making investor.

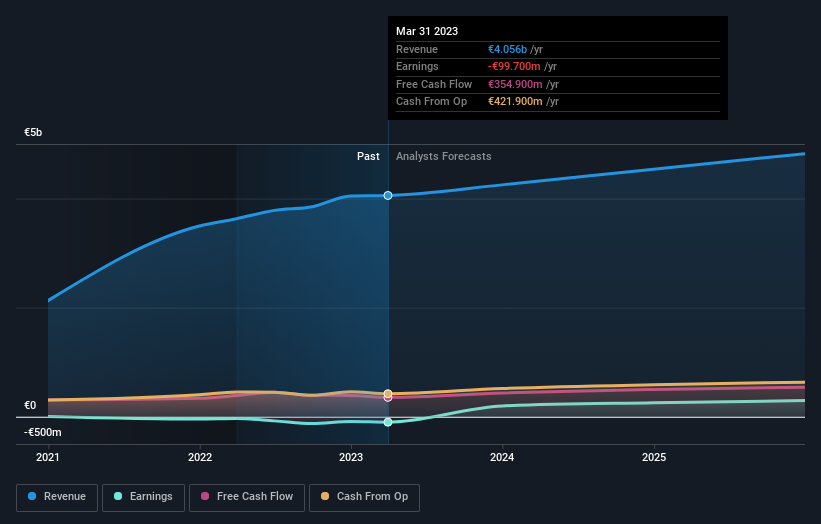

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. If you are thinking of buying or selling FL Entertainment stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of FL Entertainment, it has a TSR of -14% for the last 1 year. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

Given that the market gained 15% in the last year, FL Entertainment shareholders might be miffed that they lost 14% (even including dividends). However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. It's great to see a nice little 0.6% rebound in the last three months. This could just be a bounce because the selling was too aggressive, but fingers crossed it's the start of a new trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that FL Entertainment is showing 2 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

FL Entertainment is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Dutch exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether FL Entertainment is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTAM:FLE

FL Entertainment

FL Entertainment N.V. engages in the content production and distribution, and online sports betting and gaming businesses in Europe.

Reasonable growth potential with acceptable track record.